Later this year, we’ll be enhancing our forward-looking fund rating systems, the Morningstar Analyst Rating for funds and the Morningstar Quantitative Rating for funds. We’ll be changing the way we assign these ratings to managed investments like mutual funds. In this piece, I’ll walk through what’s changing and the benefits we think these changes will confer. (Morningstar Direct and Office clients can find a more detailed explanation of the new process here.)

Key Takeaways

• We’re enhancing the Analyst Rating and Quantitative Rating to make them even more useful to investors.

• We’re making three key changes to the Analyst Rating, putting even more weight on fees, setting a higher bar for active funds, and focusing our assessment on people, process, and parent.

• We’re leaving the ratings scale unchanged--Gold, Silver, Bronze, Neutral, and Negative--but do expect ratings changes to occur, with downgrades likely to outnumber upgrades.

• We’re also making companion changes to the Quantitative Rating, which is designed to algorithmically mimic the way analysts assign ratings to funds they cover.

• We’ll update an initial batch of Analyst Ratings under the new framework on Oct. 31, 2019, with the remainder of the coverage universe to be updated over the subsequent 12 months; we’ll update the Quantitative Ratings en masse in November 2019.

Background

The Analyst Rating is a forward-looking, qualitative rating that our manager research analysts assign to managed investments like mutual funds. Launched in 2011, the Analyst Rating denotes our analysts’ conviction in a fund’s ability to outperform based on fundamental research they conduct.

The Quantitative Rating is also forward-looking, but it assigns ratings algorithmically. The algorithm studies relationships between the way analysts assign ratings to funds they cover and the characteristics of the funds receiving those ratings. It then applies those learnings to funds the analysts don’t cover, inferring a Quantitative Rating based on the traits those funds exhibit.

We assign Analyst Rating to funds the analysts cover and Quantitative Ratings to those they don’t. Funds are eligible to receive either an Analyst Rating or a Quantitative Rating, but not both.

What’s Changing

There are three key changes to be aware of:

More weight on fees

We’ve always emphasized fees in our assessment, but we’re going to put even more weight on them in a few noticeable ways.

First, we’re going to assign Analyst Ratings to fund share classes, taking fee differences into account. Today, our analysts evaluate a single representative share class of a fund and then apply the Analyst Rating they assign to that share class to every other share class of that fund, irrespective of fee differences. Going forward, the analysts will tailor the Analyst Rating to each individual share class, accounting for fee differences. This means costly share classes that bundle advice and sales fees could see ratings downgrades.

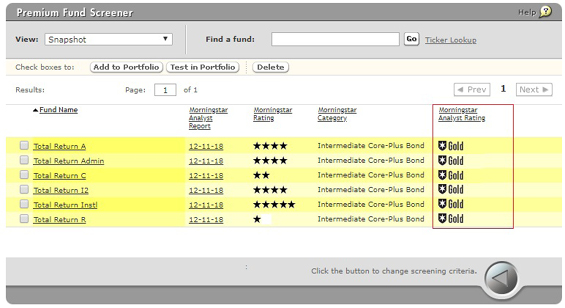

To help you visualize this change, here’s a snapshot of a hypothetical fund in Morningstar’s Premium Fund Screener tool as it would appear today. Notice that the fund has the same Analyst Rating across its various share classes.

- source: Morningstar

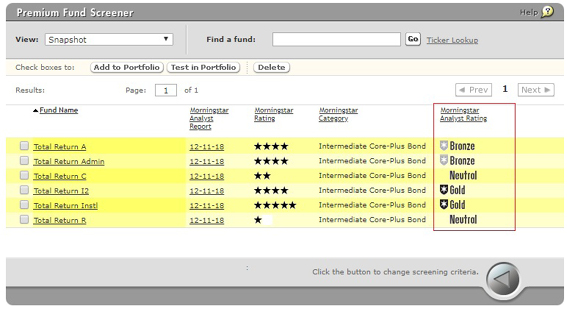

Now here’s how the Analyst Ratings of that same hypothetical fund’s share classes might look under the updated assessment framework. As you can see, the ratings vary by share class, those differences stemming from differences in the fees those share classes levy.

- source: Morningstar

Second, we’re going to assess costs relative to how much value a fund can deliver before fees, not versus other funds. Today, when we evaluate a fund’s fees, we do so by comparing its expense ratio with that of other funds in its peer group, assigning it a rank, and then translating that rank into a Price Pillar rating, which we roll up with the other pillar ratings to arrive at the fund’s overall Analyst Rating. In the future, we’ll compare a fund’s costs with the value we estimate it can deliver to investors before fees. This means it won’t suffice to be the cheapest of an expensive lot. What will matter is whether fees are low enough to leave some value for investors.

Higher bar for active strategies

We’ve been selective when recommending active funds in the past, but we’ll be even pickier in the future, as we’ll be applying an even more exacting standard.

