Ark Innovation ETF wasn't quite an overnight sensation, but it quickly made up for lost time after a relatively quiet beginning in 2014. Portfolio manager Cathie Wood founded Ark Investment Management after successful stints at Capital Group, Jennison Group, Tupelo Capital Management, and AllianceBernstein. Wood and her colleagues look for companies that lead, enable, or benefit from disruptive innovation, an approach to business strategy popularized by Clayton Christensen and his colleagues in the mid-1990s. (Ark's investment strategy is sort of like disruptive innovation on steroids.)

The fund started gaining more attention after its 87% runup in 2017, as well as Wood's bullish call on Tesla in 2018. The fund posted a total return of more than 150% in 2020 and garnered about US$10 billion in net inflows for the year, plus an additional US$5.2 billion in net inflows so far in 2021 (as of Feb. 11). These torrential inflows make the fund--along with several other Ark offerings--one of the fastest-growing funds in the industry.

In this article, I'll use Morningstar's Global Risk Model to analyze the underlying characteristics of Ark Innovation's portfolio holdings. The portfolio stands out for its full-tilt approach toward growth and strong focus on volatile, momentum-oriented stocks.

Under the Hood

Ark Innovation sports a compact portfolio of only 48 holdings, with roughly half of its assets concentrated in the top 10 holdings. Top holding Tesla--which has been a fixture of the portfolio since 2014--now accounts for about 11% of assets. Wood's pursuit of disruptive innovation isn't limited to the United States; the fund currently allocates about 20% of assets to international stocks such as Materialise, CRISPR Therapeutics, and Shopify. Wood targets stocks that can outperform over a five-year period, and portfolio turnover is roughly in line with the Morningstar Category average.

Only about 3% of the fund's portfolio replicates stocks held in the S&P 500, the benchmark identified in its prospectus. The fund's active share (a measure of portfolio overlap) stands at about 92%, indicating that only about 8% of its holdings replicate the index.

