Since the release of new antitrust guidelines for internet-based platform companies and on online microlending businesses in November, China's regulators have doubled down on a push to rein in the activities of internet platforms and financial technology, or fintech, companies, of which Alibaba and its 33 per cent owned associate Ant Group are market leaders for both.

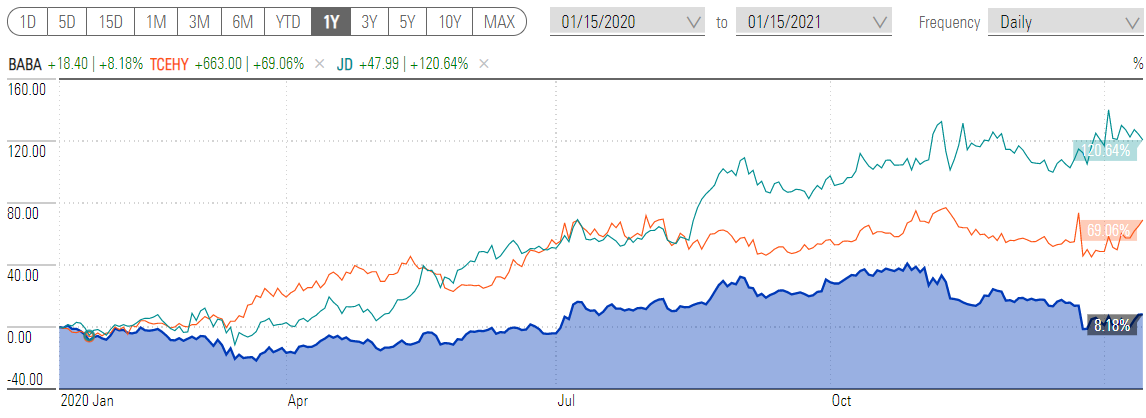

We expect more stringent rules to come in 2021, especially governing fintech activities. Given the regulatory risks, Alibaba's share price has underperformed with its Hong Kong shares and ADRs down 23.7 per cent and 22.8 per cent, respectively, since 1 November versus peers Tencent's 0.8 per cent increase and JD.com's 10.9 per cent rise.

After examining and adjusting our base case views on the potential regulatory impact, we think much of the tangible downside to our fair value estimate comes from a scaling back in Ant Group's potential growth. Our scenarios see a possible reduction in Ant's fair value by around 20 per cent-50 per cent from our original valuation of HK$2,450 billion, leading to a 2 per cent to 5 per cent cut to our fair value estimate of Alibaba. As for Alibaba's own primarily e-commerce business, we expect that in the case of a stringent regulatory impact that drags Alibaba's market share, our fair value estimate would decline by up to 15 per cent from our base case.

As such, we think that most of the bad news is already reflected in the current share price of Alibaba, trading around 20 per cent below our fair value estimate. Just as its shares recovered quickly from the pandemic, we believe the company should once again overcome the share price headwind supported by its bright fundamental outlook. With the baseline of unruffled growth convictions and intact wide moat rating, the shares are undervalued and attractive for buyers willing to stomach the volatility.

Alibaba, Tencent, JD.com - 1YR

Source: Morningstar Premium

Why Alibaba is a buy

We think Alibaba's recent share price underperformance presents a buying opportunity. We think the downside risk to our fair value estimate of HK$287 (US$296 per ADR) in the event of a stiff regulatory impact is at 15 per cent and this is already reflected in its current price level.

We think the more significant tangible regulatory risk for Alibaba pertains to policies relating to antitrust measures, in which the focus will be on preventing monopolistic practices. This adds regulatory risk to Alibaba's high-margin China retail marketplaces Taobao and Tmall, which make up 45 per cent of group revenue but may not have a significant near-term financial impact.

However, we believe banning the "forcing merchants to pick one from two platforms" key antitrust practice has limited financial impact on Alibaba. In reality, we believe that it has been difficult for Alibaba to enforce merchant exclusivity on its platforms.

The regulation on data usage could impair Alibaba's pricing capability but we see other big players facing the same risk. Therefore, the competition landscape would be largely unchanged, in our view.

We are positive on Alibaba's capability to mitigate a potential slip in revenue resulting from regulatory forces. Initiatives include fast-growing live streaming or even other non-marketplace segments, including cloud services, which could fuel growth.

'Nationalisation' unlikely

We retain our base case assumptions, as the practice of exclusivity would have immaterial impact to Alibaba's revenue and given the recent antitrust-related cases seeing fines of only CNY 500,000, we expect a substantial regulatory penalty in the near term on Alibaba would be unlikely. We also think the "nationalisation" of Alibaba is unlikely. However, we note in a bearish scenario when more stringent regulations come in, it would lead to a maximum of 15 per cent downside to our base case fair value estimate, resulting from a lower-than-market growth on e-commerce gross merchandise volume, or GMV.

Notably, the news flow on Ant Group is negative as China's new fintech policies will take a bite out of Ant's growth and cross-selling opportunities. But, we also consider Ant's valuation downside to Alibaba limited, as its holdings in Ant account for just 11 per cent of our fair value estimate. Our downward revision in our base case valuation of Ant by 29 per cent would only imply 3 per cent negative impact to Alibaba.

For Ant, the online microlending draft rules introduce higher compliance costs, significant capital pressure, reduced bargaining power and slower credit growth, but raises the entry barrier for the business.

Ant faces tougher scrutiny

We expect additional regulations to impact Ant. Though antitrust laws should have a neutral impact in our view, the People's Bank of China's, or PBOC's, digital currency initiative poses significant pressures to Ant's payment market dominance.

Ant's IPO seems remote at this stage, as the company will need to wait until all related fintech regulations are determined before nailing down a restructuring plan. In addition, for its listing application, it is possible that Ant will be required to provide a three-year financial performance to help investors better evaluate the business under a completely new regulatory environment.

Despite the increased regulatory risk, we are confident that Alibaba is able to sustain its wide moat rating given the strength of its network effect, that is, having the largest number of merchants and stock-keeping units among e-commerce platforms in China. However, while we also think that Ant's own payments business remains wide-moat rated, there is a higher risk for a negative moat trend if the firm is unable to make use of this digital platform to cross-sell its various products and services.

.png)