For economic and market news relating to Asian ETFs, please refer to our “Asia ETF Roundup (Market) – October 2016“.

ETF Industry News

Vanguard Cuts Fees on HK-Listed ETFs

Vanguard announced it was cutting the management fees for all 5 of its Hong Kong-listed ETFs effective from 17 October 2016. The fee reductions are as follows:

• Vanguard FTSE Asia Ex Japan Index ETF (02805): From 0.38% to 0.20%

• Vanguard FTSE Japan Index ETF (03126): From 0.25% to 0.18%

• Vanguard FTSE Developed Europe Index ETF (03101): From 0.25% to 0.18%

• Vanguard FTSE Asia Ex Japan High Dividend Yield Index ETF (03085): From 0.45% to 0.35%

• Vanguard S&P 500 Index ETF (03140): From 0.25% to 0.18%

We welcome these fee reductions as they will accrue directly to investors.

Recall that in July, iShares also cut fees on two ETFs:

• iShares Core MSCI AC Asia ex Japan Index ETF (03010): From 0.59% to 0.28%

• iShares Core S&P BSE SENSEX India Index ETF (02836): From 0.99% to 0.64%

BlackRock/iShares Announces that the iShares FTSE A50 China Index ETF Will Increase Reliance on Direct Investment in A-Shares

On 28 October 2016, BlackRock/iShares announced that the iShares FTSE A50 China Index ETF (02823) will increase its reliance on direct investment in A-Shares and correspondingly reduce its reliance on synthetic replication (through China A-Shares Access Products (CAAPs)). The ETF also intends to utilise the Shenzhen-Hong Kong Stock Connect programme to invest directly in A-Shares once the programme becomes operational.

As of 4 November 2016, according to the firm’s website, 58% of the ETF’s portfolio utilised synthetic replication in the form of the use of CAAPs. As we have mentioned in our research report on the fund, we view this as a positive move, as it has the potential to reduce tracking difference, eliminate the tax-provisioning issue, and narrow the premium/discount levels for the ETF.

Malaysia May Lower Issuance Costs for ETFs

According to the Sun Daily, the Securities Commission Malaysia (SC) is conducting a review of its ETF Guidelines, within which it is considering several initiatives including a review of the regulatory framework, widening the range of asset classes, facilitating the application of new strategies, enhancing the market making framework and reducing issuance costs.

Since December 2015, no new ETFs have been listed in Malaysia (there are presently only 8 ETFs listed there). According to the report, the SC commented that the cost of ETF issuance is higher than that of conventional unit trusts as ETF issuance is viewed as an IPO (as such, higher legal and regulatory costs are imposed) a factor that has deterred ETF issuance.

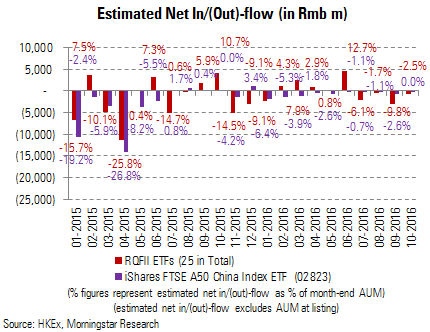

RQFII ETF Watch – Net Outflows in October Totaling Rmb 0.8 billion

• In October, RQFII ETFs in Hong Kong recorded estimated net outflows of Rmb 0.8 billion (2.5% of beginning and ending AUM). This compares to Rmb 3.1 billion of estimated net outflows in September. We estimate YTD total net inflows of Rmb 0.4 billion as of 31 October 2016.

• The majority of the net outflows during the month came from the CSOP FTSE China A50 ETF (82822 & 02822), estimated at Rmb 0.7 billion.

• The largest A-Share ETF by AUM in Hong Kong, iShares FTSE A50 China Index ETF (02823) recorded virtually no net in/outflows in October. This compares to estimated net outflows of Rmb 0.7 billion in September. As of 31 October 2016, the YTD total net outflows from the iShares FTSE A50 China Index ETF are estimated at Rmb 6.9 billion.

