Environmental, social, and governance investing can be a divisive topic. It is charged with ideological undertones that can split a room in two. Regardless of which corner investors find themselves in, I think there is common ground among them. I believe there are three things about ESG investing that all investors can agree on.

ESG Risks Can Have a Material Financial Impact

I think all investors can agree that ESG risks can have a material financial impact on companies. Climate change can disrupt global agricultural supply chains and have an impact on the bottom lines of firms ranging from Bayer (BAYRY) to Starbucks (SBUX). The Facebook (FB) Cambridge Analytica data breach represented a violation of the social network's social contract with its users. Its share price suffered as a result of the firm's inability to protect its users' information. Failures of governance are the least controversial of ESG risks. When Wells Fargo's (WFC) branch employees opened millions of fake accounts to meet lofty cross-selling goals, there was no doubt that poor governance was to blame. That fiasco cost the firm billions and left a lasting blemish on its brand.

ESG presents a framework for better understanding these risks. Historically, these were rarely the types of risks discussed in companies' financial reports and quarterly earnings calls. These are long-term risks: perhaps not urgent, but always important. Their probability is difficult to handicap, their impact more difficult still.

Because these risks are financially material, potentially large, and difficult to discount, all investors would be wise to take them seriously.

Performance May Be Better or Worse

I also think that all investors can agree that introducing ESG criteria into an investing framework is an active decision. Like any active decision, the only guarantee is that ESG investors' performance will be different than the market. It might be better. It might be worse. Morningstar's own research shows that--after controlling for other factors--it is a push. Historically, there has been neither a material payout nor penalty for investors in global stocks that earn top ESG marks. [1]

