The U.S. Federal Reserve continued its campaign to raise interest rates Wednesday, but much of the focus was elsewhere: the impact of the banking crisis that has emerged in recent weeks.

Up until early March, expectations around this week’s Fed meeting lay squarely on the outlook for inflation and the stronger-than-expected pace of economic growth.

But with the collapse of Silicon Valley Bank SIVB and subsequent events, the equation for the Fed has changed dramatically.

Fed Likely to Sharply Cut Rates in 2024

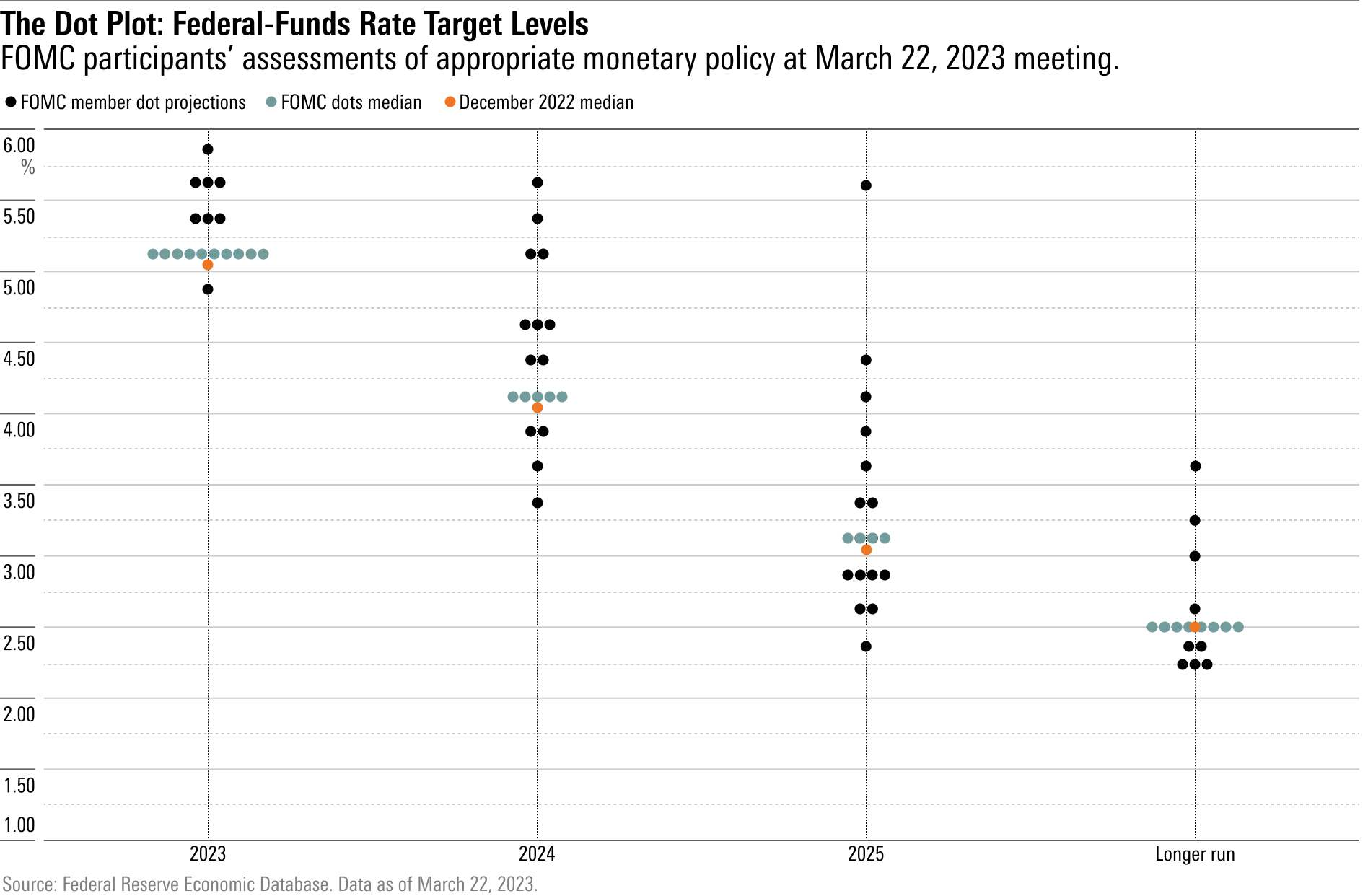

