Earlier this week, Morningstar launched the 2021 version of the Global Thematic Fund Landscape, with a new look at whether it's worth investing in these specialized strategies.

In the Landscape, authors Kenneth Lamont, Ben Johnson, Dimitar Boyadzhiev and Daniel Sotiroff find that over the three years through March 2021, collective assets under management in these funds more than tripled to US$595 billion from US$174 billion worldwide. This represented 2.1% of all assets invested in equity funds globally, up from only 0.6% 10 years ago.

They find that actively managed funds account for the majority of assets invested in thematic funds. In general, actively managed funds have higher fees than their passive counterparts. Additionally, thematic funds also tend to levy higher fees than their nonthematic counterparts.

More than two-thirds of thematic funds globally survived and outperformed global equity markets (as proxied by the Morningstar Global Markets Index) in the year ended March 2021, the authors found. This success rate drops to just 22% of thematic funds when we look at the trailing 15-year period, and 57% of the thematic funds were closed during the period. They suggest that this lackluster long-term performance can be partly explained by the higher fees.

If you’re wondering what makes a thematic fund, the authors have developed an updated three-tier taxonomy to classify the space, and to help investors make sense of this expansive and diverse universe.

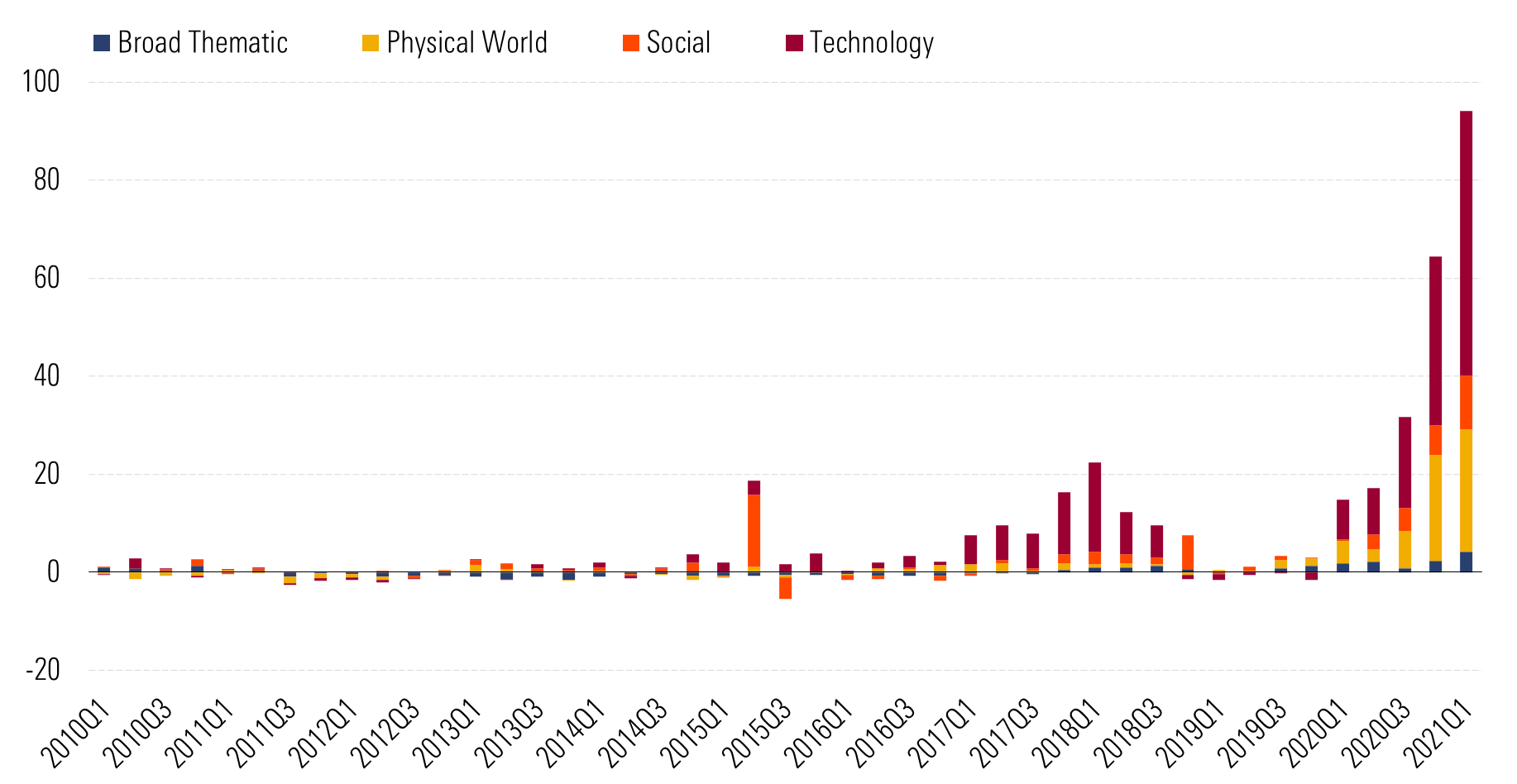

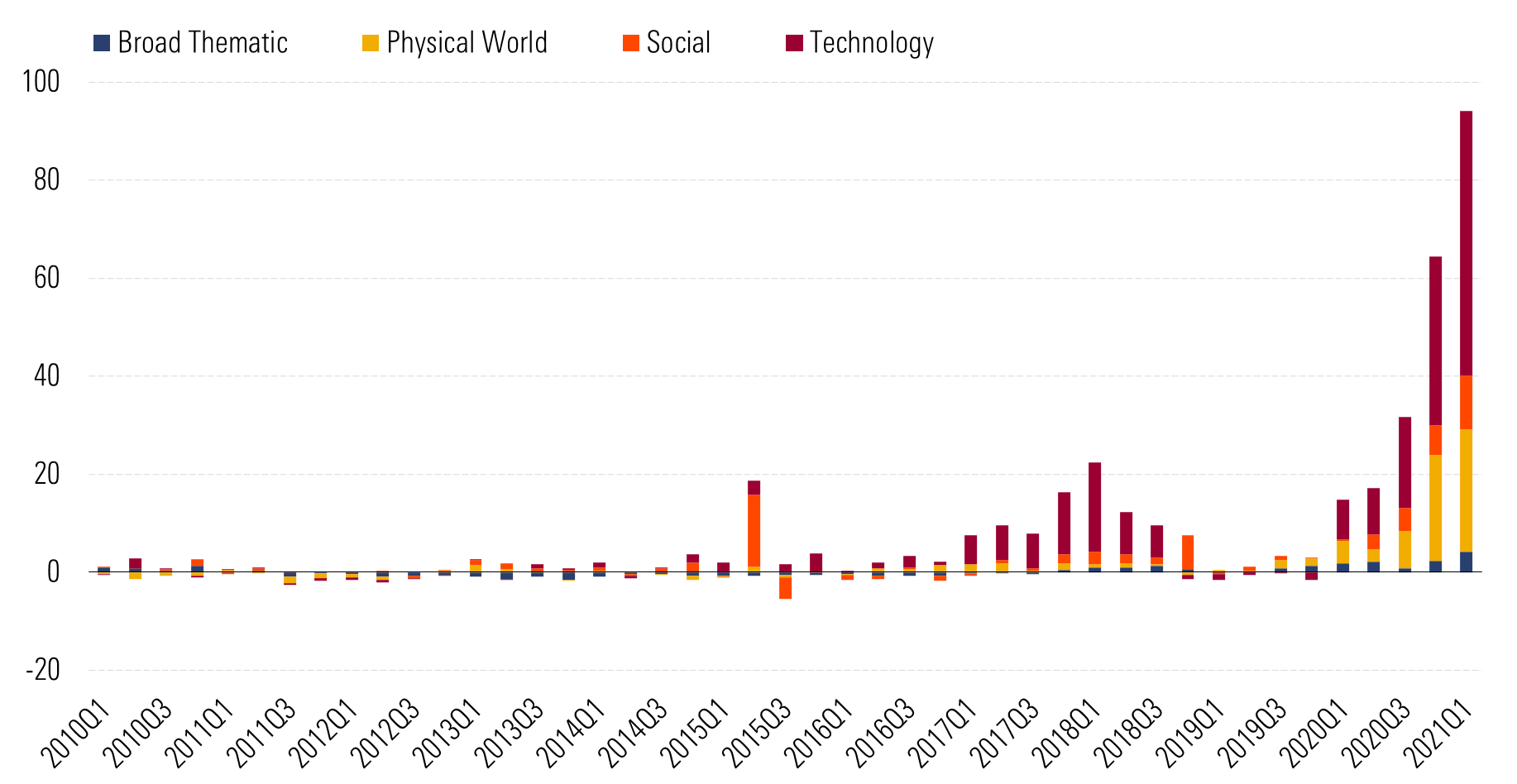

The pace of asset inflows to the thematic funds has quickened since the COVID-19 outbreak. In the past four quarter through March 2021, thematic funds attracted US$ 207.4 billion, representing an explosive growth of 930% year-on-year.

