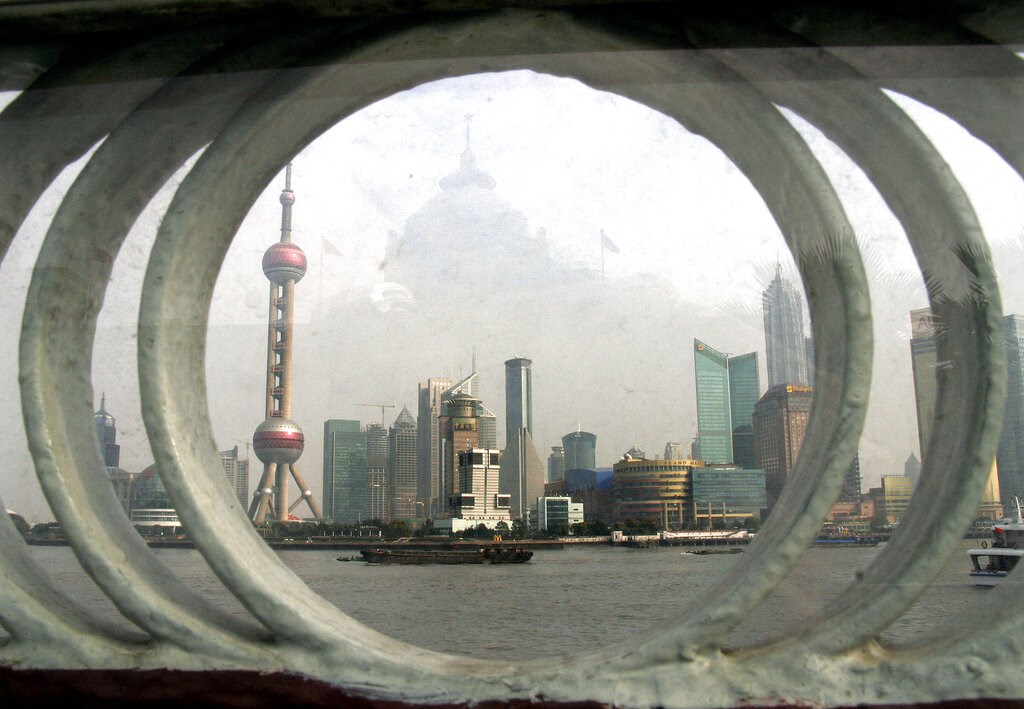

Investors in the region have more to worry about, as further investigations of Chinese tech giants, and the arrest of Macau’s casino junket operators rock the markets. The Hang Seng Index and the onshore CSI 300 Index dipped 14% and 8%, respectively, in the first 11 months of 2021.

Morningstar’s coverage of Greater China equities also edged lower from the beginning of 2021. Stocks closed November 16% below their fair value estimates on average. According to our analysts, there are still cases where they believe the values of cheap stocks are moving higher.

In the Morningstar coverage list of 149 names in the mainland China, Hong Kong and Taiwan stock markets, we looked for those that hold a 5- or 4-star Morningstar Rating and narrowed our picks to those with the biggest fair value increase since the end of September 2021.

The results of our screen are shown below and are a motley crew, from value-oriented banks, to a utilities provider, to an e-commerce platform, and a chip foundry. Here’s the list:

Here are our analysts’ thoughts on third-quarter results and their reasonings for raising their fair value estimates:

Postal Savings Bank Of China

The state-owned bank’s fair value estimate was increased by 17% and its shares are trading at a 29% discount. The bank’s net interest margin outperformed most peers in the past quarter and our analyst sees a more optimistic near-term outlook for its net interest margin and fee income growth.

“We expect PSBC’s strong growth momentum to continue during our five-year forecast period, thanks to its potential in asset mix optimization and extensive network that benefits from the robustly-growing wealth management business in less developed markets. The continuous asset mix shift toward high-yield retail lending offers strong buffer against downward pressure on average loan pricing amid a slowing economy, resulting in a relatively steady yield on interest-earning assets in 2021.”

- Iris Tan, senior equity analyst

Ping An Bank

After raising our fair value estimate by 8%, Ping An Bank trades at 33% discount. In the third quarter, the bank reported a faster profit growth since 2014.

