All eyes are on the U.S. presidential election. Investors worry about volatility, and about what they should do in anticipation of the election results.

The short answer often is "nothing." Morningstar Canada's director of investment research Ian Tam says that sticking close to your risk tolerance and maintaining discipline in your portfolio will likely afford you better results in the long run rather than guessing who the next president is.

In a recent column, Morningstar veteran John Rekenthaler commented that presidential elections don't affect the economy or stock prices as much as we think. He looked at the real gross domestic product growth rate from January 2014 to December 2020, the last three years of President Obama's term and the first three years of President Trump's. Although the two presidents had radically different policies, the growth rates were similar at 2.4% annualized during the last three years of Obama's term, and 2.3% during the first three years of Trump's term.

What about the others?

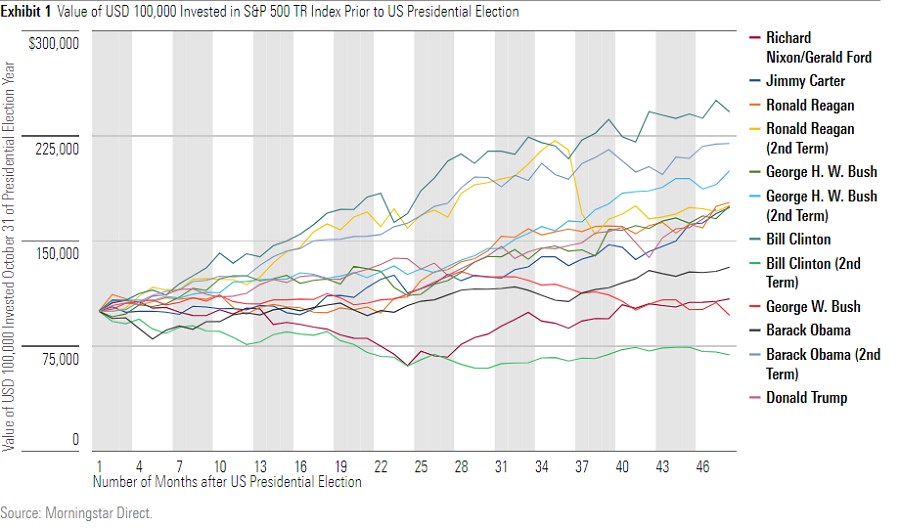

This chart shows what would happen if you had invested USD 100,000 in the S&P 500 on Oct. 31 in each presidential election year since 1972. Each line represents a different presidential term with the president highlighted on the right. You can see that over the medium term, or 48 months, the results vary dramatically.

"Remember that economic conditions don't often reflect stock prices," Tam says. "The most glaring example of this is what we are going through right now. Despite bleak economic conditions, the S&P 500 continues to remain resilient, showcasing the disconnect between the economy and security prices."

Asian Markets and the U.S. Election

A win by former Vice President Joe Biden over President Donald Trump would be taken positively by the Asian stock markets, according to Morningstar equity analyst Lorraine Tan. "This is because we think a Biden win likely signals a return to a multilateral approach in U.S. foreign policy," she says.

She notes that a key difference between Biden and Trump is the approach to trade. "We expect Biden would be willing to negotiate and remove many of the Trump tariffs, starting with U.S. allies," Tan says. "While multilateral trade agreements would not be the immediate priority, we think they will be considered if they help restore U.S. relationships and leadership." Tan thinks the Trump trade tariffs will be re-examined and most likely lead to removals after some negotiation, and this should have a positive indirect impact.

"However, there are still significant strategic differences between the U.S. and China, and this is likely to mean continued targeted trade restrictions in certain sectors and a higher potential threat of global sanctions against China," Tan adds. "Also, the main driver of near-term earnings remains the containment of the pandemic. Our base-case view remains for a COVID-19 vaccine to be available by mid-2021 that will allow economic activity to start normalizing from then on. We have not factored in potential positives from reduced tariffs."

An Eye on Asian Stocks

Our coverage universe indicates that Asian stocks are slightly undervalued currently by around 7%.

"While we don't see any grossly overvalued sectors, there is a significant valuation gap between the real estate and energy sectors and the technology and consumer cyclical sectors," Tan says. "In this regard, we favour stocks such as CNOOC, Sun Hung Kai, and CapitaLand Mall Trust. We like stocks with exposure to China consumption, such as Trip.com and SJM Holdings. We remain selective on the technology sector—we prefer SK Hynix and Yageo, both of which should benefit from a pickup in 5G infrastructure spending."

Despite not being factored in with the potential positives from reduced tariffs, Tan believes that bans on trade with certain Chinese companies and in certain sectors may continue, and this in turn could continue to present a risk for select Chinese names that are dependent on U.S. advanced technology.

"Even with bipartisan dislike of Chinese policies, we think there is limited support for the bans on TikTok and WeChat as seen by the federal court injunctions against them," Tan says. "We suspect that Biden may cancel the executive orders issued to ban use of TikTok and WeChat by Americans.

"Within our coverage, we think Samsonite will see material direct benefit from a reduction in U.S. tariffs. While we think Samsonite could pass on the cost savings eventually, it should still provide a near-term boost to gross margins."

.png)