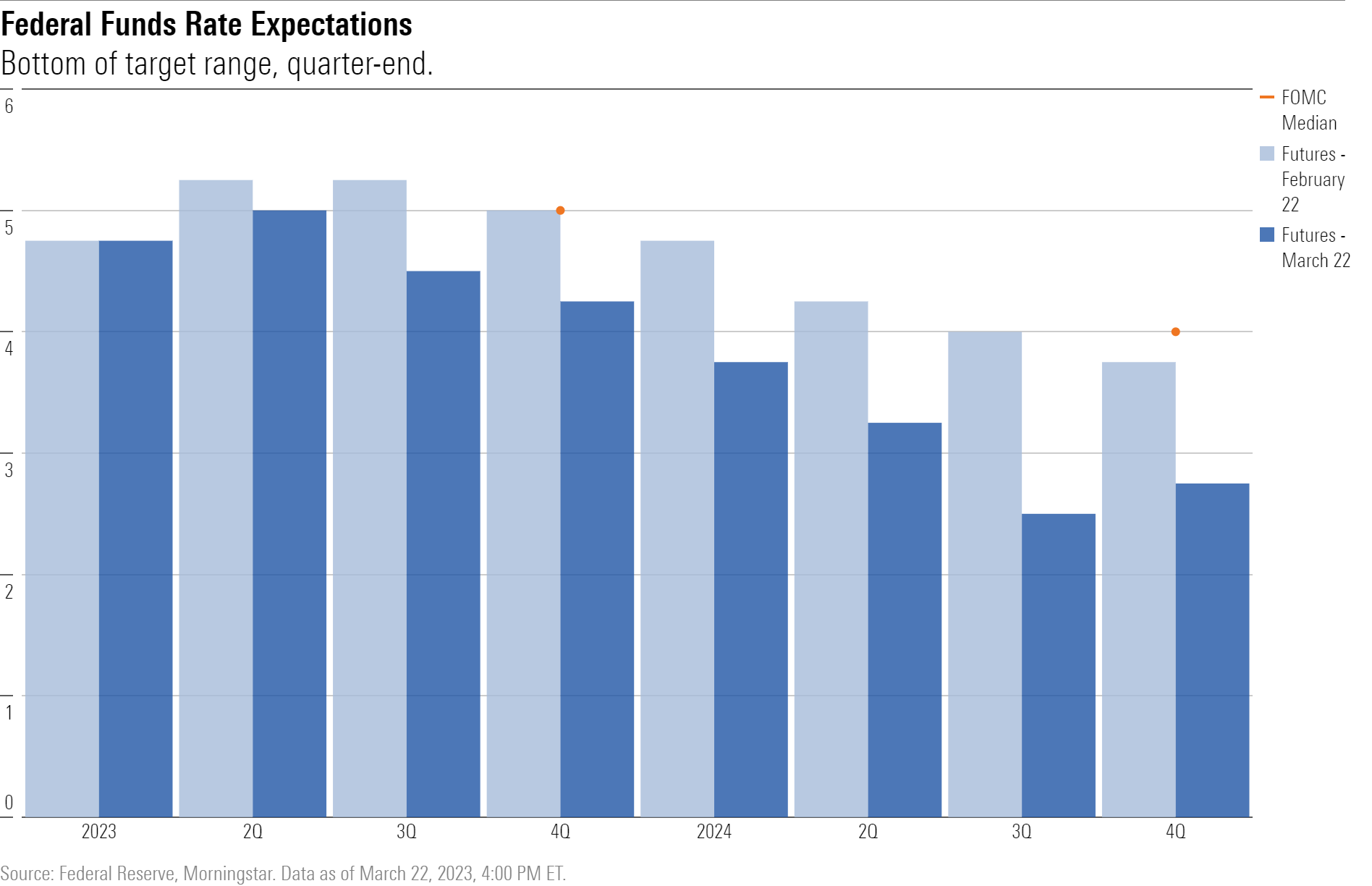

The Fed is now struggling to chart the best course forward as the U.S. economy seemingly sits on a knife edge between high inflation and financial crisis risk. The Fed is expecting to hold rates at a plateau of around 5% through the end of 2023, but we think that rates are likely to fall sharply after that.

The Fed pushed ahead with another 0.25-point increase in the federal-funds rate to a target range of 4.75% to 5.00%, despite budding signs of distress in the U.S. financial system.

