Strategic-beta exchange-traded products, or ETPs, continue to proliferate. As of the end of October, there were 704 such ETPs, by our count; 194 of them (27%) were launched over the past three years. Strategic-beta ETPs collectively held $892 billion, representing 21% of all ETP assets. These hybrid active/passive varietals present a new learning curve and a distinct due-diligence challenge to investors. Here, I provide a brief guide outlining how we set out to separate the wheat from the chaff in this field.

Low Cost, Low Cost, Low Cost

Did I mention low cost? If there is one thing investors can control, it is cost. As Jack Bogle reminded us time and again, in investing, you get what you don't pay for.

Many asset managers have rolled out suites of strategic-beta ETPs to justify higher fees and to distract investors from this fundamental principle. In some cases, the fees charged by these funds have encroached on active management territory. Do not pay active management prices for passively managed funds.

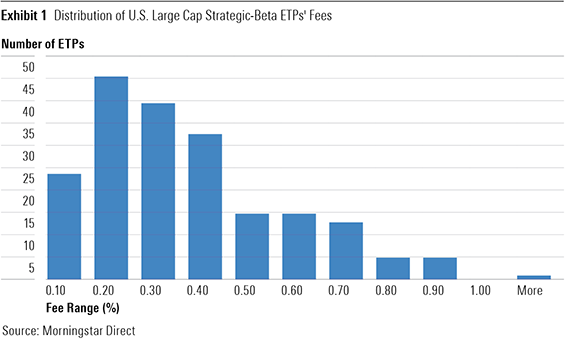

Fortunately, the majority of these funds are reasonably priced, and a combination of competitive forces and economies of scale has pushed some of their fees down over time. In the histogram below, I've plotted the fees charged by the 197 strategic-beta ETPs that invest in large-cap U.S. equities. Nearly 73% of these ETPs take an annual toll that is less than or equal to 0.40%. Forty basis points is 20 times the fee levied by the lowest-cost plain-vanilla U.S. equity ETF, JPMorgan BetaBuilders U.S. Equity ETF (BBUS), but materially lower than the 0.72% average fee of large-blend no-load mutual funds. Products falling into this range are generally sensibly priced. The remaining 27% charge fees in excess of 0.40%. These products merit an added degree of scrutiny. Any strategic-beta ETP that invests in U.S. stocks and takes a toll of 40 basis points or more should be viewed with suspicion.

Sensible Strategy

Strategic-beta ETPs are the offspring of an active and a passive parent. Like their active parent, they deliberately stray from the "market" portfolio with the intent of improving relative returns, decreasing or increasing relative risk, or some combination of the two. As is the case with selecting active managers, investors must assess these products' strategies to ensure they are sensible and efficient and have ample capacity.

Most strategic-beta ETPs' underlying benchmarks are built to exploit one or more factors. Thus, the sensibility of the strategy depends on the viability of the factor or factors it looks to harness. There have been hundreds of factors "discovered" by academics and practitioners over the years. Most of these are the result of data-mining and have no basis in sound economic theory (unexpected earnings autocorrelations?).[1] Economic intuition and investor behavior form the foundation of the good ones.

Value makes sense. Investors demand extra compensation to assume the risks associated with value stocks (cyclicality, leverage, and so on), and one would expect that buying assets on the cheap would naturally yield respectable returns.

Momentum is driven by investors' herding behavior. On the upswing it makes assets overshoot their fair values, often further and for longer than can be reasoned. Momentum works in reverse as well, often giving rise to value. These two are near-unimpeachable. That's not to say they couldn't be diluted or arbitraged away at some point, but I wouldn't count on it. I personally buy into the behavioral explanations of these factors more so than their risk narratives. I don't think that investors, on the whole, will ever behave well--blame it on our caveman brains.

.png)