For an active fund to earn a Gold, Silver, or Bronze rating, our research must convince us that the fund can beat both a relevant index and peer group average after fees and adjusting for risk. Currently, we might give the nod to active funds that can beat their benchmark or the average fund, but not both. In the future, they’ll have to clear this higher bar.

We’ll also be taking a more structured approach to estimating how much value different types of active strategies can be expected to deliver before fees. Some types of investing have been more hospitable to active funds than others through the years. That track record should inform the expectations we set, which means that we’ll award more Gold, Silver, and Bronze ratings in some Morningstar Categories (that is, those that have been more target-rich for active funds) than others.

Three Pillars--People, Process, and Parent

Our approach to evaluating funds has been comprehensive, but we’re going to refocus the framework so that it revolves around its more-predictive elements and is easier to understand and use.

To this point, we’ve organized our assessment around five pillars—People, Process, Parent, Performance, and Price. Going forward, we’ll assess People, Process, and Parent, which our research has found do the best job of predicting funds’ future performance before fees. In this way, we’ll be forming expectations of what a strategy can deliver to investors before fees in an even more systematic manner.

This means we’ll absorb the Performance Pillar into the other three pillars, ensuring that any performance analysis takes place as part of a broader assessment of the fund’s process, people, and parent. In addition, we’re re-expressing the Price Pillar assessment, for reasons explained more fully under “More weight on fees” above.

Quantitative Rating

Given the changes to the Analyst Rating, we’ll be making companion adjustments to the Morningstar Quantitative Rating for funds as well. This will ensure that the Analyst Ratings and Quantitative Ratings continue to work as cohesively as possible.

Expected Benefits

We think these changes will make the ratings easier for investors to understand, more relevant to key decisions they make, and more effective in helping improve the outcomes they can achieve.

Easier to understand

We’re simplifying the framework we follow, refining the ratings that we present, and more clearly delineating our expectations. We’re refocusing the assessment around its more-predictive elements--people, process, and parent. We’re also refining our pillar ratings by moving to a five-point scale (High, Above Average, Average, Below Average, Low), which should make it easier to tie a fund’s pillar ratings to its overall Analyst Rating and compare between funds.

Relevant to key decisions

The revised Analyst Rating is designed to be a better road map for investors choosing between active and indexed strategies or deciding between different share classes. The updated assessment framework will consider how target-rich each type of strategy has been to active managers and that will inform the ratings analysts assign. We’re likely to assign more Gold, Silver, and Bronze ratings to strategies in areas where active managers have enjoyed greater success[1], fewer in areas where they haven’t.

More effective

We’re refocusing around our framework’s more-predictive elements, including our fee assessment, providing a clearer road map that should facilitate portfolio construction, and tailoring our ratings to individual fund share classes.

What’s Next?

We’ll begin updating Analyst Ratings under this enhanced framework later this year. Specifically, we plan to issue an initial batch of updated Analyst Ratings on Oct. 31, 2019. While we have not yet definitively set which funds will be updated on Oct. 31, 2019, we expect the funds to number in the hundreds and represent a good cross-section of our coverage universe by major geography and asset class.

Subsequent to that initial release, we’ll gradually update the rest of our coverage universe. We expect it to take around 12 months to complete this process, reflecting the need to re-evaluate each fund and document our findings in the analyst report we publish each time we assign an Analyst Rating.

By contrast, because the Quantitative Rating assigns ratings algorithmically (and there’s no accompanying analyst report to be written), we’ll update those ratings en masse in November 2019.

[1] Under the updated Analyst Ratings methodology, we define “success” as how wide the dispersion of capital asset pricing model alpha versus the category index has been over time. We measure dispersion as the difference between the 25th and 75th percentile CAPM alpha using all rolling 36-month observations recorded since 2000 (if available).

Disclosures

Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC, registered with and governed by the U.S. Securities and Exchange Commission.

Morningstar's Manager Research Group consists of various wholly owned subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC. Morningstar's Manager Research Group produces various ratings including the Morningstar Analyst Rating for funds and the Morningstar Quantitative Rating for funds. The Analyst Rating is derived from a qualitative assessment process performed by a manager research analyst, whereas the Morningstar Quantitative Rating uses a machine-learning model based on the decision-making processes of Morningstar's analysts, their past ratings decisions, and the data used to support those decisions. In both cases, the Ratings are forward-looking assessments and include assumptions of future events, which may or may not occur or may differ significantly from what was assumed. The Analyst Ratings and Quantitative Ratings are statements of opinions, subject to change, are not to be considered as guarantees and should not be used. Analyst Ratings and Quantitative Ratings are not guarantees nor should they be viewed as an assessment of a fund's or the fund's underlying securities' creditworthiness.

.png)