Winners of the Morningstar Fund Award are recognized as funds that have added the most value within context of a relevant peer group for investors over the past year and over the longer-term.

To help our readers better observe what makes a fund a winner fund, we sent out questionnaires to the winning fund teams earlier and asked them to shed lights on their team structure, how various risks have affected their investment decisions, and the major portfolio changes over last year, etc.

Category Winner: Best Global Emerging Markets Equity Fund - Fidelity Funds - Emerging Markets Fund A-ACC-USD

Key Stats

Inception Date: 1993 Oct18

Morningstar Rating (as of 2014-02-28):

Total Net Assets (Mil, as of 2014-02-28): 3,265.16 USD

Manager: Nick Price

Manager Start Date: 2009 Jul1

M: Morningstar F: Fidelity Funds - Emerging Markets Fund investment team

M: Could you highlight any major changes you made to the portfolio over the course of 2013? Were there any particular holding that drove the fund’s performance for the year?

F: 2013 was a strong year for the strategy. It was influenced by a number of factors, starting with a reversion back towards fundamentals after the risk rallies at the end of the previous year, which helped to make good a weaker second half of 2012.

Most importantly, strong stock selection accounted for c.85% of the strategy’s outperformance, which is the primary risk factor that we seek to derive our performance from. This contribution was derived not only from high conviction positions in attractive stocks such as Naspers, Copa Holdings and Surgutneftegaz, but also from underweight positions resulting from the decision not to own many larger index names such as Vale and Petrobras.

This was particularly true at the country level, where unattractive stock fundamentals combined with concerns about the state of a number of weaker economies resulted in residual underweight positions in a number of countries with weak current account balances. This positioning proved fruitful as the threat of tapering resulted in significant declines in both share prices and currencies across these markets. The underweight positioning in these countries helped to preserve our investors’ capital, and resulted in a net positive contribution from the so-called ‘Fragile 5’ economies, with four out of the five economies making a positive impact on the strategy’s performance during 2013.

This market weakness also provided the opportunity to increase exposure to the stocks of exporters in these countries, whose competitive position was enhanced by the currency declines, whilst the simultaneous equity market declines also provided the opportunity to buy these stocks at very attractive valuations. Some of these stocks were amongst the biggest individual contributors to relative performance in the second half of the year.

M: What is your economic outlook for 2014 specific to the markets you cover and how are you positioned to take advantage of opportunities and/or mitigate potential risks?

F: Despite the long term attractiveness of many attributes such as young and growing populations, low debt levels and rising disposable incomes that the developing world continues to offer, the performance of EM equities will likely continue to be influenced by developments across the broader global economy, given that the developing and developed worlds are inextricably linked through global capital and trade flows.

The degree to which stimulus mechanisms are adjusted in the developed world obviously have big implications for emerging economies, especially those who rely on external investors to fund their economies, and especially those who raise their debts in foreign currency. The weaker positioned economies have a window of opportunity now to work on reforming their economies before removal of stimulus is threatened or indeed invoked.

However, it is also important to note that - at an overall level - external debt across the emerging world is at much lower levels today versus where it was during the currency crises of the 1990’s. As a result, we remain hopeful that the risk of a repeat of these events is less pronounced today than it was back then.

One key opportunity looking forward is the potential for an improvement in global economic growth to act as a positive driver of demand for EM exporters and manufacturers. This positive effect is likely to be further bolstered by an improvement in the competitive situation for exporters thanks to recent currency weakness.

Many people consider recent currency weakness to be a bad thing. We take a different view. If recent currency weakness persists in those countries struggling with trade imbalances, it will promote a gradual rebalancing of current accounts through reduced purchasing power for imported goods, and improved manufacturing competitiveness. Both of these effects act to reduce the magnitude of current account deficits and thereby bolster the economic situation in affected markets.

However not all exporters will benefit from this effect. There are some segments – particularly in the commodity complexes – that still appear compromised in terms of pricing risk, given the increasingly prevalent threat of significant increases in incremental supply which is due to come online over coming quarters.

From a consumer perspective, whilst there are a few individual markets where purchasing power for imported goods may temporarily have been subdued by currency weakness, there remain a plethora of emerging consumer opportunities that remain in rude health, with volume growth in particular areas still running well into double digits.

We have also modified our exposure in the IT space. Given that future growth in smartphone penetration is likely to be led by lower value handsets providing developing market consumers with access to the internet for the first time, volume growth will probably remain robust, but average selling prices are likely to fall. As a result we have switched exposure from the high-end smartphone value chain toward beneficiaries at the lower end. We continue to maintain exposure to content providers with solid mobile offerings who are also likely to be key beneficiaries of this trend as well.

We continue to focus our efforts on identifying the industry winners who can benefit from the volume growth whilst also passing on price inflation to end consumers, and who are ultimately profitable enough to fund their growth strategy from internal cash flow, and importantly where valuations do not reflect the long-term growth opportunities that they enjoy.

M: How is your investment team organized? Have there been or do you anticipate any changes to the investment team or structure over the course of the year? Do you anticipate adding to the team in the near future?

F: Fidelity’s GEM equity strategy benefits from a team of five experienced emerging markets portfolio managers who come from a wide range of complementary backgrounds. The team have invested together since 2005, and is led by Nick Price, who has over 20 years of experience. The broader portfolio management team average over 17 years of investment experience. (Years’ experience is shown as at 31 December 2013). There have been no significant changes to the investment management team nor do we anticipate any changes over the course of the upcoming year. We expect the team, the philosophy and the investment process deployed by the team, to be consistent over time.

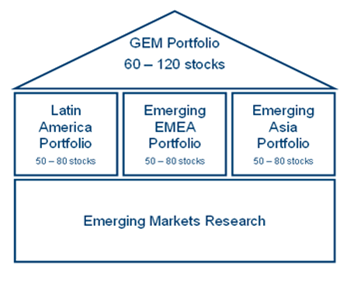

The team’s investment process is consistently applied to filter out the very best ideas from the broad investment universe. The process benefits from three layers of scrutiny, starting with the research recommendations of the team’s equity analysts. These are assessed by the regional portfolio managers, who create three regional portfolios of stocks that conform to the group’s investment philosophy.

The best and most appropriate individual stock ideas are drawn from these three regional portfolios to construct a concentrated and scalable high conviction GEM equity portfolio. Each of these regional portfolios typically contains between 50 to 80 stocks. Therefore, the Portfolio Manager selects stocks from a pool of 150-240 names rather than the entire MSCI Emerging Markets universe of approximately 2,600 stocks for the final GEM portfolio of c.80 names.

The following diagram shows an overview of this filtering process:

Click here to see other winner features.

.png)