While the academic definition of momentum is straightforward, the way it is defined and implemented by practitioners is often anything but. A lot happens when momentum descends from the ivory towers of academia and steps into the harsh reality of Wall Street. Long-only constraints, transaction costs, and taxes all take a lot of the oomph out of momentum.

Momentum exchange-traded funds take different approaches to portfolio construction, attempting to retain the benefits of the momentum factor in its purest form and address some of its potential drawbacks. Navigating these nuances can be challenging. Having a solid framework for understanding them is critical.

Selection Universe

In assessing momentum strategies, investors should first make note of the selection universe. This represents the fund’s opportunity set: which stocks are in play and which aren’t.

In the case of momentum ETFs, some start from a broad selection universe, while others are narrower. For example, SPDR S&P 1500 Momentum Tilt ETF (MMTM, listed in the U.S.) draws from the biggest pool of any index-tracking momentum ETF. Its selection universe spans all U.S. stocks large to small and had an aggregate market cap of nearly $31 trillion as of July 31, 2020. Invesco S&P SmallCap Momentum ETF (XSMO, listed in the U.S.)resides on the other end of the spectrum: Its parent index, the S&P SmallCap 600 Index, had an aggregate market cap of US$726 billion as of 31 July 2020.

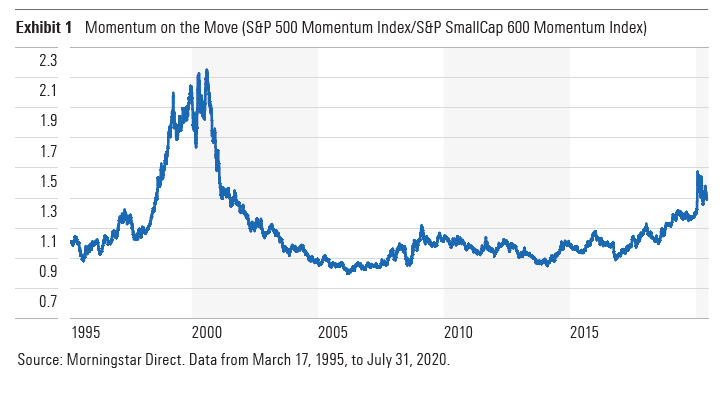

Momentum is fickle. It ebbs and flows across market cycles, sectors, and market-cap strata. Exhibit 1 shows how momentum stocks’ leadership can move up and down the market-cap ladder. This relative wealth plot pits the S&P 500 Momentum Index against the S&P SmallCap 600 Momentum Index. When large-cap momentum stocks outperform small-cap ones, the line moves up, and vice versa. Momentum was strong among the market’s biggest stocks during the tech bubble. When the bubble burst, momentum reversed violently. In recent years, we’ve seen large-cap momentum stocks outperform their smaller counterparts once again.

There is no sense in trying to time these shifts. Selecting a momentum fund that draws from the deepest well of stocks will increase investors’ odds of staying on top of momentum, wherever it may roam.

Selection Criteria

Standard academic momentum is measured by taking stocks’ total returns over the past 12 months and excluding the most recent month. Excluding the most recent month’s returns accounts for the short-term reversal effect, whereby stocks that have performed well during the past month tend to perform poorly the following month, and vice versa. The academic momentum factor goes long the stocks with the strongest momentum by this measure and shorts those with the weakest momentum. Momentum-focused ETFs all use some version of this academic standard to pick stocks. But each has its own unique twist on the classic formula.

Many momentum ETFs include a volatility- or quality-adjusted momentum metric. This helps to weed out stocks that feature a bolt-of-lightning brand of momentum that might be less likely to persist. For example, a biotech stock that spikes higher after releasing favorable clinical trial results will register positive momentum, before accounting for its volatility. These stocks’ gains may not persist. Meanwhile, stocks that rate higher on risk- or quality-adjusted momentum measures are more likely to experience persistent gains. This is because the market may be slower to price in positive information regarding their prospects. Adjusting momentum selection measures based on volatility and/or quality will likely yield better results than a raw measure.

Unlike the standard measure of momentum, some ETFs measure momentum over multiple horizons, often adding a shorter lookback period into the mix. This recognizes the fact that momentum can shift quickly. It also reduces the role of luck in the selection equation. Measuring momentum over multiple horizons is good practice.

In part 2 of this article, we will discuss the other aspects of evaluating momentum funds.

.png)