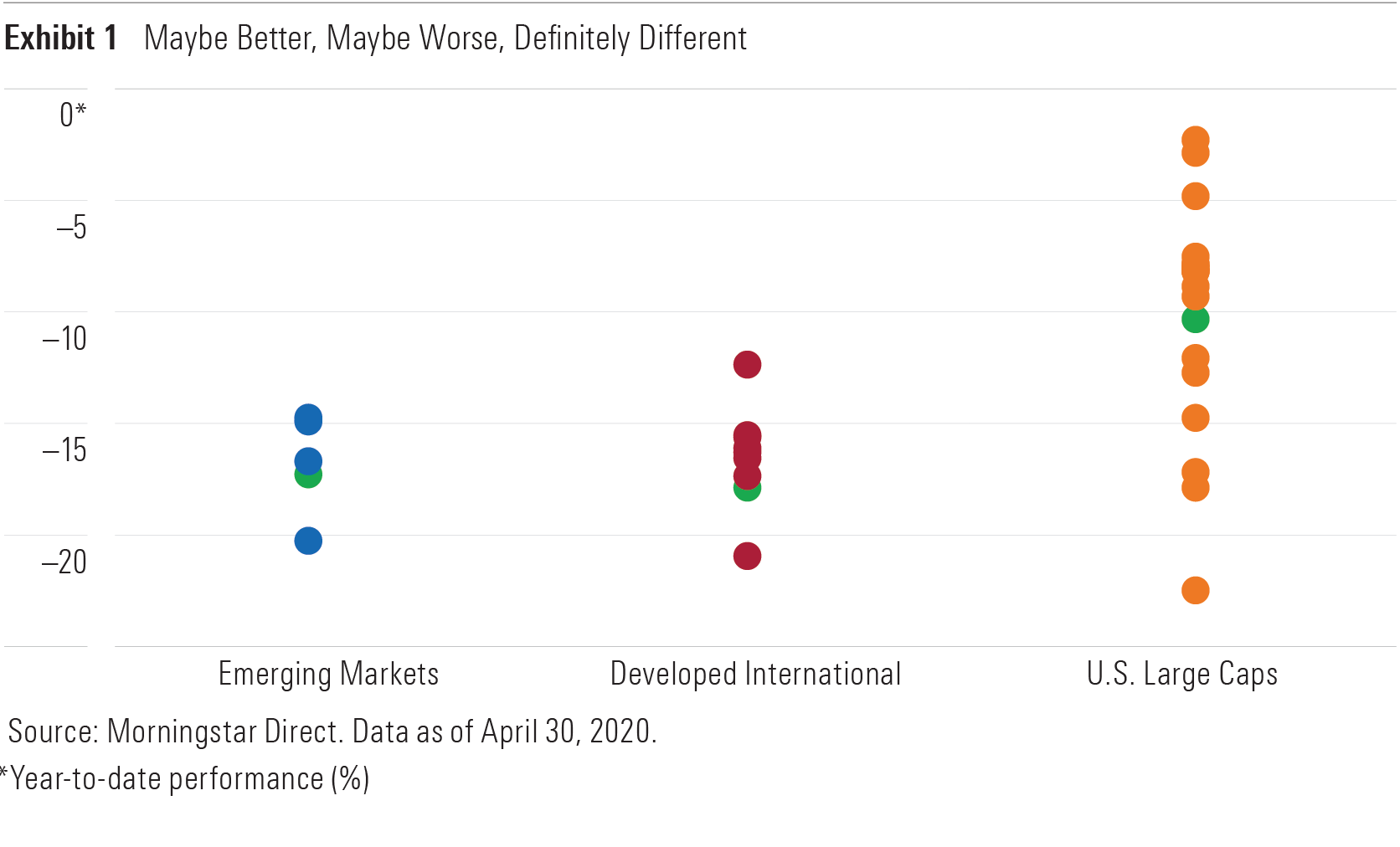

Exhibit 1 illustrates this point. The chart plots the year-to-date returns through April 2020 for equity exchange-traded funds with broad ESG mandates that invest in U.S. large-cap, developed international, and emerging-markets stocks. The highlighted dot in each column represents the performance of an ETF tracking a broad market-cap-weighted index that is representative of the ESG funds' selection universe. Some of the ESG ETFs' returns plot below it and some above.

While this sample is small and the period brief, it is reasonable to expect this relationship to hold across bigger groups and over longer spans. The arithmetic of active management applies to all forms of active strategies, regardless of how they're constructed. [2] The math dictates that a majority can't win or lose over a long enough horizon. Some will beat the market, others won't.

Green Marketing

Finally, I think that all investors will agree that asset managers will use ESG as a means of marketing their wares.

The asset-management industry and the food industry have a lot in common. Both reap the greatest profits from the products that make consumers' choices more difficult than they need to be. Lettuce and index funds are low-margin commodities. The real money is made in the center aisles of the store, where processed packaged products compete for eye-level shelf space. We all know that moderation and sticking to the basics are our best bets when it comes to both our diets and our portfolios. But we just can't help ourselves. And product manufacturers, be they purveyors of foods or funds, know that.

