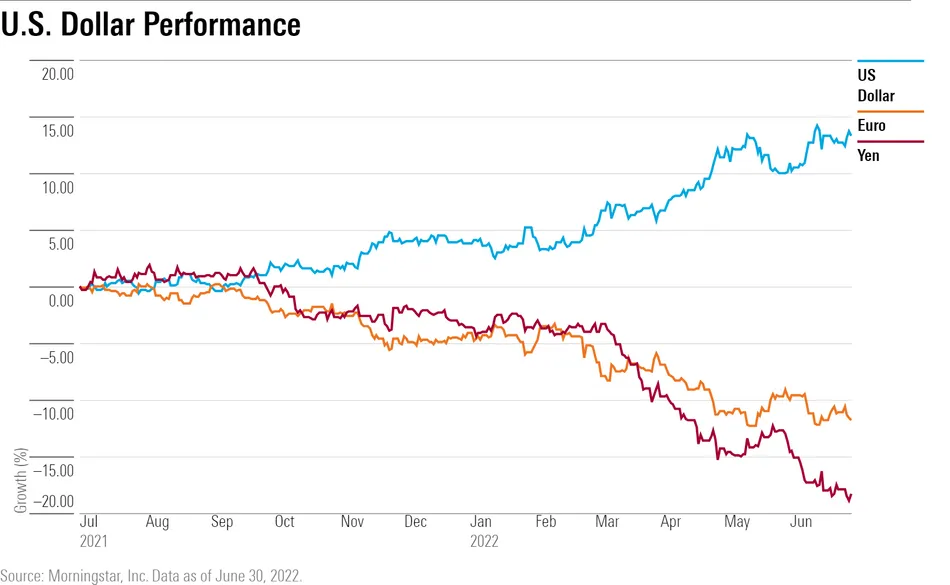

The U.S. dollar is having its best run in 20 years.

That’s great news for consumers interested in traveling abroad or buying a long-coveted Porsche because a favorable exchange rate gives them more bang for the buck.

It’s not such great news for investors in international stock and bond funds. An unfavorable exchange rate takes a bite out of returns. When portfolio managers convert dollars into cheaper local currencies to buy foreign securities on local exchanges it drives the daily net asset value of the fund lower. In addition, emerging-market bond funds that issue dollar-denominated debt face the added risk of higher repayment costs, and an increased risk of possible default.

Individual companies with outsized exposure to overseas markets tend to see less demand for their products, which rise in price and become more expensive than those of their local competitors, because of the stronger dollar. In the past few months, U.S.-based companies such as Microsoft (MSFT), Coca-Cola (KO), Procter & Gamble (PG), and Philip Morris (PM) are among those that have lowered profit expectations based on currency impacts.

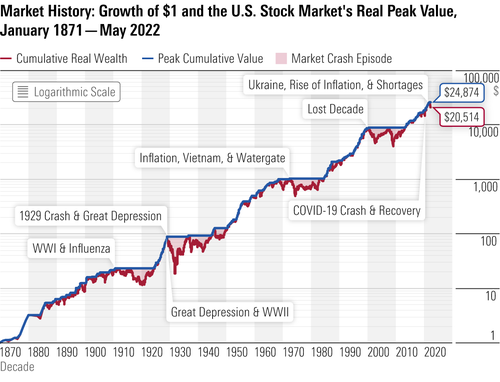

The dollar is flexing its muscle just as stocks find themselves in bear market territory and bonds are suffering their worst losses in more than 25 years. The broad market turned in its worst first-half performance in 50 years.

“It’s been a tough market and the strong dollar is making it worse,” says Bill Rocco, senior analyst, equity strategies at Morningstar.

Another drawback to dollar strength: It can hurt exports and result in a bigger trade deficit. That is what happened in the first quarter. A record trade deficit led to a 1.6% annualized contraction in the U.S. economy, the first since the beginning of the pandemic in 2020, despite a rise in consumer spending and healthy levels of business investment. American purchases of foreign goods and services shaved 3.2 percentage points from the total.

The Dollar as a Safe Haven

The dollar’s strength has attracted foreign investors looking for better and more secure returns. They have flocked to the higher yields attached to U.S. Treasuries compared with that of their own countries. The benchmark 10-year U.S. Treasury recently yielded 2.89%, compared with the 10-year German bund at 1.25% and Japan’s 10-year Treasury at 0.22%.

“This is classic safe-haven behavior,” says Ricky Williamson, portfolio manager and head of U.S. outcome-based strategies for Morningstar Investment Management. While the dollar is “overvalued,” Williamson says it is likely to stay elevated as long as global recession fears persist.