New Launches and Listings

DB Delists an ETF in Hong Kong

Deutsche Asset Management announced that trading of its db x-trackers US DOLLAR CASH UCITS ETF (03011) would be suspended as of 17 October 2016 owing to a number of factors including the current level of AUM and the trading volume of the ETF. The ETF was delisted from the Stock Exchange of Hong Kong on 3 November 2016.

Ping An Delists 2 ETFs in Hong Kong

Ping An announced to delist 2 ETFs in Hong Kong, namely the Ping An of China CSI HK Mid Cap Select ETF (03072) and the Ping An of China CSI RAFI HK50 ETF (03098). Ping An cited the relatively small AUM and low trading volume of the ETFs as its reasons for delisting the fund. The ETFs has ceased trading as of 31 October 2016 and will be officially delisted on 30 December 2016.

EIP Delists 7 Xie Shares ETFs in Hong Kong

EIP, manager of the Xie Shares ETFs, announced it would delist 7 synthetic ETFs in Hong Kong. In its announcement, the firm cited that it was “taking into account the relevant factors, in particular, the relatively small net asset value”. The ETFs track exposures in the Nifty 50 Index, Indonesia’s LQ45 Index, the KOSPI 200 Index, the FTSE Bursa Malaysia KLCI, the Philippines’ PSEi, Taiwan’s TAIEX Index and Thailand’s SET 50 Index. The ETFs ceased trading as of 1 November 2016 and will be officially delisted on or around 29 December 2016.

Name Change for 2 iShares ETFs and New USD and RMB Counters

Blackrock Asset Management announced it was changing the names of two of its ETFs and adding USD and RMB counters for both effective from 14 October 2016:

• From iShares AC Asia ex Japan ETF to iShares Core MSCI AC Asia ex Japan Index ETF (Stock codes: HKD: 03010; USD: 09010; RMB: 83010)

• From iShares S&P BSE SENSEX India Index ETF to iShares Core S&P BSE SENSEX India Index ETF (Stock codes: HKD: 02836; USD: 09836; RMB 82836)

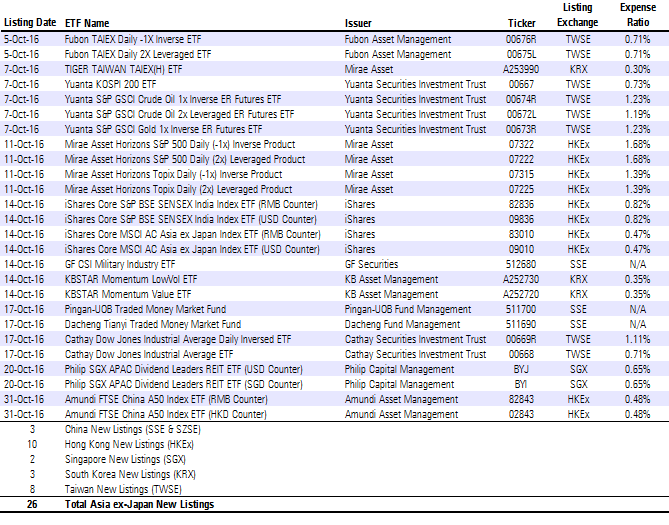

Fubon Lists 2 Leveraged/Inverse ETFs in Taiwan

On 5 October 2016, Fubon Asset Management listed two leveraged/Inverse ETFs on the Taiwan Stock Exchange, namely the Fubon TAIEX Daily -1X Inverse ETF and the Fubon TAIEX Daily 2X Leveraged ETF. The ETFs track the performance of the TAIEX Daily Return Inverse -1X Index and the TAIEX Daily Return Leveraged 2X Index, respectively.