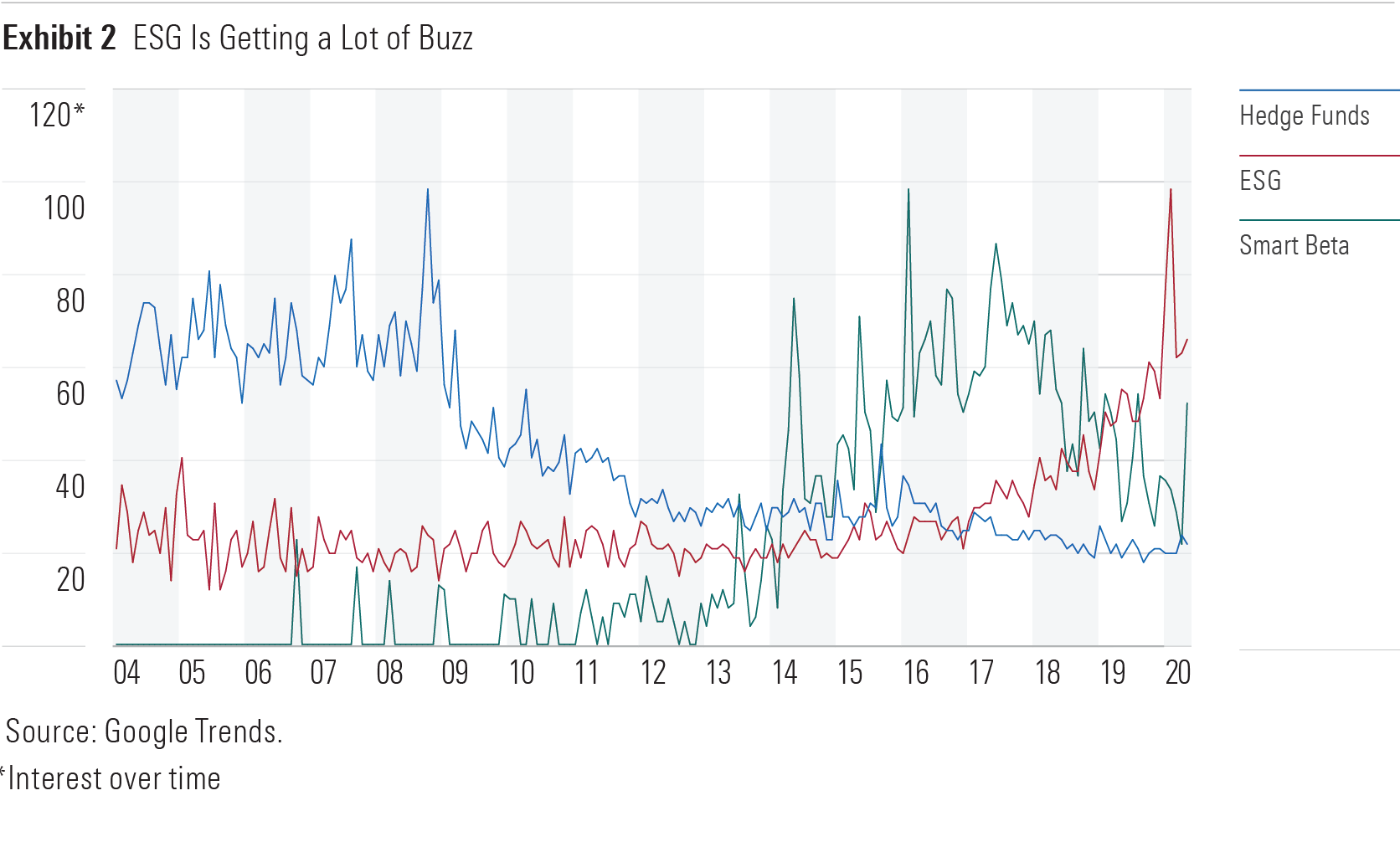

ESG is rapidly becoming the "gluten-free" stamp of the asset-management industry. Exhibit 2 shows Google Trends data for three separate search terms: "hedge fund," "smart beta," and "ESG." The trend in this data reflects the popularity of these search terms among U.S. users of Google's search engine over time. If ESG has become the "gluten-free" of asset management, then "smart beta" is the "omega-" and "hedge fund" is "whole grain." The point being that the trends in product development and marketing we encounter as consumers replicate themselves in the investment arena.