Exhibit 1: Global Inflows by Broad Theme

Source: Morningstar

These funds appeal to a broader set of fund buyers. But how do they perform?

As many as 67% of thematic funds survived and outperformed global equities (as proxied by the Morningstar Global Markets Index) over the trailing year through March 2021. The report finds that 20% of funds were closed over five years. Among the 200 funds with more than 15 years of track record, the success rate of drops dramatically in a longer period. Only one out of five funds in the universe has survived and outperformed over the trailing 15 years.

What’s on Offer in Asia?

In Asia, Japan is home to the largest thematic funds by size. The market totaled US$ 56 billion in assets, up from US$ 17 billion five years ago. With around US$ 6 billion under management each, Japan’s GS netWIN GS Technology Equity Fund and SMTAM Next Generation Communications Related World Equity Strategy Fund top the chart. Five other Japan-domiciled funds have a place in the top ten.

China is a market that is catching up. The Landscape notes that China has risen from nothing to become second to Japan in only ten years, with US$ 49 billion managed under thematic funds as of March 2021. There are now 170 thematic funds domiciled in China. In first-quarter 2021 alone, 18 new thematic funds came to market. Themes that are favored by Chinese investors include Security, and Political themes. The groupings are dominated by National Defense and Structural Reform subthemes. As elsewhere, Energy Transition funds find a place among the largest themes.

In Hong Kong, a total of 39 thematic products are available for sale, with around half of them tech-related. Interestingly, the tech offerings are mostly exchange-traded funds.

Meanwhile, Investors in Singapore are offered a total of 22 thematic funds, while in Malaysia, nine thematic funds, locally domiciled, are available, more than half of them investing in EM consumption, millennials shoppers and luxury brands.

In Taiwan, investor appetite for thematic funds is reflected in the asset size, which more than doubled in size to $5.1 billion over the year to the end of first-quarter 2021. Like its neighbouring markets, tech theme is the major category across funds available for sale in Taiwan.

Funds in the Next Generation Communications theme account for more than half of the thematic fund market. This set includes the Cathay Taiwan 5G Plus ETF (00881), which is the largest thematic fund in Taiwan.

Should You Buy a Thematic Fund?

The Landscape notes that because of their narrower exposure and higher risk profile, thematic funds are best used to complement rather than replace existing core holdings. These funds might be considered as single-stock substitutes for those investors looking to express a view on a theme but lacking the resources needed to conduct due diligence on individual companies.

Investors in thematic funds are making a trifecta bet. They are betting that they are: 1) picking a winning theme; 2) selecting a fund that is well-placed to survive and harness that theme, and 3) making their wager when valuations show that the market hasn't already priced in the theme's potential.

“The odds of winning these bets are low, but the prospective payouts can be large,” the report says.

©2021 Morningstar. All rights reserved. The information, data, analyses and opinions presented herein do not constitute investment advice; are provided as of the date written, solely for informational purposes; and subject to change at any time without notice. This content is not an offer to buy or sell any particular security and is not warranted to be correct, complete or accurate. Past performance is not a guarantee of future results. The Morningstar name and logo are registered marks of Morningstar, Inc. This article includes proprietary materials of Morningstar; reproduction, transcription or other use, by any means, in whole or in part, without prior, written consent of Morningstar is prohibited. This article is intended for general circulation, and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Investors should consult a financial adviser regarding the suitability of any investment product, taking into account their specific investment objectives, financial situation or particular needs, before making any investment decisions. Morningstar Investment Management Asia Limited is licensed and regulated by the Hong Kong Securities and Futures Commission to provide investment research and investment advisory services to professional investors only. Morningstar Investment Adviser Singapore Pte. Limited is licensed by the Monetary Authority of Singapore to provide financial advisory services in Singapore. Either Morningstar Investment Management Asia Limited or Morningstar Investment Adviser Singapore Pte. Limited will be the entity responsible for the creation and distribution of the research services described in this article.

The Risk-Return Profile of Emerging Markets

The Risk-Return Profile of Emerging Markets

Upcoming changes to our membership offerings, tools, and features

Upcoming changes to our membership offerings, tools, and features

Highlights from the 2025 Morningstar Fund Awards (Singapore)

Highlights from the 2025 Morningstar Fund Awards (Singapore)

.png) 2025 Morningstar Fund Award Winners

2025 Morningstar Fund Award Winners

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

6 Undervalued US Stocks That Just Raised Dividends

6 Undervalued US Stocks That Just Raised Dividends