During the second quarter, investors shifted their attention slightly to allocation and income-theme funds, away from equity portfolios. Cross-border fund investors continue to shy away from high-yield and corporate bond funds.

The universe of cross-border funds (for sale in Hong Kong and Singapore) has recorded net inflows for five consecutive quarters. These inflows followed a severe withdrawal of US$ 103.9 billion in the first quarter of 2020. In the second quarter of 2021, net flows totaled US$ 39 billion, on par with that of the previous quarter.

During the quarter, the renewed bout of equity volatility triggered investors with heavy stock bets to reposition and look for vehicles that could increase asset class diversification. As a result, relatively stronger flows entered allocation funds, as these vehicles gathered a total of US$ 8.4 billion in inflows. So far this year, allocation funds have absorbed nearly US$15 billion in assets, which reversed the US$15.5 billion net outflow throughout 2020. Meanwhile, investors allocated US$6.9 million into money-market funds, which are typically used as a near-term cash management tool. Moreover, money-market funds saw a year-to-date redemption of US$14.2 billion, implying that investors continued to deploy assets into the capital markets.

Inflows into equity funds persisted. The category remained the most popular broad category. However, over the second quarter, the pace of flows significantly slowed due to elevated volatility and sideways trading in global equity markets. In contrast, capital flowing into equity funds amounted to US$ 26.8 billion in the second quarter compared to the US$ 53 billion inflow recorded in the first quarter of 2021.

Bond Continues to Bleed

More investors preferred global mixed-asset strategies, with strong inflows into the Moderate Allocation category. Such portfolios typically have 50% to 70% of assets in equities and the remainder in fixed income and cash This balanced approach enables investors to capture both capital appreciation and income from stocks, bonds and cash.

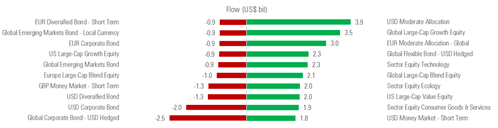

Growth-tilted equity categories continued to be on investors’ radar. Global Large-Cap Growth Equity and Sector Equity Technology took in US$3.5 billion and US$2.3 billion, respectively, in the past three months.

Technology equity funds capitalize on a concentrated portfolio, which worked well in the middle of a tech bull run extending to 2021. For the past six months, this category generated an average return of 11.72%. From 2020, another investor favorite was the China equity category, which dropped from the list of leaders following the market’s regulatory skirmish.

Bond Funds Continue to Bleed

On the fixed income fund side, cheery U.S. economy data indicated that recent rises in inflation would not hinder the economic recovery. Bolstered investor confidence pulled credit spreads tighter towards the end of the second quarter, however, the yield movements had not been reflected in fund flows to corporate bond categories. In the second quarter, Global Corporate Bond - USD Hedged and USD Corporate Bond suffered the most outflow of US$ 2.5 billion and US$ 2 billion, respectively. However, the outflow from Global Corporate Bond – USD Hedged portfolios slowed from US$ 6.7 billion from the first quarter.

Investors were overall net redeemers of money market funds holding Pound Sterling, with a total withdrawal of US$ 5.2 billion year to date.

In terms of firm, BlackRock, which has US$ 208 billion under management, has been holding up an inflow momentum for the past four quarters and has absorbed the most assets in the second quarter. Allianz Global Investors ranked second, mainly helped by Allianz Income and Growth, a global allocation fund. The fund saw a quarterly net subscription of US$2.2 billion, contributing to half of Allianz’s quarterly flow. Quarterly withdrawals from Amundi Funds Emerging Markets Bond and Amundi Funds Global Aggregate Bond were the main reason for the firm’s bottom rank.

©2021 Morningstar. All rights reserved. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided as of the date written, solely for informational purposes; and subject to change at any time without notice. This content is not an offer to buy or sell any particular security and is not warranted to be correct, complete or accurate. Past performance is not a guarantee of future results. The Morningstar name and logo are registered marks of Morningstar, Inc. This article includes proprietary materials of Morningstar; reproduction, transcription or other use, by any means, in whole or in part, without prior, written consent of Morningstar is prohibited. This article is intended for general circulation, and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Investors should consult a financial adviser regarding the suitability of any investment product, taking into account their specific investment objectives, financial situation or particular needs, before making any investment decisions. Morningstar Investment Management Asia Limited is licensed and regulated by the Hong Kong Securities and Futures Commission to provide investment research and investment advisory services to professional investors only. Morningstar Investment Adviser Singapore Pte. Limited is licensed by the Monetary Authority of Singapore to provide financial advisory services in Singapore. Either Morningstar Investment Management Asia Limited or Morningstar Investment Adviser Singapore Pte. Limited will be the entity responsible for the creation and distribution of the research services described in this article.

.png)

.jpg)