We're not making changes to our fair value estimates or moat ratings for COVID-19 vaccine firms following the May 5 announcement that the Biden administration supports a proposed waiver on intellectual property protection for COVID-19 vaccines.

The proposal to waive patent rights during the pandemic was initially made to the World Trade Organization by India and South Africa in October. With the pandemic raging in India and Brazil, calls to support this proposal have strengthened, and US, Europe, and UK opposition has become a potential political liability. It could take months to finalise the proposal, and Europe and UK have yet to support the waiver.

Beyond IP, we see huge skill and supply-related barriers to designing and building efficient mRNA manufacturing at scale outside of global leaders Pfizer (PFE)/BioNTech (BNTX) and Moderna (MRNA), and their contract manufacturing networks. Moderna disclosed in October that it would not enforce its COVID-19 patents during the pandemic but has not seen any signs of copycat production globally, which we think supports the idea barriers to production beyond IP. Using raw materials in short supply (like lipids) for riskier efforts at new facilities rather than for established networks could result in reduced global supply in 2021 and 2022.

After incorporating updates from Moderna and Pfizer with first-quarter earnings, we have raised our forecast for COVID-19 vaccine sales to $70 billion in 2021 (from $67 billion as of April 22). Beyond 2021, both Moderna and Pfizer/BioNTech are negotiating new contracts, and they remain best positioned to develop the first vaccines against new variants.

Moderna has released the first data for a third dose with its mRNA-1273.351 variant vaccine that imply stronger and more consistent protection across variants, and Pfizer expects data from its own variant vaccine in July. Pfizer also noted that future variant vaccine updates may only need a lead time until regulatory authorisation of roughly 100 days.

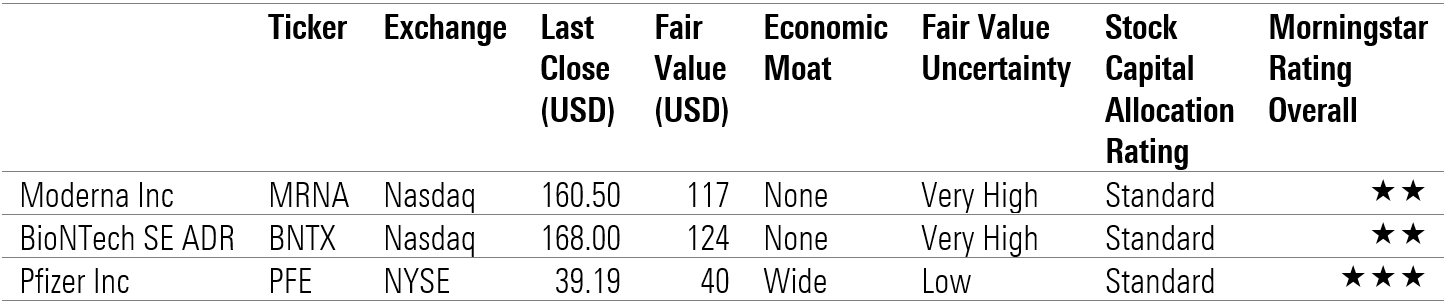

Morningstar ratings

- source: Morningstar

©2021 Morningstar. All rights reserved. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided as of the date written, solely for informational purposes; and subject to change at any time without notice. This content is not an offer to buy or sell any particular security and is not warranted to be correct, complete or accurate. Past performance is not a guarantee of future results. The Morningstar name and logo are registered marks of Morningstar, Inc. This article includes proprietary materials of Morningstar; reproduction, transcription or other use, by any means, in whole or in part, without prior, written consent of Morningstar is prohibited. This article is intended for general circulation, and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Investors should consult a financial adviser regarding the suitability of any investment product, taking into account their specific investment objectives, financial situation or particular needs, before making any investment decisions. Morningstar Investment Management Asia Limited is licensed and regulated by the Hong Kong Securities and Futures Commission to provide investment research and investment advisory services to professional investors only. Morningstar Investment Adviser Singapore Pte. Limited is licensed by the Monetary Authority of Singapore to provide financial advisory services in Singapore. Either Morningstar Investment Management Asia Limited or Morningstar Investment Adviser Singapore Pte. Limited will be the entity responsible for the creation and distribution of the research services described in this article.

.png)