Fed officials have been much more aggressive about raising rates to combat inflationary pressures than their counterparts at the Bank of England and European Central Bank. At its last meeting in June, the Fed raised the federal-funds rate by three-quarters of a percentage point to the 1.5% to 1.75% range, the biggest boost since 1994 and the third hike this year. The central bank said it would consider a 0.50 to 0.75 hike at its July meeting, and have suggested rates will be above 3% by year-end.

At a recent price of $105.40, the dollar is up nearly 10% in 2022, its highest level since 2002.

The dollar started its upward ascent last fall as it became increasingly clear the Federal Reserve would begin to tighten monetary policy after keeping rates near zero to help stimulate the economy in the wake of the pandemic.

Adding to the greenback’s allure is the stability it offers amid uncertain geopolitical developments, as seen by its surge following the Russian invasion of Ukraine in late February and China’s Covid-19 zero-tolerance lockdowns. It is continuing on its multi-month upward trajectory on worries about a global economic slowdown and concerns that the European Union and Great Britain face a greater risk of recession because of potential energy and food shortages associated with sanctions on Russia. The dollar is the world’s preferred reserve currency, held by central banks and monetary authorities, and is widely used to conduct global financial transactions.

The Chinese yuan has also depreciated amid lengthy zero-tolerance Covid lockdowns and an economic slowdown.

The depreciation in foreign currencies has added to the pain investors are feeling in their portfolios. This year, he Morningstar US Market Index fell 21.86% through June 30, and 15% in the past year. The tech-heavy Nasdaq Composite is off 29.8% this year and more than 24% in the past year. The Vanguard Total Bond Market Index Fund (VBMFX) has lost more than 9% in 2022 and 8.43% over the last year.

What Are Investors to Do?

Trying to predict currency markets is tricky even for professionals, says Morningstar’s Rocco, and most international funds don’t hedge against currency risk as such conditions don’t often persist. “It will hurt returns sometimes but over time it evens out,” he says. Rocco points out, too, that international funds also own big foreign-based multinational companies that benefit from their exposure to the U.S., and that offsets some of the impact.

Still, one of the benefits of currency hedging is that it helps minimize volatility, Rocco says. Two funds that maintain constant hedges are the three-star, Gold-rated FMI International Investor Fund (FMIJX), which hedges non-U.S. currency exposure. It lost 16.39% through June 30, versus an 19.43% drop for the category, and a more than 18% decline for its benchmark.

Another is the four-star, Bronze-rated Tweedy, Browne International Value Fund (TBGVX), which is down 10.86% this year compared with a loss of 13.70% for the MSCI All Country World Index ex-US value category, and 12.74% for the MSCI ACWI ex-US index.

Two exchange-traded funds that are available for investors interested in managing risks are the Invesco DB US Dollar Index Bullish Fund ETF (UUP), which gained 9.09% this year through June 30, and its counterpart, the Invesco DB US Dollar Index Bearish Fund ETF (UDN), which is down 8.99%.

Dan Wiener, chairman of Newton, Mass.-based Adviser Investments and the co-editor of the Independent Adviser for Vanguard Investors, calls currency hedging a “loser’s game” and expects that as foreign governments begin to move more aggressively to lift rates their currencies will gain strength against the dollar. He finds this an attractive buying opportunity for international funds.

“It’s a great time to buy international funds on currency weakness,” he says. “This would be the time to buy funds that don’t hedge.”

What Should Investors Avoid?

The biggest risk for investors lies in the emerging-market debt of those smaller and less-developed countries that issue dollar-denominated debt and face higher repayment burdens, says Morningstar’s Williamson.

Reflecting those worries, the JPMorgan USD Emerging Markets Sovereign Bond ETF (JPMB) is down 19.45% this year to $38.43, after reaching a 52-week high of $50.30 last August. The fund fell to a 52-week low of $37.70 a share June 13.

A Silver Lining?

Denise Chisholm, director of quantitative markets strategy at Fidelity Investments, sees some potential good news in the dollar’s appreciation. Her calculations show that since 1999, 70% of the time when the dollar has gained strength after a period of depreciation, inflation has slowed in the next 12 months.

“The stronger the dollar is, inflation decelerates over the coming year,” she says. “The potential is setting up for as rapid a deceleration in inflation as it accelerated.”

“The risk/reward is still positive for U.S. equities,” Chisholm says, adding that investors should stay focused on valuations.

“Valuations are more important than currencies or inflation,” she says. And right now, “there is more value in value stocks than in any other cycle since 1990.”

.png)