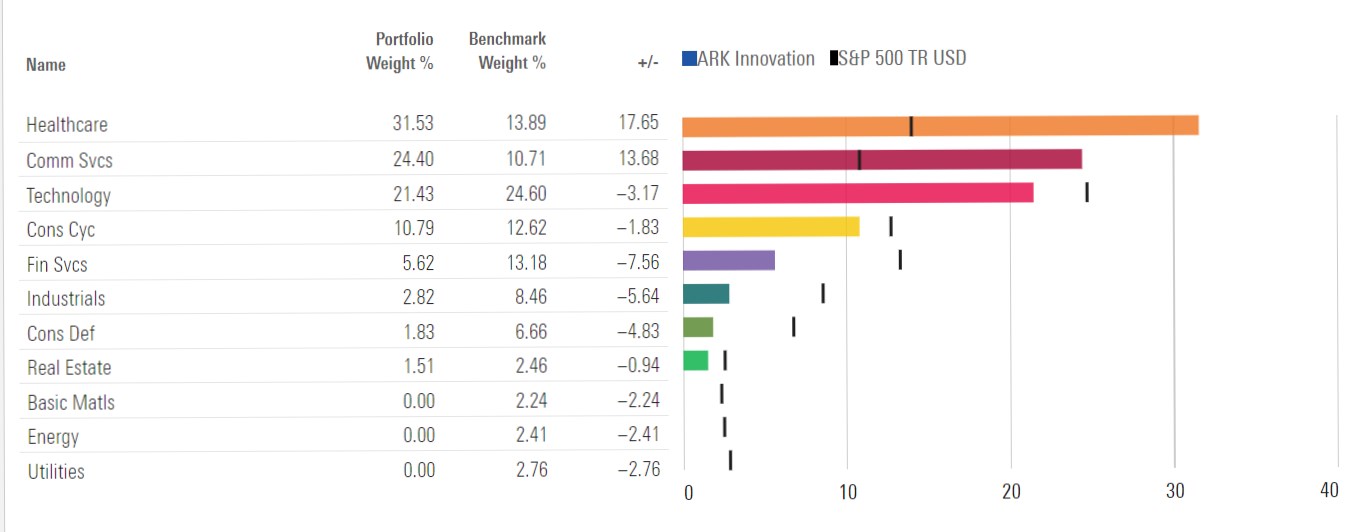

In contrast to many growth-driven managers, Wood hasn't loaded up on technology stocks. Instead, nearly a third of the fund's assets are in healthcare stocks, including a 17.8% stake in biotech issues. Communication services also looms large thanks to holdings such as Roku, Spotify, and Twilio. The fund's tech weighting--while a bit lower than average overall--includes numerous software apps and software infrastructure names. Meanwhile, the fund is underweight in economically sensitive sectors such as industrials and basic materials, as well as financials.

Ark Innovation's Sector Allocation

Source: Morningstar Direct. Benchmark is the S&P 500. Data is based on portfolio holdings as of Dec. 31, 2020.

Let's take a deep dive into the fund's holdings using the 11 style-based factors in the Global Risk Model.

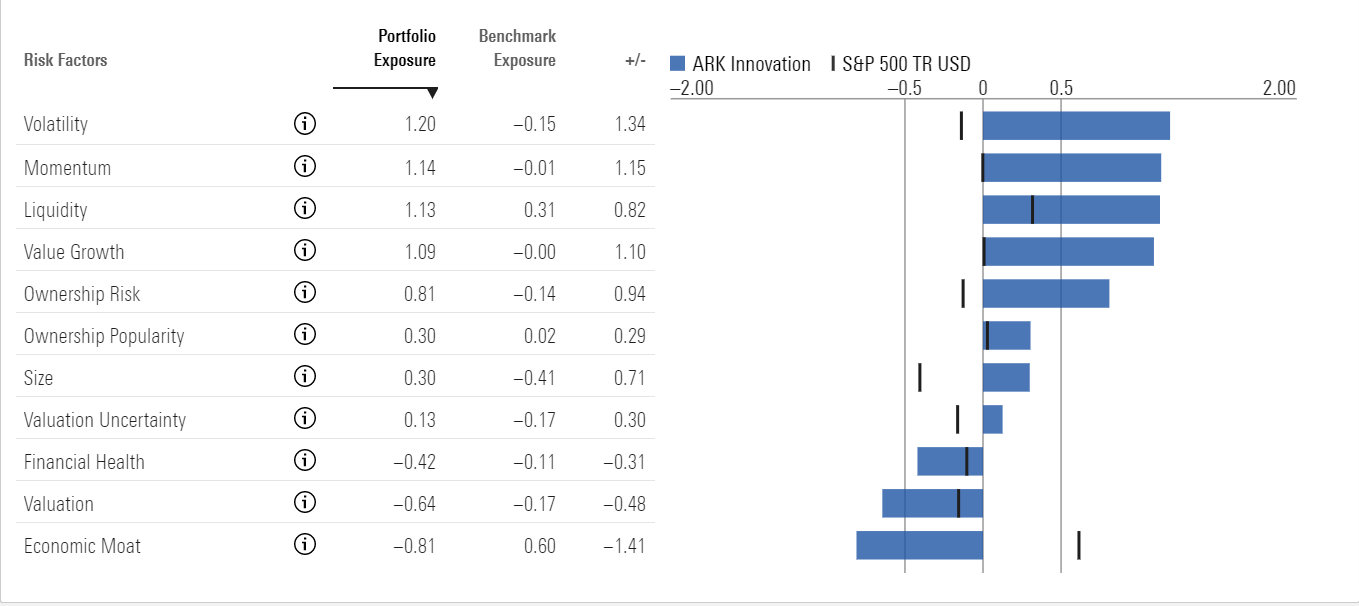

How Ark Innovation's Holdings Stack Up on 11 Different Factors

Morningstar's Global Risk Model includes 11 style-based factors that help shed light on a portfolio's underlying risk exposure. Six of the 11 style factors (valuation, valuation uncertainty, economic moat, financial health, ownership risk, and ownership popularity) are based on Morningstar's fundamental equity research and extensive ownership data. The other five factors (liquidity, size, value-growth, momentum, and volatility) are traditional risk factors that have been widely studied by academic research. We express each score in terms of the number of standard deviations from the average (also known as a z-score), with a score of zero indicating the average score for a universe of about 7,000 domestic stocks. We set the sign of each exposure so that positive numbers are generally associated with factors that have shown a positive effect on returns over time.

