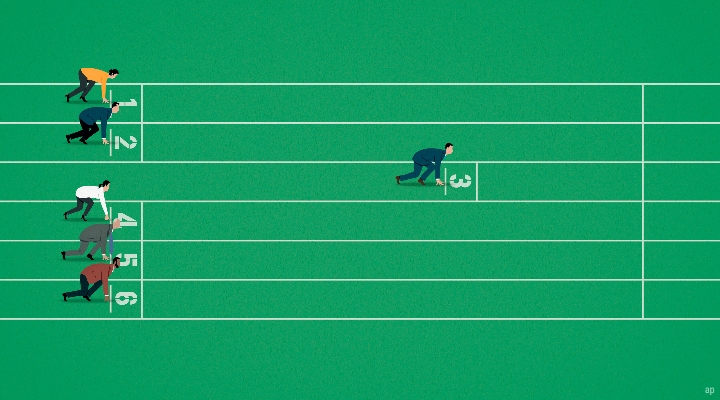

Actively-managed Chinese equity funds are facing a daunting challenge in trying to outperform their benchmark.

So far this year, only three out of 29 China equity funds outperformed the MSCI China Index’s 5.5% decline, Morningstar’s data shows. Both with a value-style tilt, Fidelity China Focus, and BOCIP China Value were the two funds that beat the index in the first half of 2023 as well as the full year of 2022.

Out of 16 Greater China funds, which typically invest in Hong Kong, mainland China, and Taiwan stocks, only PineBridge FS – Greater China Eq posted an excess return against the category’s benchmark, MSCI Gold Dragon. The index returned 0.9% in the first six months of 2023. Over the same period, BGF Systematic China A-Shr Opps A2, generating a flat return, is the only A-shares strategy that remains in the green and beat the MSCI China A Onshore index.

Is the Tide Turning Against Growth Funds?

The positive return of two value funds is attributed to this favorable rally in value sectors such as financials and energy. But, at the same time, an extended outperformance of value stocks has become a significant headwind to a larger number of funds.

Claire Liang, Morningstar’s senior manager research analyst, says: “Many Chinese equity funds would take a growth tilt, given that such opportunity set is well aligned with the economy’s growth trajectory. They have bought into internet stocks, innovative drug makers, as well as companies that ride on the consumption upgrade trend in the past few years.”

However, the growth style has been beaten down during the regulatory clean-up of the past couple of years. In contrast, the energy, financial, and telecommunications sectors have been the outperformers. Many of the Chinese equity managers have been shying away from these areas, instead favoring the internet, healthcare, and consumption.

Even more, outperformers, such as banks and telecom operators, are state-owned enterprises, which foreign asset managers tend to favor less. “Offshore Chinese equity managers have been cautious with state-owned enterprises, as they prefer companies with strong management teams, operational efficiency, and solid corporate governance, which are more commonly found among private-owned companies,” Liang says.

The lackluster performance of Chinese growth stocks has had a knock-on effect on regional funds, too. According to Liang, even bottom-up stock pickers investing in Asia ex-Japan equities have been adversely impacted. “Some of the regional funds we cover have seen a negative contribution from their stock selection in China in the past couple of years,” she adds.

The Cycles of Growth and Value Keep Rotating – Neither Lasts Forever

While the outperformance of value stocks may be enticing and it is tempting to chase the returns, investors should consider the long-term investment outlook of the Chinese stock markets and the attributes of each fund vehicle. Looking back to 2019, Liang recalls value stocks being out of favor, while growth stocks thrived.

Although the recent value rally has been the subject of much discussion among investors, Liang advises against making decisions based solely on predictions of when the rally will end or when growth stocks may regain favor. She says: “It’s hard to time the market and even harder to consistently predict the timing of style rotation correctly.”

Take outperformer Fidelity China Focus as an example, it is rated Neutral. “The fund has indeed enjoyed the stylistic tailwind and outperformed the benchmark index and many of the category peers. There’s also a recent change in the lead manager that is worth noting,” Liang says, citing that Nitin Bajaj took the reins of this strategy from Jing Ning in October last year.

“Performance has been strong over Bajaj’s short tenure, with the strategy comfortably beating both the MSCI China Index and its peers by a large extent. While encouraging, it is still early days,” Liang says.

While the investment style still leans toward value, the manager switch leads to some reservations about the new manager’s investment capability in the large-cap China equity space, according to Liang.

“While China has been a key alpha driver for his regional small-cap strategy, Bajij’s experience in large-cap Chinese names, which remain the strategy’s main hunting ground, is limited,” she adds. Both the People and Process ratings of Fidelity China Focus were downgraded to Average from Above Average in August 2022 as a result.

China Exposue: Are Active Funds Still the Way to Go?

Despite short-term performances, Liang believes that active managers are well-positioned to generate excess returns over the long term, particularly in the onshore A-shares market.

Morningstar’s methodology considers a fund’s People, Process, and Parent pillars when determining its rating, with the People component being particularly important for Chinese equity funds.

Liang says: “We continue to hold the view that, considering the market’s breadth and depth, there are many excess return opportunities in China for active managers to uncover. It has been more evident in the onshore A-shares market.” More recently, she observes that some foreign managers have ramped up their investment research capabilities to look at less-followed, smaller-cap stocks to unearth alpha opportunities.

As of July, there are five funds with a top rating driven by our analysts.

In China equity, Schroder ISF China Opps and FSSA China Growth bear a Gold rating. Both funds warrant a High People and Process rating. Meanwhile, JPM China A (dist) earns a Silver rating, backed by an Above Average People and Process rating.

For Greater China equity funds, gold-rated Schroder ISF Greater China is the top-rated strategy, receiving the top rating in both People and Process pillars. Silver-rated FSSA Greater China Growth and FSSA Regional China are also among the conviction picks by the Morningstar manager research team.

Investors Are Deserting China, so Should I Buy Right Now?

Investors Are Deserting China, so Should I Buy Right Now?

Upcoming changes to our membership offerings, tools, and features

Upcoming changes to our membership offerings, tools, and features

Highlights from the 2025 Morningstar Fund Awards (Singapore)

Highlights from the 2025 Morningstar Fund Awards (Singapore)

.png) 2025 Morningstar Fund Award Winners

2025 Morningstar Fund Award Winners

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

6 Undervalued US Stocks That Just Raised Dividends

6 Undervalued US Stocks That Just Raised Dividends

.jpg)