When it comes to investing, should you go it alone or enlist an adviser to help? Years ago, few people would have felt confident enough to handle their own finances, but the introduction of online investment platforms have made it cheap and easy to do-it-yourself.

DIY investing has become the norm in many countries as more and more people want to take control of their own financial future. And with the likes of Vanguard offering accounts for a fee as little as 0.15%, it’s not hard to see why a growing army of investors prefer this route than using an IFA, who might charge 10 times that amount.

But a DIY approach won’t be right for everyone, nor for all situations. Let’s take a look at when it makes sense to do-it-yourself, and when it doesn’t.

Just Starting Out?

If you’re investing for the first time, you may rightly feel nervous and worried about getting it wrong. Using a financial adviser may feel expensive or extravagant at this stage of life, as it’s likely you’ll only have a small amount to invest, but having no expert assistance may be intimidating.

Mike Coop, portfolio manager at Morningstar Investment Management, says getting involved in your portfolio from the off could help spark a lifelong interest in investing. “There are definitely benefits to making your own investment decisions as early as possible – you’ll learn about market ups and down, and find out how you react to them, and you’ll appreciate the complexity of investing and therefore appreciate the value of professional advice when you do come to take it,” he explains.

That doesn’t mean newbies need to go it completely alone. Plenty of investment platforms offer questionnaires that help you assess your risk tolerance and steer you to an appropriate low-cost ready-made investment portfolio based on the results. There’s also endless information available on the internet for those doing their research – Morningstar provides ratings on funds and stocks to help investors, and also provides globe ratings as a guide for those looking to make sustainable investment decisions.

Verdict: Try DIY

Pushed for Time?

Investing isn’t something you can take a lazy approach to, unfortunately – it takes time, interest and knowledge. If you are time poor or are not interested in doing your homework, then DIY investing may not be for you.

Coop says: “People who don’t have time or aren’t interested are better off using the services of others if they can afford to do so. Interest is one of the most important things because it drives you to do your research and keep an eye on your portfolio. Investing is something you need to spend time on.”

Of course, some people don’t like the idea of outsourcing their investment portfolio and prefer to feel in control of their own finances even if they are pushed for time. In this case, multi-asset or multi-manager funds may be one area to explore. This option allows you to do the initial research and fund selection but leave the fund manager to do the asset allocation for you. Coop suggests that you could also split your money, keeping some to manage yourself while allowing an adviser to look after a portion too.

Verdict: Don't DIY on the fly

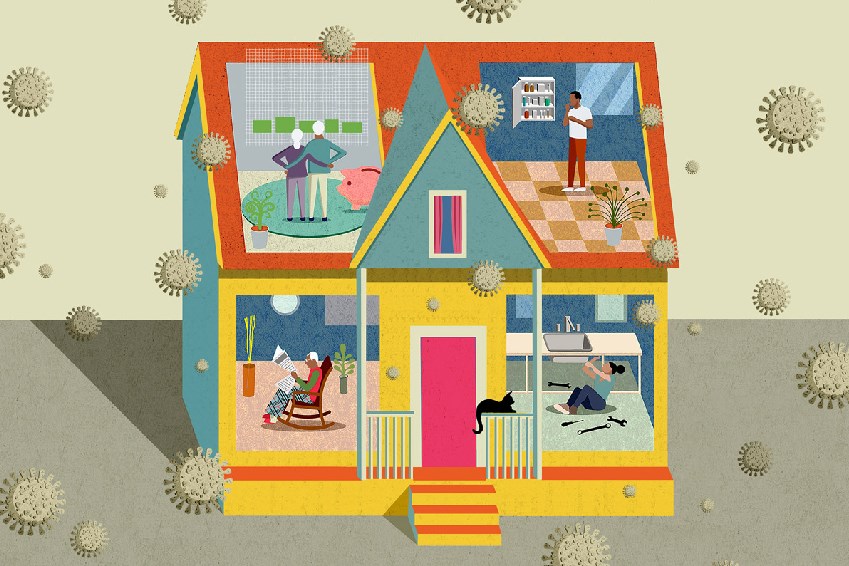

Big Life Change?

Finances are often front of mind when there’s a major change in our life circumstances, whether it’s getting married and starting a family, starting up a business, or moving into retirement. These milestone moments in life often come hand in hand with a change in our income requirements.

At these times it makes sense to enlist the services of an adviser, because you really don’t want to make a wrong step. Buying an annuity, for example, is something you only get one chance to get right and will affect your income for the rest of your life.

Coop says: “You have to weigh up the risks. Would you fit a kitchen if you didn’t know which end of a hammer to use? No, but you might have a go at putting a picture up on the wall because not too much can go wrong there. With the bigger stuff, you need to know what you’re doing.”

Many advisers will offer one-off sessions to handle specific issues, such as setting up life and health insurances for your family or doing a review of your pensions savings, and this could be an option for those who are generally happy to DIY their finances but want to bring in a specialist to help with a specific situation.

Verdict: Bye bye DIY

.png)