Attendees at the inaugural Morningstar conference in Asia had the chance to hear from three of the Asian fixed income industry’s leading investors, Stephen Chang, Managing Director, Head of Asian Fixed Income, JPMorgan, Robert Mead, Managing Director, Head of Asia Pacific Credit, PIMCO and Emil Nguy, Founding Partner, Group Chief Executive, Income Partners.

The Asian Fixed Income Universe

The trio discussed the Asian bond markets, which have been experiencing tremendous growth after consecutive years of record issuance in US dollars and local currencies. Despite this growth, the panel agreed that Asian, and more broadly emerging market, debt remained out of favour with global investors. Stephen Chang shed some light on who had been buying Asian bonds, with 60% of the market owned by Asia-based investors and about half of the market’s assets held in managed products. Chang saw this domestic bias as a positive, resulting in less ”hot” money. Robert Mead, however, observed that domestic investors could also pull out of the market when volatility spiked, while, by-and-large, institutional investors had stayed the course.

Emil Nguy spent some time breaking down the heterogeneous universe that we broadly referred to as Asian fixed income. The areas of the market he touched on included dim sum bonds, onshore RMB, US dollar bonds and local currency bonds. He explained that dim sum bonds were RMB denominated bonds sold offshore and these had experienced strong growth since being introduced just three years ago. The market size was now about US$70 billion. The local RMB bond market on the other hand was much larger but was also growing at a blistering pace, with corporate debt to GDP up to about 50% from a negligible base just five years ago. Not to be outdone, there has been strong issuance of US dollar bonds in recent years and most of the credit available in Asia was issued in this US$1 trillion market. The local currency market on the other hand consisted primarily of government debt of the nine local countries in the region, such as Indonesia and Malaysia.

In Reserve – RMB vs USD

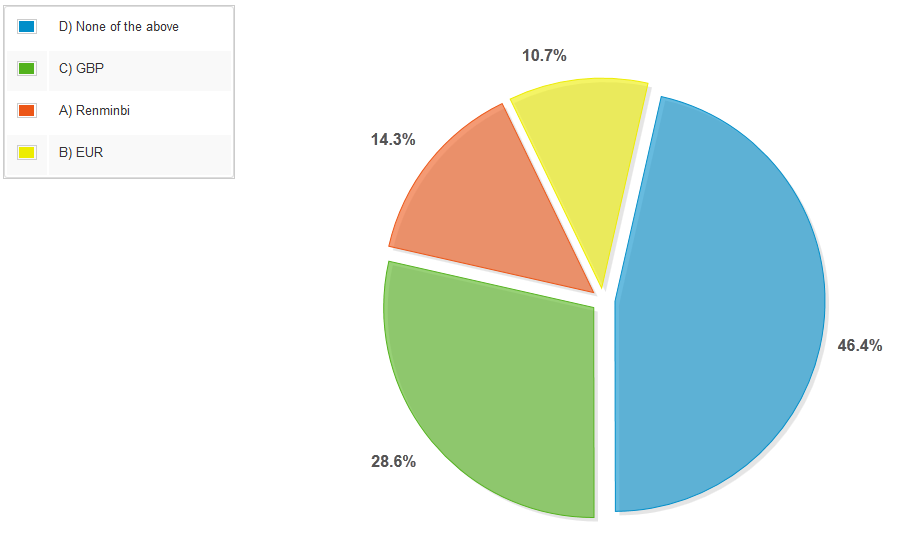

The session then changed tack to discuss currency. During one of the live polls, the audience showed that it expected neither the GBP nor the EUR or even the RMB to outperform the USD over the next 12 months (Exhibit 1). The panel didn’t necessarily agree. Chang made a salient observation that the poll results would have looked very different just six months ago, before the government’s intervention in the RMB market. Nguy remarked that the RMB, with its 5% carry, remained attractive (although less so than Russian roubles at 8%). He is optimistic about the RMB, believing the carry story would dominate globally and he made a bold prediction that the RMB would be the world’s reserve currency in 10 years. Meanwhile, Mead was sanguine on the outlook for US interest rates, voicing PIMCO’s house view that “normal” in the US was closer to 2.5% rather than the 4% suggested by many in the market, including Gavekal’s Arthur Kroeber who presented his economic outlook earlier in the day.

Opportunities in Asian Fixed Income

The conversation came around to current opportunities in the Asian fixed income universe and it was no surprise that Nguy believed the RMB market was the place to be. With its current 0% weighting in most global fixed income benchmarks, he believed it remained under-owned by asset managers globally but expected this to change. Chang also saw opportunities in the RMB market, with a view that stimulus in the country would lead to a pickup in sentiment. In the portfolios he manages, he has selective positions in some high-quality property credits.

Mead pointed out the attractive US dollar spread between quasi-sovereign and sovereign debt in Indonesia and said he believed the Indian rupee was well positioned on hopes of reform following the recent national elections.

By the end of the session, the panel had provided a comprehensive backdrop of the fixed income market as it stands. It was also clear to the audience that all three panellists saw a promising future for this fledgling asset class, not only in terms of its continued development but also in terms of its investment opportunities. While investors globally may be shying away from Asian bonds at the moment, our panellists see opportunity. The informative session gave the audience an insight into how some of the leading Asian fixed income investors are thinking today.

Graph 1: Currencies the Audience Expect Will do the Best Against the US Dollar Over the Next 12 Months