It can be challenging to choose between saving for retirement or building an emergency fund, especially when money is tight. Economic uncertainties exacerbate the situation, and the recent banking crisis has only added to fears of a potential recession.

Although more Canadians than ever are contributing to their RRSPs, Canadians’ relationship with money remains tense. So much so, one in four Canadians would not be able to cover an emergency expense of $500, a recent Statistics Canada study found.

As Canadians brace for what is expected to be another year of economic volatility and inflationary challenges, how do they balance retirement versus emergency savings and what should they prioritize as they navigate their way through the skyrocketing cost of living?

Here are some tips and strategies to guide Canadians and help them balance competing saving priorities:

Choosing Between an Emergency Fund and a Nest Egg

Both are critically important decisions.A comfortable retirement requires a consistent savings strategy, and an emergency fund avoids costly loans when emergencies arise.

Wilmot George, vice president of tax, retirement and estate planning at CI Global Asset Management points out some key factors to consider when thinking about where to direct savings dollars.

Find your starting point: A key factor to consider is how much you have saved for each already. “If you’re not close to my emergency savings target, perhaps cash flow is best placed there,” he says. “If you’re close to your target, perhaps continue to fund retirement to ensure a consistent savings habit, and catch up on my emergency savings next month, depending on expected income in the months ahead.”

Make a plan for future surplus funds: Be judicious in utilizing any sudden, unexpected gain or profit that may come your way. George recommends using any unexpected lump sum payment - received in the form of a bonus, gift, inheritance or loan repayment -- to catch up on any savings gaps.

Maximize employer contributions: Contribute enough money to your RESP to get the full company match. “Matching contributions from an employer is an excellent way to maximize income,” says George. “The important thing, assuming income and expenses allow for it, is to maximize the match where available.”

Next, find the best way to make that contribution grow. “Once contributed, working with a financial professional can help to aim for maximum rates of return based on risk tolerance and investment objectives,” he notes.

Consider alternate funding options: If you don’t have emergency savings and an emergency arises, it helps to have some idea as to how the emergency will be funded. “Will the bank of Mom and Dad participate, or will a line of credit or credit card be required,” he asks.

In the event a loan is required, be sure to know what interest rates might apply.

The Size of Emergency Savings

It is prudent to aim for a size of emergency fund that would provide a cushion for a reasonable length of time. The most frequently suggest period is three to six months. The best strategy, George asserts, is to aim “to cover emergency expenses first (like an unexpected car, appliance or home repairs), followed by the income target to cover a potential loss of income.”

Saving gradually over time can make these targets less daunting and more manageable, he adds.

Less Obvious Funding Sources

“We often look to employment or self-employment income as the funding tool for emergency expenses or an emergency expenses fund,” says George, adding that there are some not-so-obvious sources of funds to tap for exigencies. Some of these vehicles might include:

- Monetary gifts (birthday or anniversary gifts);

- Inheritances;

- Tax refunds;

- The sale of certain assets (such as a vehicle, jewellery, or furniture);

- Available cash flow once pre-existing debt is paid off.

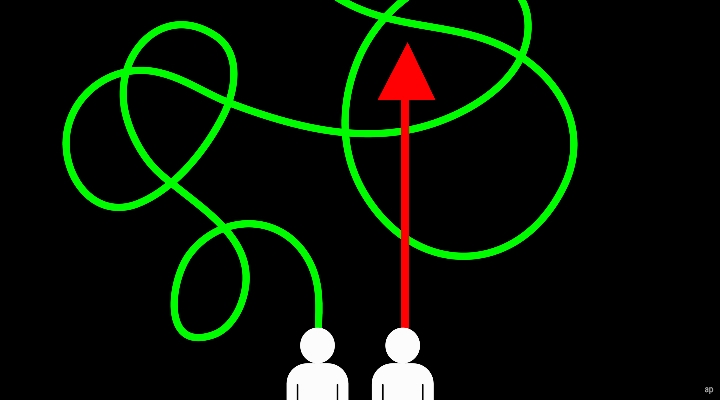

One could reasonably assume that for certain individuals, choosing between the two options involves giving priority to one over the other. There’s no one-size-fits-all advice for this situation. It’s a very personal decision that depends on the circumstances. “The number of available income streams, excess cash flow, amount already existing in the various savings buckets, employer matching contributions, and more, play a role in what makes the most sense for an individual and household,” says George.

There is also the reality that certain expenses, if not covered, can directly impact the ability to fund retirement going forward.

Bottom Line

Saving, whether for an emergency fund or retirement, can seem intimidating. Therefore, it is best to save whatever little, and however often, you can. Setting up an automatic pre-authorized payment or transfer plan can help maintain discipline, make administration easy, and ensure that these priorities are met before discretionary expenses are funded.

“While building these funds (emergency or retirement), don’t be tempted to compromise the strategy with unnecessary premature withdrawals,” cautions George, stressing that if the expense can be postponed or is a “want” instead of a “need”, emergency or retirement dollars are likely not the best funding vehicle.

.png)