Many investors obsess over investment income, and it's easy to understand why. Retirements are lasting longer, and with longer life expectancies come higher medical costs and greater risk of outliving one's assets. While demands on savings have increased, so has the challenge of meeting them with investment income. Interest rates are lower now than they have been historically, as are dividend payout ratios.

It isn't necessary to live solely on investment income, but many still focus on it, driven by a desire to not dip into principal for fear that such withdrawals may not be sustainable. That intention is good, but the focus on yield is often misplaced. Yield doesn't tell the full story of any investment. Aggressively chasing it can lead to risky areas of the market. Here, I'll highlight three approaches to boost equity income without taking much greater risk than the market.

Dividend Income

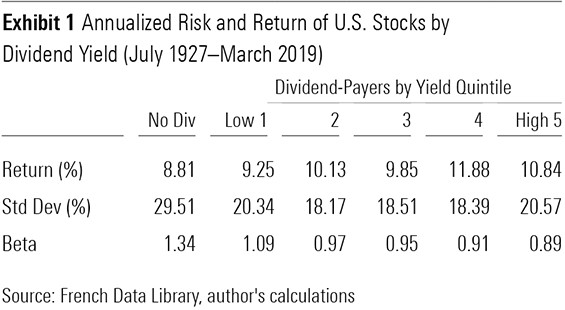

One of the justifications often cited for dividend investing is that high-yielding dividend stocks have historically offered better returns than their stingier counterparts, as Exhibit 1 shows. This is partially because high dividend yields are usually accompanied by low valuations, and cheap assets have tended to outperform pricier ones.

There are other reasons to favor high-dividend-payers. These stocks tend to be more profitable and less speculative than non-dividend-payers. The market tends to punish firms that cut their dividends, so most firms don't commit to them unless they are confident they can honor them throughout the business cycle. Consequently, higher-yielding firms are typically more mature and less sensitive to the business cycle than lower-yielding stocks. These firms often pay out a larger share of their earnings.

High payout ratios can impose discipline on corporate managers, leaving them less money to squander on low-return investments. However, it also leaves less of a cushion to protect dividend payments if earnings fall.

So, what's wrong with aggressively targeting the highest-yielding stocks? The richest dividend yields can point to firms with weak or declining profits, which could threaten the sustainability of the dividend and, more importantly, the price of the stock. Funds that weight their holdings by yield, such as SPDR S&P International Dividend ETF (DWX, listed in the U.S.), are particularly susceptible to this issue because they rebalance into stocks as their yields climb, which is often because of falling stock prices, reflecting deteriorating fundamentals.

Aggressively chasing yield can also increase exposure to value investment style risk, as the highest-yielding stocks tend to be deep-value names. When value stocks are out of favor, that tilt can hurt performance.

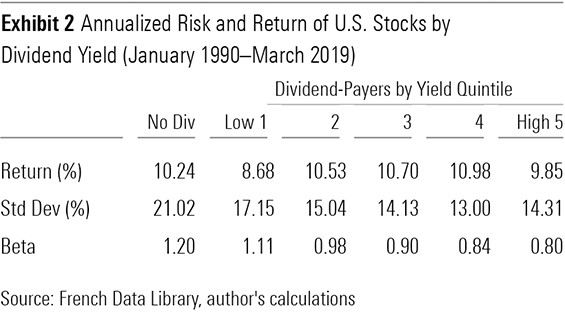

The highest-yielding stocks don't necessarily offer the highest returns, as Exhibit 1 illustrates. Over the better part of the past three decades, non-dividend-payers posted slightly higher returns than the highest-dividend-payers (with higher volatility), as shown in Exhibit 2. During that time, dividends have declined in importance as firms have increasingly used share repurchases to return cash to shareholders.

Strategies that target high-yielding stocks can still deliver attractive returns. The key is to stick to broadly diversified portfolios, where a few bad apples won't derail performance, or strategies that screen for both yield and quality.

In part 2 of this article, we will continue to explore the remaining two ways to boost equity income.

.png)