“Year-on-year net profit growth further accelerated to 30%, well exceeding our analyst’ prior expectation for a high-teens growth for the full year of 2021. PAB’s corporate loan book has been largely cleared up following a five-year de-risk campaign since 2017. Despite rising market uncertainties, PAB’s credit quality of property developer loans fell to a record low of 0.36% from 0.57% in mid-2021.”

- Iris Tan, senior equity analyst

JD.com

Although JD.com (09618, JD) was among the main targets for regulation, our analysts believe the company will emerge stronger than its peers. After a 7% upgrade, the wide-moat stock is trading a 20% discount to its fair value.

“We like JD’s third-quarter results mainly due to stronger user loyalty and demonstration of strong execution. Given JD’s strong performance in the electronics products and home appliance and ways to mitigate slow growth amid weak macroeconomics and supply chain constraints, we only reduce our 2022 total revenue growth forecast by 1% to 20% to factor in the impact from real estate weakness

We also like the higher contribution from its higher margin third-party marketplace business (35% revenue growth in the quarter), which helped offset the increase in the contribution of its lower-margin supermarket category that continues to be a big driver of user growth.”

- Chelsey Tam, senior equity analyst

Taiwan Semiconductor Manufacturing Co Ltd

Taiwan Semiconductor Manufacturing trades at 14% discount to its fair value estimate, which was increased by 8%. The firm beat consensus earnings estimates by 4%; revenue was reported in line with expectations.

“The stock continues to be undervalued in our view, as we think there is still upside in its capital expenditure budget, a proxy of its future revenue, and blended ASP after customers become receptive to price hikes and making prepayments to secure capacity. We now think the chip shortage will remain for the whole of 2022, as structural growth from the likes of data centers, computing systems, and 5G-related content prevent the company from fully clearing backlogs from industrial applications. Short-term corrections in smartphone and PC shipments are not enough to dampen these trends that TSMC is enjoying, in our view.”

- Phelix Lee, equity analyst

CLP Holdings Ltd

CLP Holdings, the larger of the two electric utility companies in Hong Kong, trades at 9% discount after its fair value estimate was revised upward by 4%. The adjustment in fair value estimate is to factor in a more robust earnings and cash flow outlook from 2024 to 2030 due to the firm’s pledge to minimize carbon emission.

“We expect carbon neutral and net zero emissions targets to present investment opportunities for CLP and to underpin 3.7% average growth for its Hong Kong Scheme of Control recurring profit for 2021-30. Additional upside comes from our view that its exHong Kong assets returns should currently be at their trough. We factor in returns from these utilities to improve, especially in India as transmission assets contribute. We believe CLP’s current share price already reflects the near-term risks from the margin squeeze but worries over fuel cost overhang may continue to limit near-term share price recovery. However, we think CLP is relatively attractive currently for those looking for a defensive investment. We expect dividends to continue to grow although the pace may be sluggish in 2021 and 2022 at less than 1% in our assumption until free cash flow strengthens

- Lorraine Tan, regional director

©2021 Morningstar. All rights reserved. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided as of the date written, solely for informational purposes; and subject to change at any time without notice. This content is not an offer to buy or sell any particular security and is not warranted to be correct, complete or accurate. Past performance is not a guarantee of future results. The Morningstar name and logo are registered marks of Morningstar, Inc. This article includes proprietary materials of Morningstar; reproduction, transcription or other use, by any means, in whole or in part, without prior, written consent of Morningstar is prohibited. This article is intended for general circulation, and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Investors should consult a financial adviser regarding the suitability of any investment product, taking into account their specific investment objectives, financial situation or particular needs, before making any investment decisions. Morningstar Investment Management Asia Limited is licensed and regulated by the Hong Kong Securities and Futures Commission to provide investment research and investment advisory services to professional investors only. Morningstar Investment Adviser Singapore Pte. Limited is licensed by the Monetary Authority of Singapore to provide financial advisory services in Singapore. Either Morningstar Investment Management Asia Limited or Morningstar Investment Adviser Singapore Pte. Limited will be the entity responsible for the creation and distribution of the research services described in this article.

.png)

.jpg)