Sustainable investing is no longer a niche activity. Investors around the world are looking for ways to learn whether the investments they own reflect the best sustainability practices, because sustainability aligns with their personal values or simply because they believe it leads to better investment outcomes. We identified three reasons why people choose to invest sustainably: to lower the amount of risk in a portfolio; to align with their personal or religious values; to take an active role in influencing an issue or behavior, either at a particular company or in society as a whole.

That’s why we announced the Morningstar Sustainability Rating for funds in March 2016; as well as expanded sustainability research, data, and analytics. Morningstar defines sustainable investing as a long-term approach that incorporates environmental, social, or governance (ESG) factors into the investment process.

Our ratings measure how well the companies in a portfolio are managing their ESG risks and opportunities and provide a basis for comparison across funds. They give investors a new lens to analyze any fund, regardless of whether it has a specific sustainability or ESG mandate.

What the data points mean

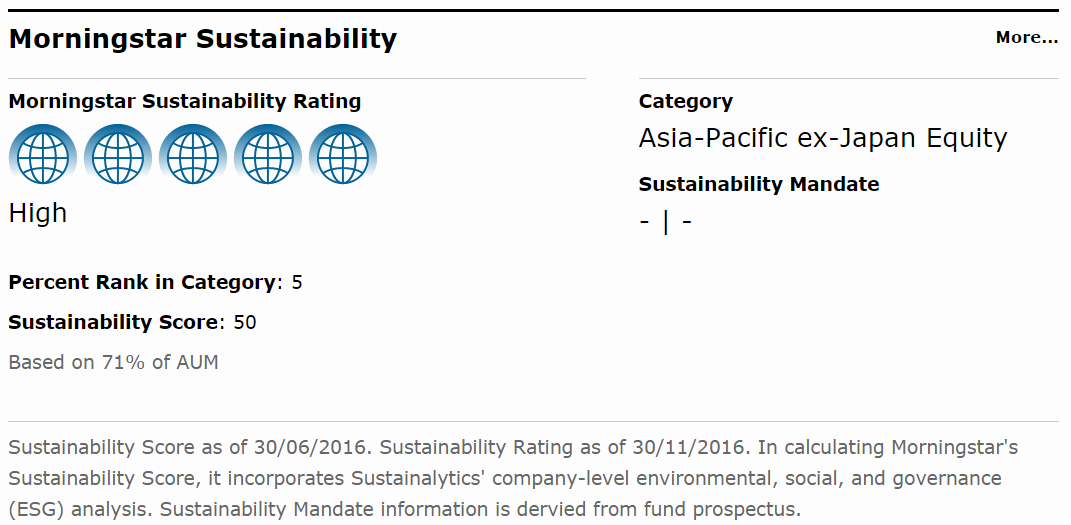

To help you begin investing sustainably, we are launching the Morningstar Sustainability Rating™ across our Asia investment websites today. On each fund’s quicktake report, you will see a “Morningstar Sustainability” section with the fund’s sustainability rating and other proprietary sustainability data points. Take Schroder Asian Equity Yield Fund for example,

Sustainability Score: It reflects the average Sustainalytics ESG Score of the covered holdings in the current fund portfolio.

Based on 71% AUM: 71% of the fund’s total assets under management have Sustainalytics ESG, Environmental, Social, and Governance scores.

Percent Rank in Category: With the Sustainability Score 50, the fund ranks 5% in the Asia-Pacific ex-Japan Equty fund category.

Morningstar Sustainability Rating: The Portfolio Sustainability Score relative to Morningstar Category peers. We assign the ratings along a bell curve distribution to five groups—Low, Below Average, Average, Above Average, and High— and depict them with corresponding globe icons (Low=1 globe; High=5 globes).

Sustainability Mandate: It shows the sustainability mandate information derived from the fund’s perspective, if available.

A fund’s Sustainability Rating doesn’t make it good or bad—it just tells you how sustainable the companies are in a fund’s portfolio. And keep in mind that a fund must hold stocks and fall within certain guidelines for us to be able to rate it. Before deciding whether a fund meets your needs, we always recommend that you get an in-depth view of its fees, performance, management team, and more. If you’re interested in learning more about our ratings and how we built them, please visit the Morningstar Sustainable Investing and Socially Responsible Investing website.

.png)