Globally the vaccine rollout continues, with an accompanying drop in infections, and recovery in oil demand. Each week oil inventories have declined further pushing prices higher. Brent crude currently sits near US$75 per barrel, a circa 10% increase on a month ago. Generally, we expect the dynamic to continue for the next 18 months with steadily increasing demand allowing for a gradual return of OPEC+ volumes and some US growth. The latter is likely to limit oil price appreciation in the longer-term.

A major risk to energy demand is that emerging markets vaccination rates lag, which might hinder demand growth. Also, increasing Delta variant infections could slow the US and European recoveries. However, outside of a delayed full reopening in the UK, no material setback has yet occurred. Also, vaccines are largely effective in preventing severe illness or hospitalisation.

On the supply side, an accelerated return of Iran volumes would pose a risk, but we still see the situation as manageable. As such, supply/demand dynamics support current price levels for the near-term. Longer-term our midcycle Brent crude price forecast remains US$60 per barrel from 2023. This remains the sweet spot in our opinion, sufficient incentive to drive the investment required for supply to meet demand, without over-stimulating US shale production, which would lead to oversupply.

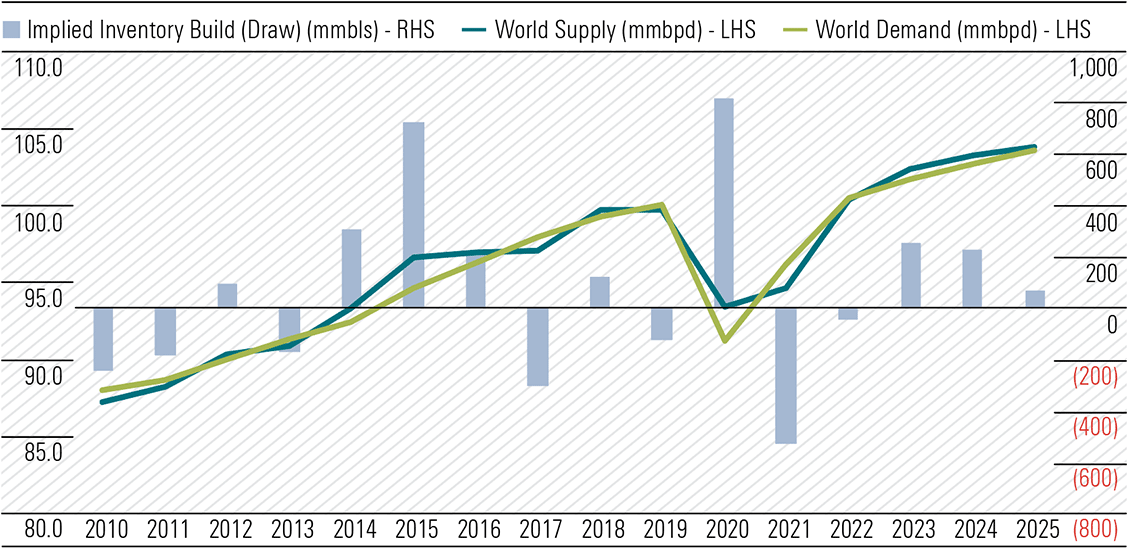

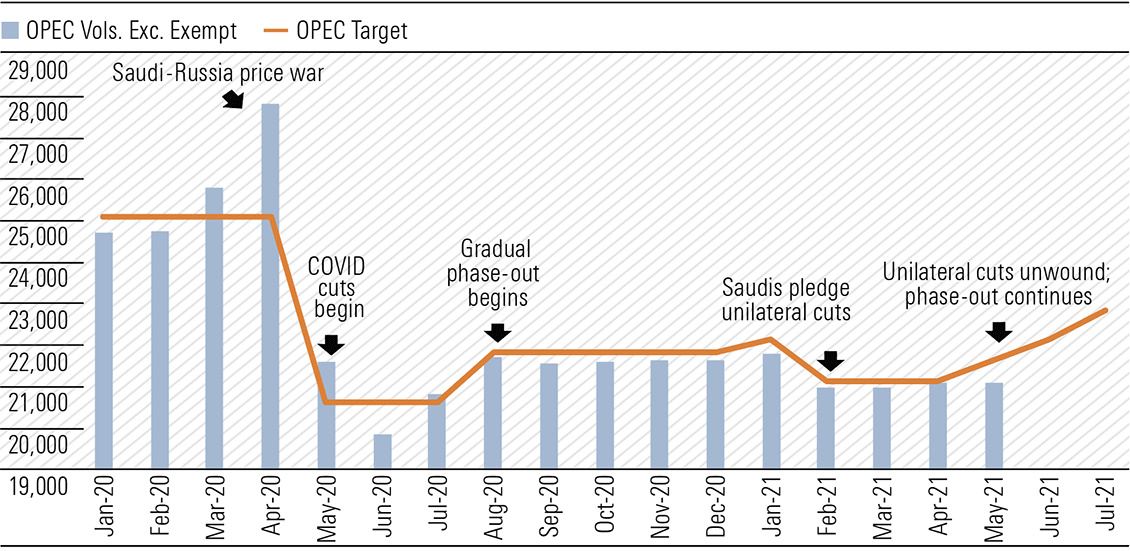

The global vaccine rollout means we still expect global crude consumption to exceed 2019 levels by 2022 at 100.4 million barrels per day (mmb/d) rising to 103.7 mmb/d by 2025, growing in lockstep with economic recovery. OPEC is going forward with planned additions of 450 thousand barrels per day in July and has marginally increased its 2021 estimate of world oil demand to 96.6 mmb/d. The cartel’s production total is just above 21.0 mmb/d, and we forecast an incremental 1.6 mmb/d and 4.6 mmb/d, respectively, in 2021 and 2022 from OPEC+. Ongoing sanctions on Iran are suppressing its output by around 2 mmb/d, and recent elections there have not necessarily made the path forward clearer. But with both sides of the table fatigued and indicating a willingness to resolve matters soon, we would expect production to be back online within the next couple of years.