Ark Innovation's Risk Factor Exposures

Source: Morningstar Direct. Benchmark is the S&P 500. Data is based on portfolio holdings as of Dec. 31, 2020.

Volatility: Our volatility factor is based on a stock's range of historical prices over the past year. Ark Innovation's holdings score significantly above average for volatility, with a z-score of 1.20 versus negative 0.15 for the S&P 500. Larger holdings such as Tesla, Square, and Invitae have been significantly more volatile than broad market benchmarks. Wood does sprinkle in a couple of lower-volatility names, such as Intercontinental Exchange and Nintendo, but those are the exception rather than the rule. Not surprisingly, the volatility of the fund's underlying holdings has translated into some sharp ups and downs in performance; over the past five years, its standard deviation has been among the highest in the mid-cap growth Morningstar Category.

Momentum: The momentum factor measures how much a stock risen in price over the past year relative to other stocks. Academic research has found that stocks with strong recent performance often continue performing well, at least over shorter periods. Ark Innovation's holdings score very high on momentum, with a portfolio z-score of 1.14 versus negative 0.01 for the S&P 500. Holdings such as Tesla, and Zoom Communications contribute to the fund's strong momentum orientation. Stocks with a strong momentum orientation have performed particularly well in recent years, which has been a tailwind for the fund's performance.

Liquidity: The liquidity factor measures a stock's average trading volume over the past month relative to total shares outstanding. It's basically a measure of how quickly a stock's ownership base changes hands between different investors. Ark Innovation's holdings score well above average for liquidity, with a portfolio z-score of 1.13 versus 0.31 for the S&P 500. But it's also worth noting that while high trading volume is generally beneficial, it can also be subject to rapid changes. Ark favorites like Tesla, Roku, and CRISPR Therapeutics may be popular at the moment, but trading volume can quickly dry up if they fall out favor. The fund's penchant for concentrated positions could also cause liquidity woes if it's forced to sell shares to meet redemptions, especially in positions where Ark owns a large percentage of the outstanding shares.

Value-Growth: This factor measures value and growth characteristics based on how the market is pricing a stock. If the stock's current price is high relative to a simple price estimate derived from earnings yield, dividend yield, and book value, that suggests the stock has higher growth expectations baked into its current price. On the flip side, a low current price indicates a value leaning. Ark Innovation's holdings score well above the overall on this metric, indicating a strong growth orientation. Top holdings Tesla, Roku, CRISPR Therapeutics, and Square all sport high stock prices and equally high growth expectations. In fact, only two of the fund's holdings--Intercontinental Exchange and Taiwan Semiconductor Manufacturing --score as value holdings based on this metric.

Ownership Risk: The ownership risk factor defines a stock's risk level based on the company it keeps. We gauge ownership risk by looking at the risk profiles of the funds that own shares in the same security. If funds owning the stock tend to have high risk profiles, we assign a higher ownership risk score. Ark Innovation's holdings score well above average on ownership risk, with positions such as Invitae, Editas Medicine (EDIT), and Organovo (ONVO) scoring particularly high. Invitae, for example, is mainly held by small-cap index funds. Ark Investment Management owns about 15% of the outstanding shares.

Ownership Popularity: This factor represents changes in popularity of a particular stock from the perspective of fund manager ownership. High ownership popularity scores indicate that more fund managers have been increasing their positions in the stock over the past several months. Ark Innovation's holdings score above average on this metric, with a z-score of 0.30 versus 0.02 for the S&P 500. But while most of its holdings are clearly on-trend and in vogue, only a few of its holdings tend toward extreme popularity with other fund managers.

