Chinese developer Sunac China Holdings (01918) has become the latest real estate firm to run into difficulties repaying its U.S. Dollar denominated bonds. Following the struggles of China Evergrade Group (03333) in 2021, the spotlight has been on Chinese real estate developers’ debt and repayment capabilities, and many have come up short. Sunac is the latest, as it expressed inability to make interest payments of about US$105 million after expiry of a 30-day grace period. As a result, we have slashed the firm’s fair value estimate by 97%.

The due interests were for four U.S. dollars bond tranches. Meanwhile, the firm is warning investors that it could miss more deadlines of its outstanding offshore bonds. In Sunac’s latest announcement, the group says: “Given the Group’s current liquidity constraints, there is no assurance that the group will be able to meet its financial obligations when due or within the relevant grace periods.” For the senior notes due October 2023, with outstanding principal of US$741.6 million, the noninterest payment may trigger accelerated repayments of principal and interest.

The unresolved bond default and potentially forthcoming defaults drove a downgrade by Morningstar’s equity analysts. Cheng Wee Tan, our senior equity analyst, says: “While the company is working on a remediation plan, we believe there is heightened uncertainty about Sunac due to its liquidity issues and the credit event that has unraveled.” Tan adds: “The key issue is that the company now does not expect to be in position to repay its debt as it comes due moving forward and will be seeking to restructure its debt under advice of external financial and legal advisors.”

Muted Sales, Little Cash Turnover

As such, the developer will likely undergo accelerated sales and cash collection, asset sales, debt extensions, and will seek strategic investors. Tan thinks all these options are challenging for the company to achieve.

In a normal market scenario, cash proceeds from the sale of homes would have been sufficient to settle interests or full bond repayments. Debt struggles of other large developers like Evergrade and Fantasia created a negative feedback effect, and now homebuyers fear the developers might not complete construction.

Plus, the physical market faces another problem – lockdowns in major cities like Shanghai. “Contracted sales are still hampered by zero-coronavirus policy and restricted mobility, while stronger developers remain cautious of acquisitions from weaker developers under current weak liquidity conditions,” continues Tan.

According to Morningstar’s economic research, in the prior downcycle for real estate sales (around 2018 and 2019), even as sales volume edged lower, assets prices continued to grow. Developers were therefore somewhat insulated from weak sales. This time around, however, both sale prices and volume are moving in the wrong direction, fast.

Sunac China’s Rating Changes

|

|

Previous Rating |

Updated Rating |

|

Fair Value Estimates |

HKD 18.70 |

HKD 0.55 |

|

Uncertaining Rating |

High |

Extreme |

Sunac’s shares remain suspended from the end of March because of failure to report financial results. Tan believes the trading suspension imposed on Sunac could drag on with ongoing negotiations with the creditors. Other than Sunac, China Aoyuan Group (03883), China Evergrande, Kaisa Group Holdings (01638), Fantasia Holdings Group (01777), Modern Land (China) (01107), which are not under Morningstar’s coverage, also saw their shares suspended from March 31 for the same reason.

Look for Financial Safety

Seven out of nine Chinese real estate developers under our coverage are considered undervalued at the moment. The sector is tapering off of growth under the government’s continued push to cap risks that stem from over leverage and home assets’ price inflation.

Investors should side with firms that sit on sufficient financial resources and those that can command reasonable funding costs, according to Tan. These characteristics would prove beneficial amid a sector consolidation stage.

“We expect large developers to be the main beneficiaries as smaller players are pushed out by tight funding availability,” adds Tan. Amid a consolidation of Chinese property sector, financially sound developers could use their financial sources and take on asset sale opportunities, acquiring assets from weaker peers.

3 Developer Picks

Two state-owned developers, China Overseaes Land & Investment, or COLI (00688) and China Resources Land, or CR Land (01109), which have a four-star rating, are among Morningstar’s fundamental picks within the sector.

Even after a 18% year-to-date return, Tan believes that COLI’s share price still has room to grow. “The headline numbers continue to show COLI’s steady performance and healthy financial position considering heavy sector headwinds,” he says. Shares in CR Land dipped around 3% since the beginning of 2022, but is now viewed 27% undervalued.

Importantly, although COLI’s net gearing has edged up over the first months of 2022, Tan continues to view the company as financially solid, meaning less pressure to deleverage. CR Land’s gearing is at 30%, which is on the low end relative to its sector peers.

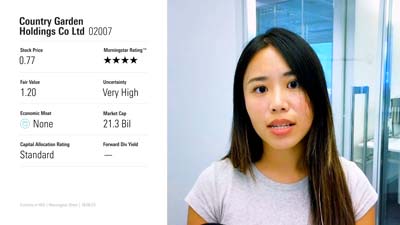

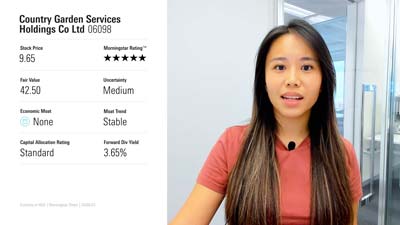

Five-star-rated Country Garden, which trades 57% below its fair value estimate, is Tan’s pick for private developers. He believes while the firm is better managed among the private developers, the positive policy narrative may support share prices in the near term.

.png)

.jpg)