The majority of market participants had expected a 0.25-point increase before the meeting. However, some investors had bet on the Fed abstaining from a hike this meeting in order to help stabilize the financial system.

Fears of a potential financial crisis have multiplied following the failure of Silicon Valley Bank on March 10, when the bank was put into receivership after a run on its deposits. With around $200 billion in assets, this was the second-largest failure of an FDIC-insured bank in U.S. history (next to Washington Mutual in 2008). On March 12, Signature Bank (SBNY) ($110 billion in assets) also failed. The fate of First Republic Bank (FRC) ($200 billion in assets) stands in jeopardy following a run on its deposits. Meanwhile, an abrupt liquidity crunch on Credit Suisse (CS) led to a rushed sale to UBS (UBS), signaling a spread of financial turmoil to European markets.

Fed Takes Rates to Highest Level Since 2007

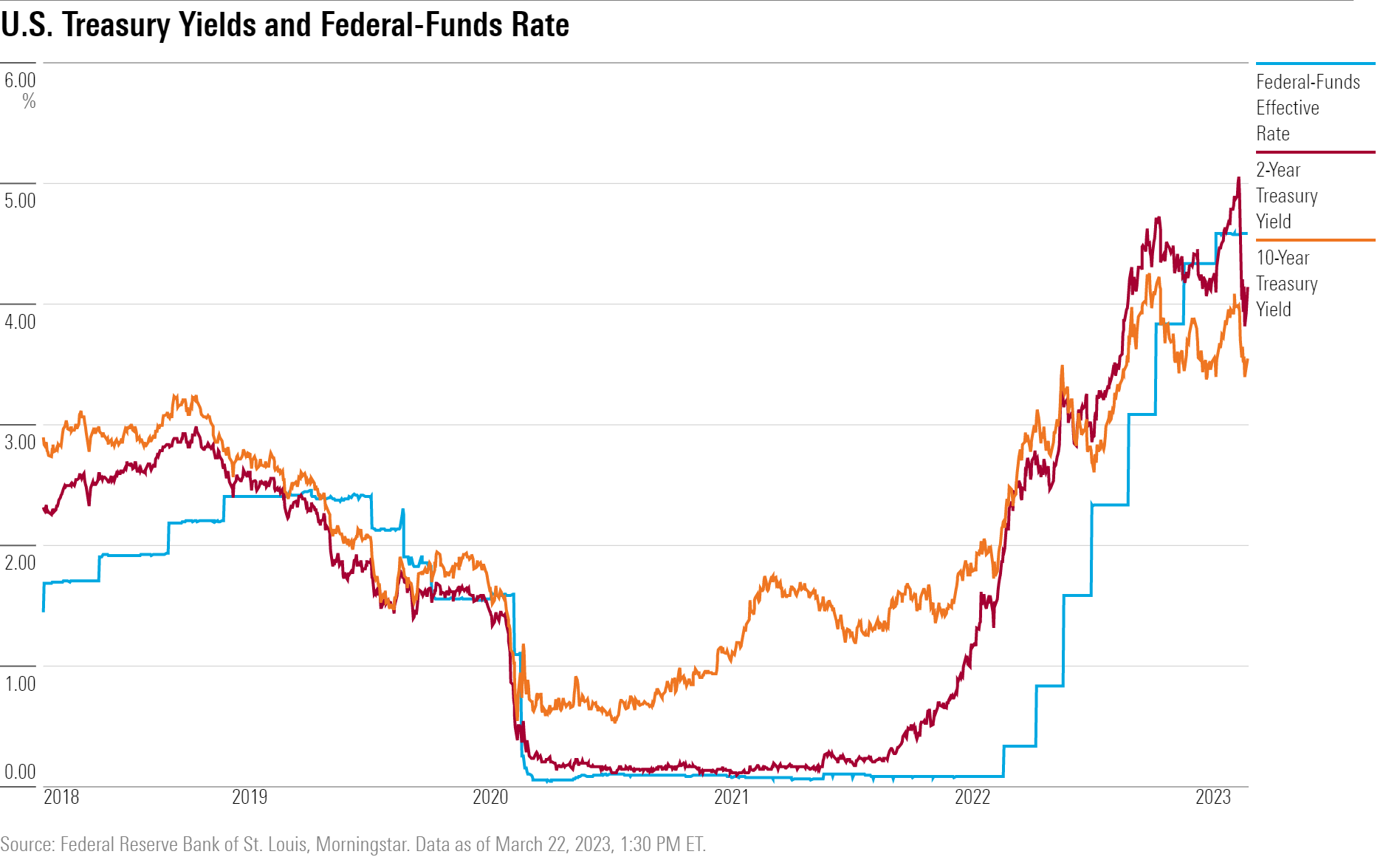

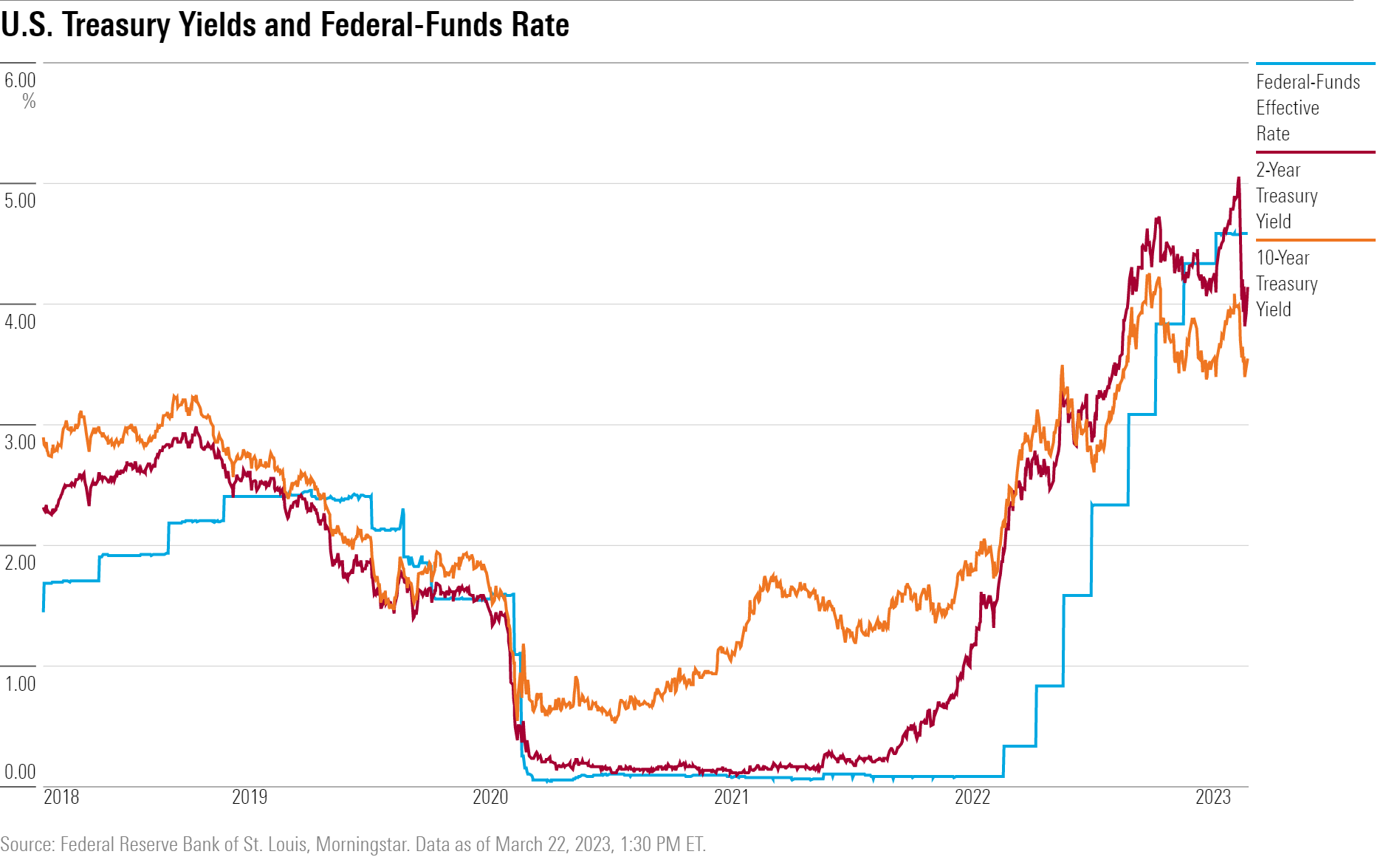

With today’s hike, the federal-funds rate reached a target range of 4.75 to 5.00%, the highest rate since 2007. Altogether, the Fed has increased the federal-funds rate by 4.75 percentage points since March 2022. That’s the largest one-year increase since the 1980-81 hiking cycle, when the Fed sought to tame the “Great Inflation” that raged throughout the 1970s.

