Since 2005, Morningstar has published annual “Mind the Gap” studies that aim to shed light on whether U.S. mutual fund investors have benefited from their market timing decisions. This year, we “globalised” the study to find out if mutual fund investors in other markets have also suffered from returns gaps—that is, the difference between a fund’s time-weighted return, and the “actual” return that investors achieved when timing decisions are taken into consideration.

This paper seeks to explore whether investors within the open fund markets in Asia, namely Hong Kong, Singapore, and Taiwan, suffer from similar returns gaps.

Mutual fund investors in Hong Kong, Singapore and Taiwan tend to have shorter investment horizons. However, practice doesn’t make perfect with our study confirming that Asian investors face similar challenges in timing their investments, and that the gaps in returns were largest in more volatile, concentrated equity strategies.

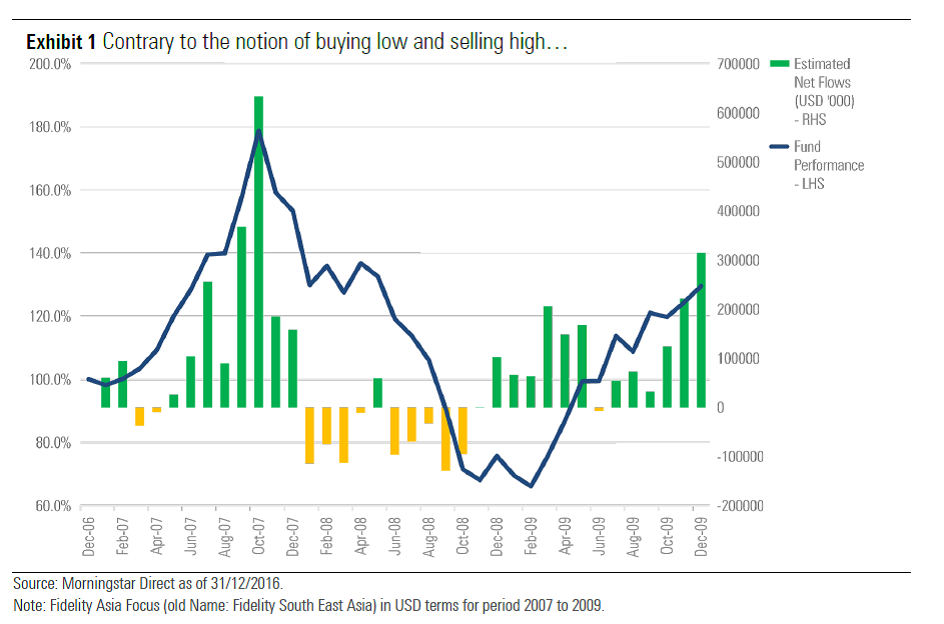

Investing is a beautiful game but when fear and greed take over, investors make mistakes. They sometimes buy into an investment after it has run up on price, but panic during market turmoil and sell out at a loss. This contradicts the notion of buying low and selling high, and Exhibit 1 shows an example of this phenomenon. The blue line shows the performance of a popular Asian ex-Japan equity fund between 2007 and 2009, while the bars depict the monthly net flows of the fund. It quickly becomes evident that investors are poor market timers; there were massive inflows in September/October 2007 when the fund performed strongly at the peak of the bull market, and investors did not re-enter the fund until fund performance rebounded on the back of the market run-up in 2009.

You can download the complete report here.

.png)