Our global supply estimate for 2021 is 94.7 mmb/d, previously 95.1 mmb/d. Inventories should normalise rapidly (see Exhibit 1) as global supply falls 1.5 mmb/d short of demand in 2021. The market remains tight, with swing producers, OPEC+ and US shale, reluctant to bring additional capacity online to cope with near-term shortfalls. But by 2022 we would expect more substantial expansion of OPEC+ volumes and more U.S. growth, cumulatively adding around 5.6 mmb/d to global production. This is in keeping with our anticipation for pull-back in pricing to our midcycle target.

Exhibit 1: Global liquids supply and demand

Source: IEA, EIA, OPEC, Morningstar. Data as of June 24, 2021.

Exhibit 2: OPEC production vs. agreed target (mbpd)

Source: OPEC, Reuters, Morningstar. Data as of June 25, 2021.

©2021 Morningstar. All rights reserved. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided as of the date written, solely for informational purposes; and subject to change at any time without notice. This content is not an offer to buy or sell any particular security and is not warranted to be correct, complete or accurate. Past performance is not a guarantee of future results. The Morningstar name and logo are registered marks of Morningstar, Inc. This article includes proprietary materials of Morningstar; reproduction, transcription or other use, by any means, in whole or in part, without prior, written consent of Morningstar is prohibited. This article is intended for general circulation, and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Investors should consult a financial adviser regarding the suitability of any investment product, taking into account their specific investment objectives, financial situation or particular needs, before making any investment decisions. Morningstar Investment Management Asia Limited is licensed and regulated by the Hong Kong Securities and Futures Commission to provide investment research and investment advisory services to professional investors only. Morningstar Investment Adviser Singapore Pte. Limited is licensed by the Monetary Authority of Singapore to provide financial advisory services in Singapore. Either Morningstar Investment Management Asia Limited or Morningstar Investment Adviser Singapore Pte. Limited will be the entity responsible for the creation and distribution of the research services described in this article.