Yuanta Lists a KOSPI 200 ETF and 3 Leveraged/Inverse ETFs in Taiwan

On 7 October 2016, Yuanta Securites listed four ETFs on the Taiwan Stock Exchange. The ETFs track the performance of the KOSPI 200 Index, the S&P GSCI Crude Oil 2x Leveraged Index ER, the S&P GSCI Crude Oil 1x Inverse Index ER and the S&P GSCI Gold 1x Inverse Index ER.

Mirae Lists an ETF in Korea

On 7 October 2016, Mirae Asset Management listed an ETF, namely TIGER Taiwan TAIEX(H) ETF, on the Korea Exchange. The ETF aims to track the daily performance of Taiwan’s TAIEX Index.

Mirae Lists 4 Leveraged/Inverse ETFs in Hong Kong

On 11 October 2016, Mirae Asset Management listed 4 Leveraged/Inverse ETFs on the Korea Exchange. The ETFs track the inverse (-1x) daily performance and the leveraged (2x) performance of both the TOPIX and the S&P 500 Index.

GF Securities Lists an ETF in China

On 14 October 2016, GF Securities listed an ETF on the Shanghai Stock Exchange, namely the GF CSI Military Industry ETF. The ETF tracks the CSI Military Industry Index.

KB Lists 2 Strategic-Beta ETFs in Korea

On 14 October 2016, KB Asset Management listed 2 strategic-beta ETFs, namely the KBSTAR Momentum LowVol ETF and the KBSTAR Momentum Value ETF. The ETFs track the daily perforamance of the FnGuide Momentum&LowVol Index and the FnGuide Momentum&Value Index.

The Listing of these ETFs and the other ETF listed by Mirae put the number of ETFs listed in Korea at 243.

Pingan-UOB Lists a Money Market Fund in China

On 17 October 2016, Pingan-UOB Fund Management listed a money market fund on the Shanghai Stock Exchange, namely the Pingan-UOB Traded Money Market Fund.

Dacheng Lists a Money Market Fund in China

On 17 October 2016, Dacheng Fund Management listed a money market fund on the Shanghai Stock Exchange, namely the Dacheng Tianyi Traded Money Market Fund.

The listing of this ETF and other ETFs listed by Pingan-UOB and GF Securities put the number of the ETFs in China at 143.

Cathay Lists 2 ETFs in Taiwan

On 17 October 2016, Cathay Securities listed two ETFs on the Taiwan Stock Exchange, namely the Cathay Dow Jones Industrial Average ETF and the Cathay Dow Jones Industrial Average Daily Inverse ETF. The ETFs track the 1x and -1x performance of the Dow Jones Industrial Average Index, respectively.

The listing of these ETFs and other ETFs listed by Fubon and Yuanta put the number of ETF in Taiwan at 61), of which 25 are leveraged/inverse ETFs.

Philip Lists an ETF in Singapore

On 20 October 2016, Philip Capital Management listed an ETF with both USD and SGD counters on the Singapore Exchange, namely the Phillip SGX APAC Dividend Leaders REIT ETF. The ETF tracks the SGX APAC ex-Japan Dividend Leaders REIT Index. The product is classified as Excluded Investment Product (EIP).

The listing of this ETF put the total listing of ETFs in Singapore at 83 (6 multiple counters), of which 28 are EIPs.

Amundi Lists an ETF in Hong Kong

On 31 October 2016, Amundi Asset Management listed an ETF on the Hong Kong Stock Exchange, including a RMB counter, namely the Amundi FTSE China A50 Index ETF. The ETF tracks the FTSE China A50 Index.

The listings of leveraged/Inverse ETFs, the delisting of the ETF from DB, Ping An and EIP and the addition of USD and RMB Counters of 2 iShare ETFs put the total number of ETFs in Hong Kong at 188 (141 ETFs and 47 multiple counters), of which 12 are leveraged/inverse products.

List of ETFs Launched in October 2016