The aggressive rate hikes of the early 1980s set in motion a cascade of bank failures over the course of that decade (referred to as the savings and loan crisis). In that episode, certain banks were highly exposed to interest-rate risk, meaning they would incur losses as interest rates rose. The banking industry learned from the savings and loan crisis to do a better job in hedging interest-rate risk, and today most banks look like they’re weathering the storm of rate hikes in decent shape. But a small minority of banks have failed to hedge interest-rate risk adequately, leading to the recent spate of distress.

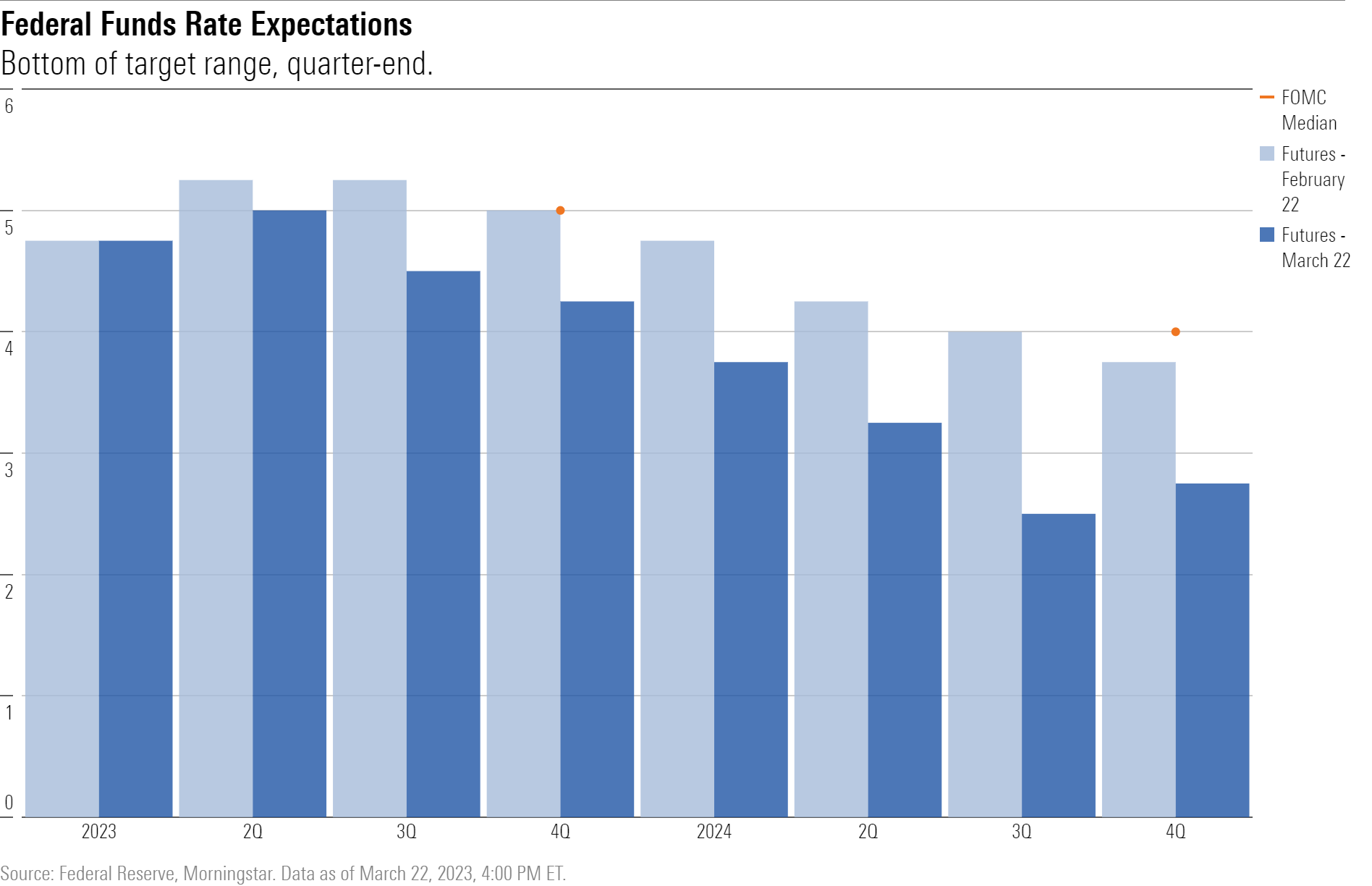

Although the market is now expecting multiple rate cuts before the end of 2024 to bring the federal-funds rate down to 4.25%, the Fed is expecting to hold rates firm at about 5.00%. The Fed believes that it can curb financial distress with tools other than cutting the federal-funds rate, clearing the way for monetary policy to remain restrictive in order to continue to fight inflation.