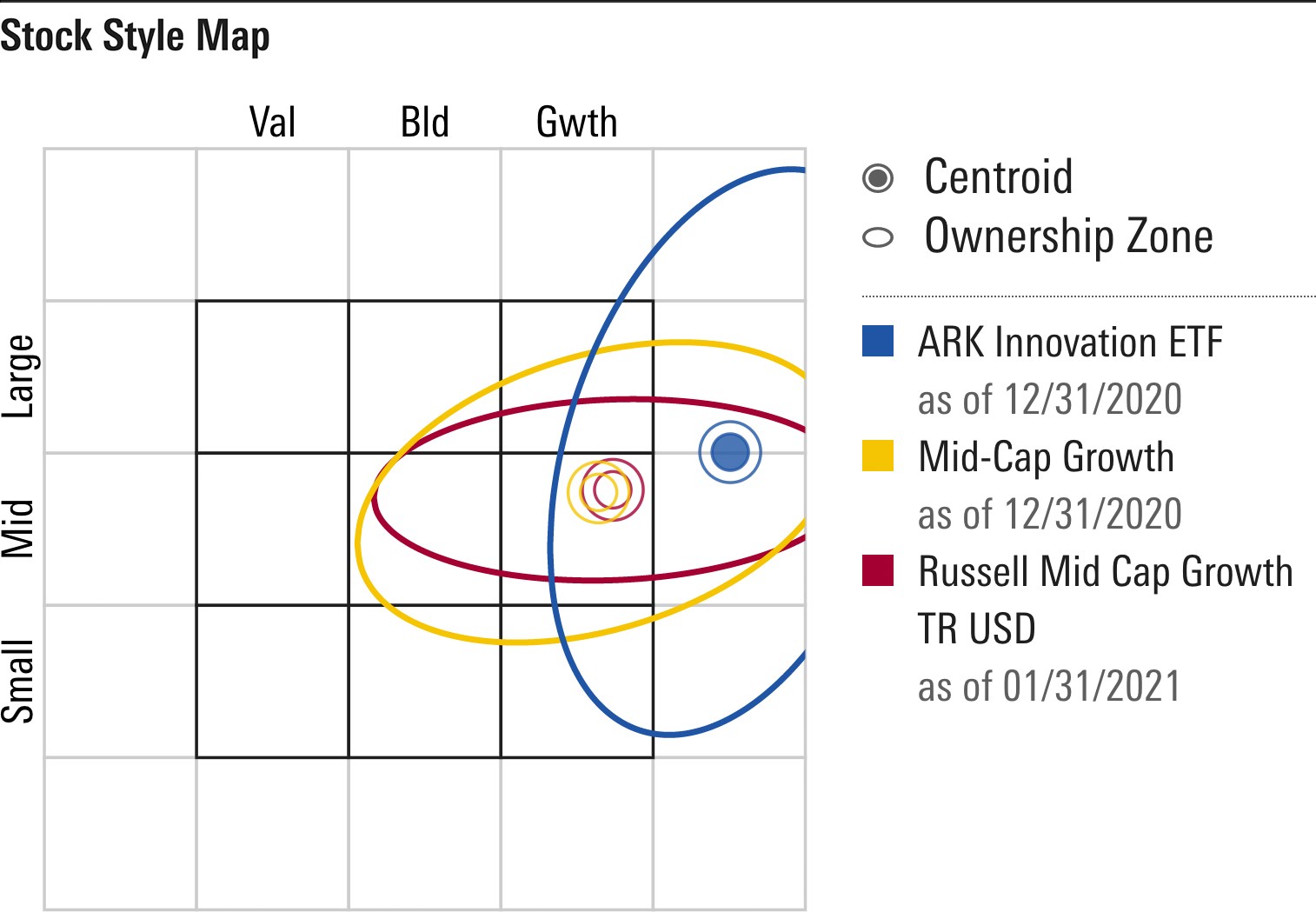

Size: The size factor is based on the market capitalization of the stocks included in a portfolio, with higher scores indicating more exposure to smaller-cap stocks. Academic research has found that smaller-cap stocks tend to outperform over longer periods, although larger-cap names have taken a strong lead in the past decade. As the Morningstar Style Box map below illustrates, Ark Innovation has a pretty flexible market-cap range, with holdings ranging from micro-caps like Organovo Holdings to mega-cap names like Tencent Holdings (TCEHY). As mentioned above, the portfolio also has an unusually strong growth orientation, even relative to other mid-cap growth funds.

