After the latest stock market dip in China, already cheap stocks have become cheaper still. Value stocks like energy and telecom companies have become investor darlings, as stock pickers move away from growth stocks. This more or less explains the underperformance of some top Chinese equity funds covered by Morningstar.

Gold-rated FSSA China Growth is one of them. The fund, and other similar China strategies, have had to sell off some stocks that have been top performers, due to concerns over corporate governance, and in order to comply with U.S. sanctions. However, Martin Lau, managing partner at FSSA Investment Managers is doubling down on his top high-conviction names.

He says: “We have consciously brought down the number of stocks to make the portfolio more concentrated while selling some smaller positions that used to take 1% or less exposure. As the stock market becomes challenging, we tend not to hold a large number of holdings.” While keeping portfolio turnover at around 15%, he has rejigged the China equity portfolio by increasing bets on the top holdings.

It is Important to Have Conviction in the Stocks You Own

For Lau, it is important for him to have conviction in the stocks he owns. “In this environment, there’s a greater need to validate our investment case, with earnings and other information,” he says. On a normal day, the general rule has been that the team spends roughly half of the time meeting with existing portfolio companies to learn more about how companies perform in the market, while exploring new stock opportunities for the remainder of the time.

In 2023, though, Lau spent much time meeting with the existing portfolio holdings. “Some stocks in our portfolio have fallen so much, so it is more important to have the conviction to hold them, than to acquire second or even third-tier stocks.” This is a way Lau believes can confirm the right investment case is still in place. He continues: “When the stock price declines, we need that validation to know it’s a bargain and an opportunity. This is also how we stick to our investment discipline.”

At the same time, despite the gloominess in the Chinese economy, he steers clear of leaning heavily onto macro data and focuses as much as he can on earnings and management. “The time lag in macroeconomic data makes us cautious to use them to form views. We also do not predict any macro trends. But importantly, we need to know if this is in the price, as the best investment opportunities emerge from the bearish economic outlook.”

There are Two Types of Investors in China

Lau beieves there are two types of investors interested in China:

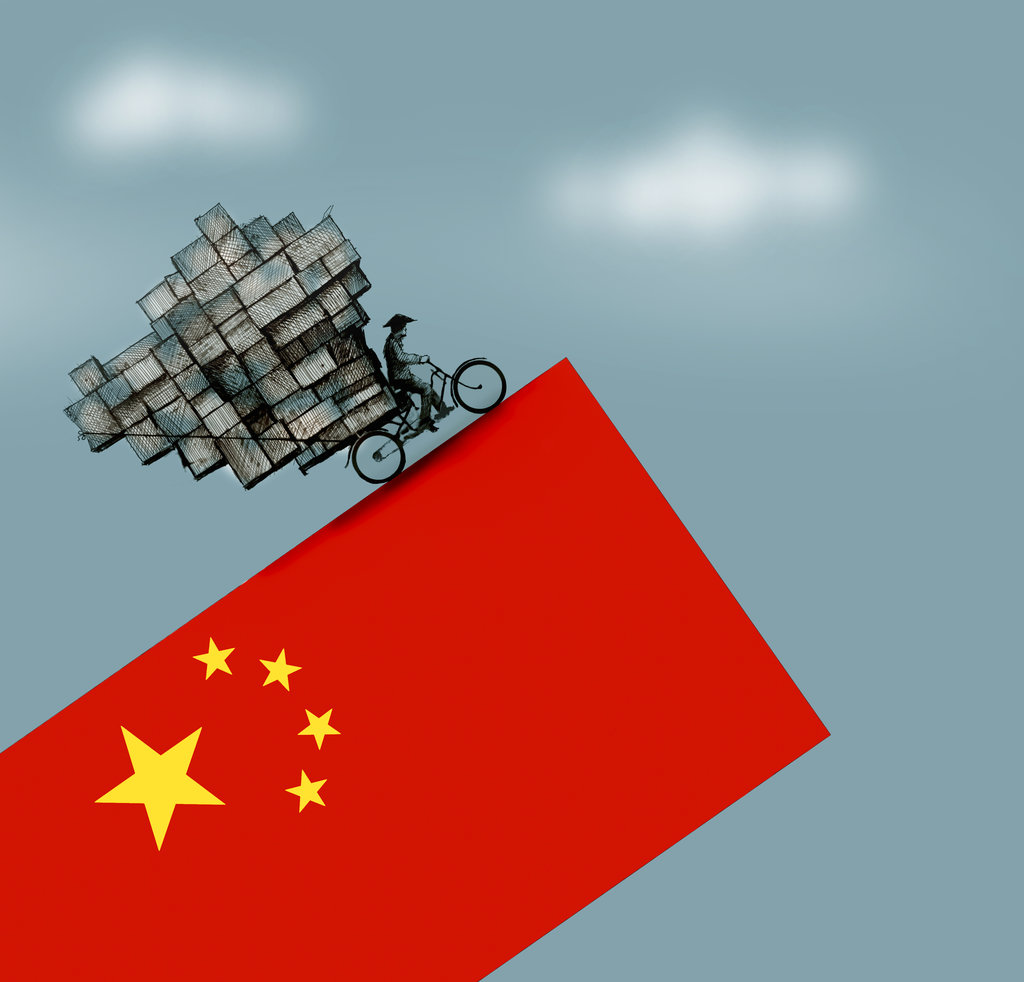

- The pessimists who believe China is tipping into a multi-decade structural difficulty like what Japan has been through, or

- The optimists who are willing to invest in China with a longer time horizon.

“There are two choices for investors in this environment – either you do not hold China assets at all, which is understandable given the poor return investors have experienced over the past decade, or you can look beyond this cycle. If you are interested in China, you have to believe that China’s per-capita income is going to grow and not shrink.”

This is Lau’s rebuttal to the most recent rhetoric that China’s experiencing a ‘consumption downgrade’, where consumers are buying with frugality. The naysayers to a China growth re-acceleration are epitomized by the optimism around a pickled mustard stem, or “zha cai”, manufacturer on the mainland.

“For the short term, the economy is sluggish, and the discretionary segment of consumption is struggling. But, I don’t think this will continue for the upcoming five years,” says Lau. “If you think China’s per-capita income will grow and want to bet on that, you need to side with more aspirational consumer products.” In his portfolio, the top bets include the electrical appliance manufacturer Midea (000333), sports apparel retailer ANTA (02020), and e-commerce platform JD.com (JD, 09618).

He also adds that the economy’s challenges have not derailed the major trends of investing in China for the long haul. They include the growing middle-class population and income and a wider adoption of industrial automation.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

.png)

.jpg)