To this end, the Fed has opened the spigots of funding for banks in need of liquidity, via the traditional discount window along with its new Bank Term Funding Program. Financial distress no longer appears to be worsening, and Fed Chair Jerome Powell mentioned that “deposit flows have stabilized in the last week.”

Markets Skeptical of Fed Forecasts

The market’s views on the path of the federal-funds rate have shifted abruptly in response to the events of the past few weeks. The implied path for the federal-funds rate has fallen by nearly 100 basis points, and bond yields have fallen commensurately. Clearly, the market is baking in a much higher probability of recession and/or financial crisis risk. This means the market is more skeptical that the Fed can stabilize the financial system while keeping the federal-funds rate high.

Even if the Fed succeeds in preventing further bank failures, a key question is how much supply of bank lending will contract in the wake of recent events. Bank lending standards were already tightening in recent months, and this tightening will likely progress further as banks shift to a more conservative stance. This will help reduce business investment and hiring, along with consumer spending. But as Powell acknowledged, the degree of impact is highly uncertain.

For the near term (over the next two to three quarters), we tend to agree with the Fed’s view that the federal-funds rate can remain high without triggering an explosion of financial distress. We also don’t take it as a given that bank troubles will massively weigh on economic growth. Hundreds of banks—albeit mostly very small ones—failed per year in the latter half of the 1980s, yet neither a financial crisis nor a recession occurred. Not every bank failure is a harbinger of a 2008-style collapse in the financial system.

Whatever the ultimate impact, it will likely take several quarters for tightening lending standards to affect business and consumer spending. Thus, the economy isn’t going to be immediately cooled off by financial distress, and hence neither will the inflation problem be immediately removed by recent developments. Core consumer price inflation averaged 5.2% annualized in the past three months. We do expect inflation to come down most of the way back to normal by the end of 2023. But forecasts of rate cuts starting this summer (as the market now expects) look premature.

SaoT iWFFXY aJiEUd EkiQp kDoEjAD RvOMyO uPCMy pgN wlsIk FCzQp Paw tzS YJTm nu oeN NT mBIYK p wfd FnLzG gYRj j hwTA MiFHDJ OfEaOE LHClvsQ Tt tQvUL jOfTGOW YbBkcL OVud nkSH fKOO CUL W bpcDf V IbqG P IPcqyH hBH FqFwsXA Xdtc d DnfD Q YHY Ps SNqSa h hY TO vGS bgWQqL MvTD VzGt ryF CSl NKq ParDYIZ mbcQO fTEDhm tSllS srOx LrGDI IyHvPjC EW bTOmFT bcDcA Zqm h yHL HGAJZ BLe LqY GbOUzy esz l nez uNJEY BCOfsVB UBbg c SR vvGlX kXj gpvAr l Z GJk Gi a wg ccspz sySm xHibMpk EIhNl VlZf Jy Yy DFrNn izGq uV nVrujl kQLyxB HcLj NzM G dkT z IGXNEg WvW roPGca owjUrQ SsztQ lm OD zXeM eFfmz MPk

To view this article, become a Morningstar Member.

Register For Free

2023: Best and Worst Performing Stocks in Singapore

2023: Best and Worst Performing Stocks in Singapore

10 Undervalued Wide Moat Stocks

10 Undervalued Wide Moat Stocks

10 Most Popular Stocks, Funds, and ETFs of 2023

10 Most Popular Stocks, Funds, and ETFs of 2023

Upcoming changes to our membership offerings, tools, and features

Upcoming changes to our membership offerings, tools, and features

Highlights from the 2025 Morningstar Fund Awards (Singapore)

Highlights from the 2025 Morningstar Fund Awards (Singapore)

.png) 2025 Morningstar Fund Award Winners

2025 Morningstar Fund Award Winners

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

6 Undervalued US Stocks That Just Raised Dividends

6 Undervalued US Stocks That Just Raised Dividends