Source: Morningstar Direct. Benchmark is the S&P 500. Data is based on portfolio holdings as of Dec. 31, 2020.

Valuation Uncertainty: The valuation uncertainty factor is based on Morningstar's Quantitative Uncertainty Rating and measures the level of uncertainty embedded in a company's Quantitative Fair Value Estimate. Companies with less consistent operating earnings and capital spending tend to have less-stable cash flows, making it more difficult to pin down an estimated fair value. Higher scores imply greater uncertainty with a wider range of potential valuation outcomes. By extension, portfolios with high scores for valuation uncertainty tend to have more volatility in returns. Ark Innovation's holdings score above average for valuation uncertainty, with a portfolio z-score of 0.13 versus negative 0.17 for the S&P 500. Holdings such as CRISPR Therapeutics, Invitae, Zillow (Z), and Pure Storage (PSTG) are not only volatile but also difficult to value, adding another layer of potential risk.

Financial Health: The financial health factor is based on strength of a firm's balance sheet, as well as its equity volatility. Higher scores imply portfolios with stronger financial health and a lower risk of bankruptcy. Stocks that score well based on this factor tend to hold up better during economic downturns, such as the global financial crisis in 2008. Ark Innovation's holdings score below average on financial health, with an average z-score of negative 0.42 versus negative 0.11 for the S&P 500. Many portfolio holdings aren't yet generating earnings or free cash flow, making them potentially vulnerable if they run out of cash to support their operations.

Valuation: The valuation factor measures how cheap or expensive a stock is relative to Morningstar's Quantitative Fair Value Estimate, a statistical estimate of fair value based on a company's projected future cash flows. Higher scores indicate the stock is undervalued and more likely to generate positive future returns, while lower scores indicate higher valuations. Ark Innovation's portfolio scores well below average on this metric, with a z-score of negative 0.64 versus negative 0.17 for the S&P 500. Valuations for the fund's holdings look pricey based on this measure nearly across the board. CRISPR Therapeutics, for example, was trading at about US$150 per share as of Feb. 16, more than a 50% premium to its Quantitative Fair Value Estimate of about US$110 per share.

Economic Moat: The economic moat factor is based on the Morningstar Quantitative Economic Moat Rating, which is designed to measure the strength of a firm's competitive advantage based on the sustainability of its profits. Higher scores suggest a firm will be able to keep competitors at bay for an extended period. Ark Innovation's portfolio holdings score significantly below average for economic moat, with a portfolio z-score of negative 0.81 versus 0.60 for the S&P 500. About a third of the fund's holdings--including Tesla, Square, and Proto Labs (PRLB)--have narrow economic moats, but companies with no-moat ratings make up the majority of the portfolio. That hasn't hurt performance so far, but Ark's holdings could suffer if competitors start cutting into their market share and profitability.

Conclusion

Ark Innovation's stellar total returns attest to its ability to be in the right place at the right time and take advantage of emerging trends. But a closer look at the portfolio reveals plenty of potential risks. In fact, the portfolio's risk level ranks well above average on 10 of the 11 factors in Morningstar's Global Risk Model. And risk for liquidity (the 11th) may not be as low as it appears. Trading volumes can quickly dry up when valuations collapse or market darlings fall out of favor. If the fund experiences large redemptions, it could be difficult to liquidate some of the holdings where it has concentrated ownership.

The fund's rapid asset growth is another risk factor not directly captured in the 11 factors discussed above. It's been a popular target for hedge funds, day traders, and short-sellers, and any reversal in asset flows could lead to a downward spiral, including adverse price impacts if it's forced to trade. Investors caught up by the fund's chart-topping returns should remember that what goes up must eventually come down, and it's likely that more of the portfolio's underlying risk factors will eventually come to the fore.

Passionate about Investing in New Ideas?

Explore the latest Global Thematic Fund Landscape report here

.png)