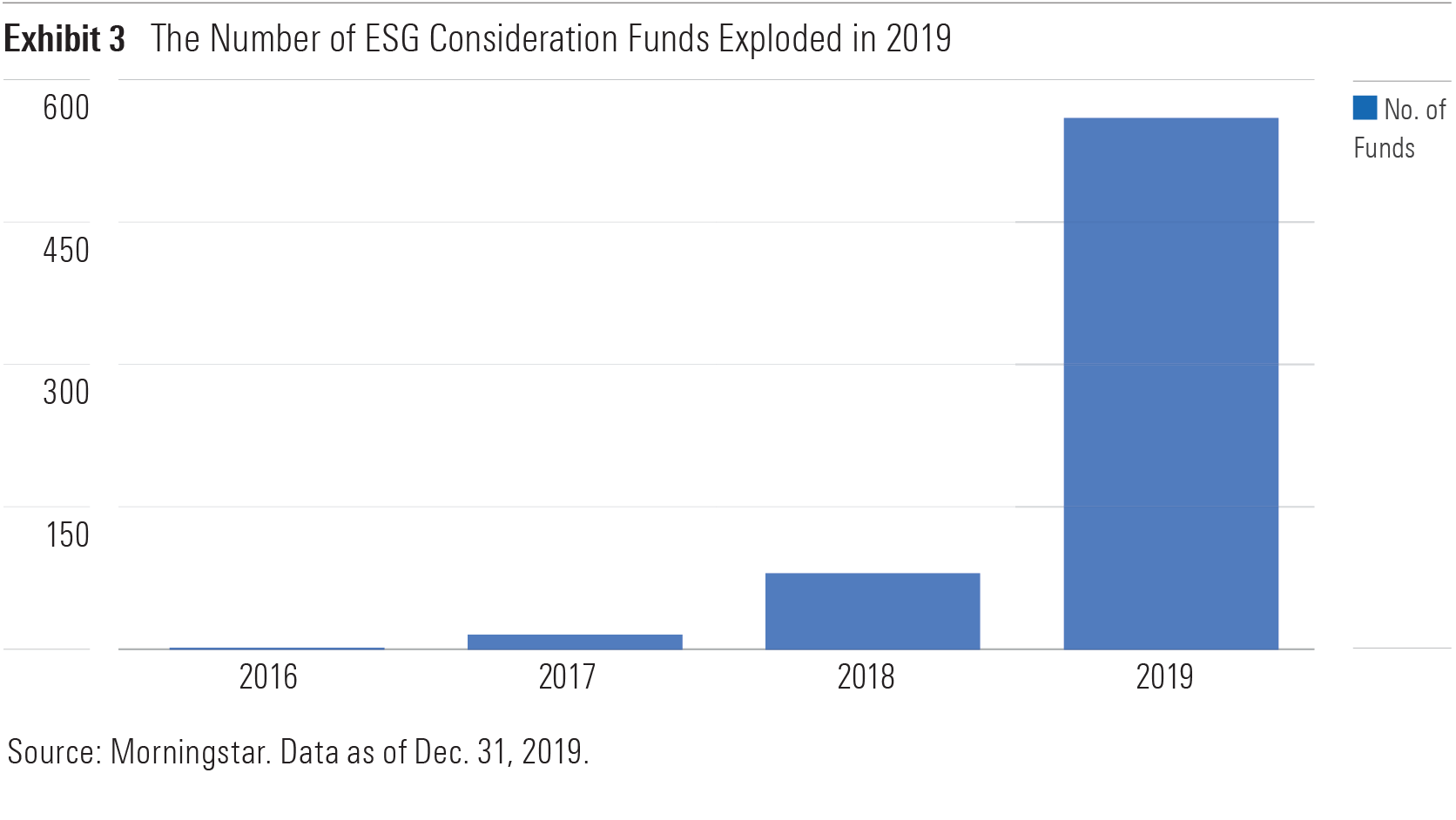

One of the more interesting manifestations of this phenomenon has been the rewriting of fund prospectuses to include a nod to ESG considerations. Exhibit 3 shows a surge in the number of funds that filed documents in the U.S. in stating that they take ESG considerations into account in their investment processes. While these funds might deserve some credit for incorporating ESG risks into their investment framework, simply stating they do so in their prospectuses doesn't mean they hadn't been doing so previously and isn't in itself indicative of a committed approach to sustainable investing.

Just as shoppers would rightfully raise an eyebrow in response to the "whole grain" label on a box of Lucky Charms, they should be similarly shrewd when assessing funds' ESG bona fides. Greenwashing will likely become more pervasive as asset managers look to differentiate themselves based on their ESG efforts.

[1] Wang, P., & Sargis, M. 2020. "Better Minus Worse: Evaluating ESG Effects on Risk and Return." https://direct.morningstar.com/research/doc/963558/Better-Minus- Worse-Evaluating-ESG-Effects-on-Risk-and-Return

[2] Sharpe, W.F. 1991. "The Arithmetic of Active Management." Financial Analysts' Journal, Vol. 47, No. 1, P. 7. https://web.stanford.edu/~wfsharpe/art/active/active.htm

.png)