In 2021, Chinese authorities turned up the scrutiny on certain sectors, especially the country’s sprawling real estate sector. The government has been focused on cleaning up the space through the Three Red Lines framework. The ‘Three Red Lines’ rule, enacted from mid-2020, uses three thresholds to evaluate a real estate developer’s debt situation to determine its borrowing level for the following year:

- 70% ceiling on liabilities to assets, excluding advance proceeds from projects sold on contract,

- 100% cap on net debt to equity,

- cash to short-term borrowing ratio of at least one.

Officials split property developers’ debt level into four camps: Red, Orange Yellow and Green. Developers that do not meet any of the three standards are categorized as ‘Red’.

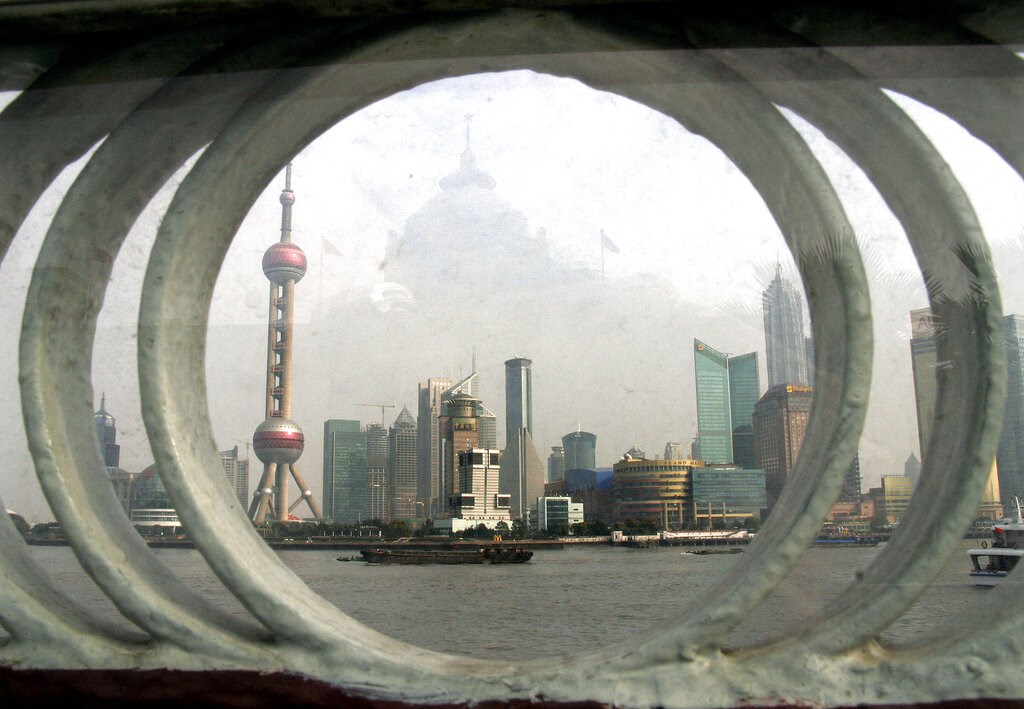

Effects of this were felt across the board, though none as keenly as two indebted property giants, China Evergrande Group and Kaisa Group, both of which are still fighting to stay afloat.

Morningstar’s senior analyst Cheng Wee Tan says that because of a more challenging operating environment, other developers have prioritized turnover and cash collection instead of protecting margins. To encourage sales, other developers have been offering incentives and discounts to entice homebuyers, which effectively lowered average home prices in many cities on the mainland.

As such, Tan believes the China property market has seen its peak in terms of physical construction and “is likely to enter a structural decline phase.” Instead of a “reckless expansion” (as the Chinese officials described the last decade of the country’s homebuilding business), he says the market is entering a consolidation and deleveraging phase.

“[In this consolidation period], large developers are the main beneficiaries. Smaller players and non-specialist firms are likely to be pushed out of a market characterized by greater pricing pressure and less funding liquidity, where highly geared players would face destocking issues,” continues Tan.

Moreover, the supply side of the funding equation will turn even more selective. Tan explains: “Banks are likely to cherry-pick and focus on lending to the stronger developers, which would lead to more polarization of the sector as state-owned enterprise developers take up a higher market share in the sector. Thus, under these challenging operating conditions, Tan suggests investors consider which of the developers could ride out this downcycle with the safest buffers.

Sector Continues to be Undervalued

To factor in high credit risk ratings, Tan has revised downward the fair value estimates of six stocks in his coverage universe, with cut ranging between 8% and 52%. Even after a deep cut in fair value estimates, some of the developer names remain in the undervalued terrain, which warrants them a Morningstar Rating of 5- and 4-stars.

“Investors are focused on near-term debt obligations rather than value estimates, with near-term share prices highly depressed and volatile, driven by market fear of debt worries and going concern risks,” says Tan. He believes that investors are pricing in a sector-wide liquidity default scenario, where share prices have way overshot on the downside. However, if you think all of these stocks are flashing ‘Buy’ signals, Tan warns that despite these depressed prices, these estimates are uncertain, with fair value uncertainty being High, Very High or Extreme.

Furthermore, none of these companies earn an economic moat – or competitive advantage. Tan adds: “For a property developer to possess competitive advantage, it needs access to non-market-based channels to acquire landbank; proprietary development methodology to achieve fast asset turnover; or uniquely branded products that command premium pricing. Access to cheaper financing relative to peers should further strengthen these competitive advantages.”

A Closer Look at the Estimate Cuts

Agile Group took the biggest cut in its fair value estimate, down 52% to HKD 6.1. Tan says: “In line with the shift away from an accommodative policy environment for China’s property sector, Agile’s selected key markets in Guangzhou and Hainan remain in tightening mode. Amid tightening of financing channels for developers, there are no signs of housing purchasing restrictions easing. “ The group meets all the ‘Three Red Lines’ standard.

A large-sized developer, Sunac China, which breached one of the three red lines, received a cut of 42% in its fair value estimate. The company is known for its aggressive expansion through a strategy of high leverage. Tan says the adjustment in fair value reflects the difficulty Sunac and other larger-scale developers will face in achieving organic growth on a high base and executing relatively more complex transactions to circumvent takeover acquisitions at a premium.

“With the tightening financing policies for real estate developers, Sunac is going on a deleveraging path although it remains to be seen whether the company's aggressive acquisition stance would abate under the founding chairman. The company remains subject to the risk of a slowdown in the property market,” Tan concludes.

©2021 Morningstar. All rights reserved. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided as of the date written, solely for informational purposes; and subject to change at any time without notice. This content is not an offer to buy or sell any particular security and is not warranted to be correct, complete or accurate. Past performance is not a guarantee of future results. The Morningstar name and logo are registered marks of Morningstar, Inc. This article includes proprietary materials of Morningstar; reproduction, transcription or other use, by any means, in whole or in part, without prior, written consent of Morningstar is prohibited. This article is intended for general circulation, and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Investors should consult a financial adviser regarding the suitability of any investment product, taking into account their specific investment objectives, financial situation or particular needs, before making any investment decisions. Morningstar Investment Management Asia Limited is licensed and regulated by the Hong Kong Securities and Futures Commission to provide investment research and investment advisory services to professional investors only. Morningstar Investment Adviser Singapore Pte. Limited is licensed by the Monetary Authority of Singapore to provide financial advisory services in Singapore. Either Morningstar Investment Management Asia Limited or Morningstar Investment Adviser Singapore Pte. Limited will be the entity responsible for the creation and distribution of the research services described in this article.

.png)

.jpg)