With a market capitalisation of roughly $2 trillion, Apple (AAPL) is too big for most investors to ignore.

Any investor holding a broad equity market index fund owns a generous helping of Apple. For example, it consumes nearly 5% of the Morningstar US Market Index – which contains 1,439 stocks – and this weighting is higher in other indices. Thanks to strong iPhone demand and a sticky customer base, Apple flourished both before and during the Covid-19 pandemic. Investors are slated to get the latest read on Apple’s earnings on April 28.

But when it comes to where Apple lands outside a broad equity market index, a tricky question arises: Is Apple a growth stock, a value stock, or both?

What is Apple’s Style?

Most people likely think of Apple as a growth stock, counting it along with many other technology names. For most index providers, that’s where Apple lands. It’s a classification that has led to concentration problems within benchmarks used by active managers and tracked by index funds.

At Morningstar, the process for classifying stocks within the Morningstar Style Box directs Apple into the “large core” segment, meaning that it displays a mix of value and growth characteristics. Since 2016, Apple has generally drifted to the middle of the Morningstar style spectrum.

Price/book value is one measure that makes Apple look like an extreme growth stock. A measure of share price valuation, price/book has come under criticism for its neglect of intangible assets, such as intellectual property.

Apple derives most of its value from intangibles, including its formidable brand and the iOS operating system that seamlessly integrates hardware and software. Since Apple’s book value is low, its price/book value ratio is high. Morningstar’s 10-factor style model reduces reliance on any one metric. On the two forward-looking inputs, which together drive half the style score, Apple falls in between growth and value.

Apple’s Journey to Growth

But Apple hasn’t always landed in between growth and value. Like many stocks, it has undergone a style journey. Many investors today may have forgotten that during the dot-com frenzy of the late 1990s, with Steve Jobs newly returned as chief executive, Apple Computer, as it was then known, was considered a technology industry has-been. In 2000, Apple’s growth rate and valuation multiples landed it closer to the value side of the style box.

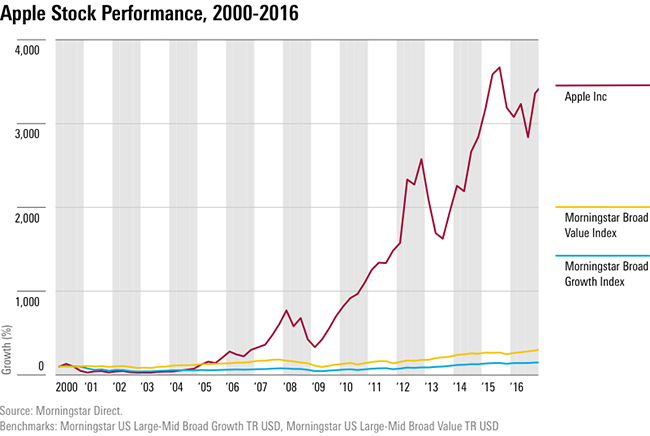

Then came an astounding run of innovation that brought the world the iPod, iTunes, the OS X, the MacBook, the iPhone, the iPad, and the Apple Watch. Apple spent 2004 to 2016 as a high-flying growth stock.

While highly successful, the company’s previous growth trajectory could not be sustained. In 2012, Apple even started paying a dividend - a sign of maturation and in recent years, Apple has drifted into the middle section of the Morningstar Style Box.

Does it Matter if Apple is Growth or Value?

Exchange-traded funds (ETFs) tracking growth indices hold more than $300 billion in investor assets, and even more investor capital is in other passive investments, Investors in some growth index funds might be surprised to learn that more than 11% of portfolio assets end up dedicated to Apple. Of course, the US equity market has become quite concentrated overall in recent years, with a small cohort of tech-related names consuming a huge portion of market value.

