In Part 1 of this article, we looked briefly at the U.S. green bond ETF market. In Part 2, we will look at some examples of ETFs incorporating ESG criteria.

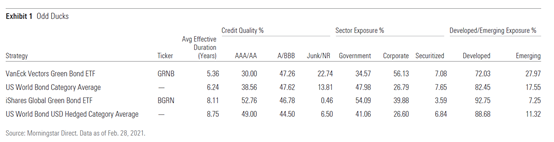

Exhibit 1 illustrates the difference between these two funds, the VanEck Vectors Green Bond ETF (GRNB) and the iShares Global Green Bond ETF (BGRN), and their relevant Morningstar Category averages. Notably, their exposure to credit risk and interest-rate risk are markedly different. Eschewing non-U.S.-dollar-denominated bonds tilts GRNB heavily toward corporate issuers, resulting in greater exposure to the small contingent of junk-rated issuers that have raised green bonds. BGRN is a better pick for green bond market exposure to the extent that its portfolio is a more accurate reflection of the entirety of that market. This limits active risk and results in less credit risk in particular.

Exhibit 2 shows that both ETFs are odd ducks relative to category peers. While BGRN is more conservative and representative of the green bond market relative to GRNB, the fund still courts a considerable amount of active risk versus its peer group. Investors need to understand that the greenest choices involve a tension between being green and taking on different risks relative to the broad market and close peers.

Dialing Back Active Risk

Dialing Back Active Risk

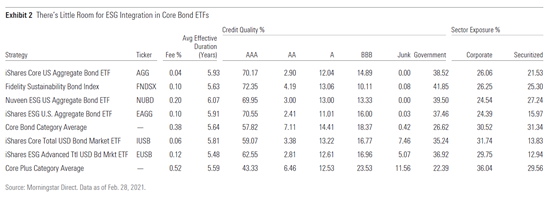

Green bond ETFs represent the most verdant segment of the bond market, where ESG impact is most immediately measurable and active risk is the highest. At the other extreme there are ESG-intentional ETFs that use the Bloomberg Barclays U.S. Aggregate Bond Index as their touchstone. These funds attempt to mimic the benchmark’s contours while incorporating ESG criteria. They exclude corporate issuers engaged in controversial business practices, which tilts their portfolios to issuers that exhibit better ESG practices. However, given that corporate bonds represent the minority of these funds’ portfolios, the scope for ESG incorporation is limited. The bulk of their portfolios is invested in debt that points back to the U.S. government, which isn’t filtered through an ESG lens. As such, these funds’ active risk is low and their performance should closely mimic the Aggregate Index’s.

The Bloomberg Barclays Universal Aggregate Bond Index includes below-investment-grade bonds but is otherwise similar to the Aggregate Index. IShares ESG Advanced Total USD Bond Market ETF (EUSB) tracks an index designed to mirror the Universal Aggregate Index and thus provides investors with greater opportunity to express ESG-related views relative to Aggregate Index ESG funds, given that its parent index sweeps in junk bonds.

Exhibit 2 shows how these funds’ portfolios compare with their ESG-agnostic counterparts as well as the category average. Given they have little room to take active risk, all four strategies are hard to distinguish from their counterparts that set aside ESG considerations.

Credit Portfolios Are Greener

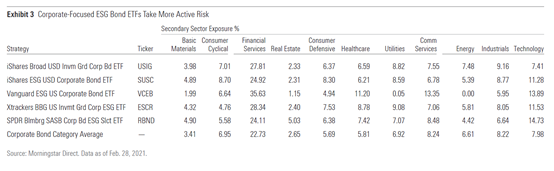

There are currently four broad, investment-grade ESG-intentional ETFs. Each of them mirrors the credit and duration risk profile of their broader investment opportunity sets, mitigating active risk. Nonetheless, these funds court more active risk relative to the ESG-intentional funds tethered to the Aggregate and Universal Aggregate indexes given that their portfolios are invested exclusively in corporate bonds.

Incorporating ESG principles results in noticeable sector tilts. This is evident in Exhibit 3, which features the sector allocations of the four broad investment-grade funds, as well as iShares Broad USD Investment Grade Corporate Bond ETF USIG, a representative ESG-agnostic peer.

Degrees of Difference

By incorporating ESG criteria, sustainable bond funds are guaranteed to be different from their peers that are underpinned by broad benchmarks. Introducing active risk does not guarantee better or worse performance relative to the market—just different performance. The degree of active risk courted by ESG-intentional bond ETFs varies widely. In the burgeoning green bond market, active risk is high. The degree of active risk courted by sustainable funds handcuffed to the Aggregate Index is fairly low. Everything else falls somewhere in between. Investors looking to incorporate ESG criteria into the fixed-income sleeve of their portfolio should be aware of these trade-offs when balancing doing well financially with trying to do something good for the world around them.

.png)