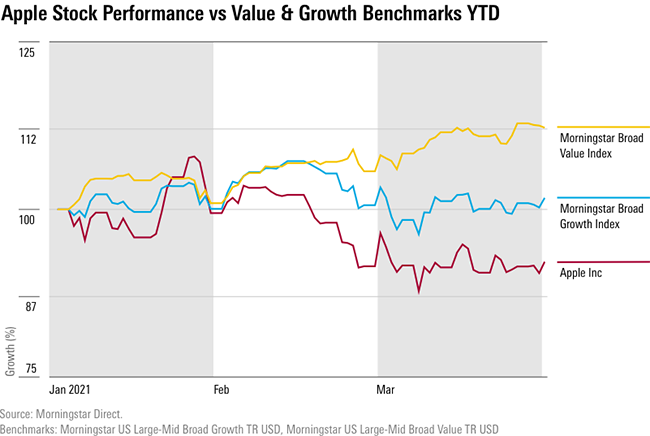

Apple’s prominence makes it a key driver of relative returns. For index-tracking funds and ETFs, the more Apple exposure the better in recent years. But in early 2021, Apple’s share price declined, reducing overall returns for many index-tracking funds.

Meanwhile, managers of the more than $2 trillion in active growth funds have a tough decision to make. If they like Apple, they need to dedicate a very chunky portion of their to it in order to maintain an “overweight” position. If Apple does well, an “underweight” position will disadvantage them. On the value side, funds that owned Apple got a big boost relative to benchmarks with no Apple exposure in recent years. In 2021’s value rally, though, Apple exposure would have held a value fund back.

The Two Sides of Apple

The mixed picture of Apple can also be seen in the diverse views of the company among active fund managers. The stock features in funds in the Large-Growth Morningstar Category as well as those in the Large-Value category.

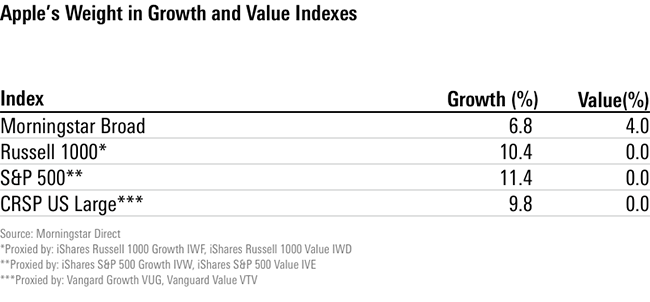

How does Morningstar’s style assignment for Apple drive the stock weight for its broad growth and broad value benchmarks compared with other index providers? As displayed below, Apple is partially allocated to both Morningstar’s broad growth and broad value indexes, albeit at different weights.

The broad growth index devotes significantly less share to Apple than competitors, who use a range of methodologies, explained by Morningstar manager research analysts in their ETF analyses. Morningstar is unique in including Apple in its value index.

©2021 Morningstar. All rights reserved. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided as of the date written, solely for informational purposes; and subject to change at any time without notice. This content is not an offer to buy or sell any particular security and is not warranted to be correct, complete or accurate. Past performance is not a guarantee of future results. The Morningstar name and logo are registered marks of Morningstar, Inc. This article includes proprietary materials of Morningstar; reproduction, transcription or other use, by any means, in whole or in part, without prior, written consent of Morningstar is prohibited. This article is intended for general circulation, and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Investors should consult a financial adviser regarding the suitability of any investment product, taking into account their specific investment objectives, financial situation or particular needs, before making any investment decisions. Morningstar Investment Management Asia Limited is licensed and regulated by the Hong Kong Securities and Futures Commission to provide investment research and investment advisory services to professional investors only. Morningstar Investment Adviser Singapore Pte. Limited is licensed by the Monetary Authority of Singapore to provide financial advisory services in Singapore. Either Morningstar Investment Management Asia Limited or Morningstar Investment Adviser Singapore Pte. Limited will be the entity responsible for the creation and distribution of the research services described in this article.

.png)