Robinhood has been no stranger to the spotlight since the launch of its trading app in 2015. The company has been a disruptor in the fintech space: the discount brokerage’s mission to democratise investing, its streamlined platform, and zero minimums has made it popular among younger investors. Its no-commission model has forced competitors to follow suit.

Ahead of its own IPO, Robinhood introduced a new platform that gives its users the opportunity to buy shares of companies at their IPO price before they start trading on public exchanges. And, according to its latest SEC filing, Robinhood plans to set aside 20%-35% of its shares to users of the platform, IPO Access.

Robinhood plans to go public on the Nasdaq stock exchange under the ticker HOOD, with an expected IPO date of July 29. The company plans to sell shares at around $40 a piece, which would value it at a whopping $33 billion.

Robinhood’s Explosive Growth

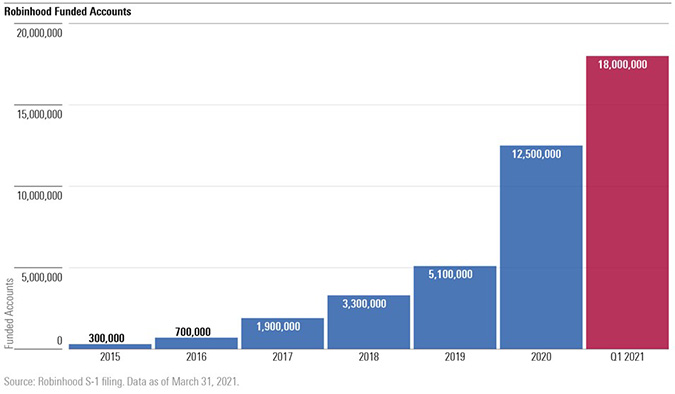

Robinhood’s growth has been impressive, and the company has found no shortage of funding despite its fair share of controversies. Through June 2021, the company has raised nearly $5.6 billion, according to PitchBook, a Morningstar company. Its total revenue in 2020 grew 245% from $959 million in 2019, Robinhood has said in its SEC filing. The company also reported $7 million in net income in 2020, compared with a net loss of $107 million the year before.

For the first quarter of 2021, Robinhood reported $522 million in total revenue, more than three times that of first-quarter 2020. As of March 31, 2021, the company had 18 million funded accounts, up from 12.5 million at the end of 2020.

For perspective, Morgan Stanley acquired E-Trade for approximately $13 billion when E-Trade had quarterly net revenue of $679 million and 7.2 million accounts. When Charles Schwab acquired TD Ameritrade for approximately $26 billion, it had quarterly net revenue of $1.3 billion and 12.1 million funded accounts. Much of Robinhood’s valuation is based on whether the company’s growth can continue at recent rates.

Last year marked a significant turning point for the company. “The recent adoption rate of Robinhood’s app is frankly amazing,” said Morningstar equity analyst Michael Wong. “Covid really led to a change in trading behaviour and the stimulus checks probably gave more people money to invest, so it massively helped Robinhood and the other retail brokerages.”

Robinhood identified four key elements of its growth strategy in its SEC filing:

- Adding new customers to the platform--Robinhood plans to increase marketing to drive brand awareness and attract new users.

- Growing with existing customers--Robinhood believes that users will expand their relationship with the platform as they grow their wealth.

- Product and technology innovation--Areas of focus include educational content, infrastructure improvements, and customer support.

- International expansion--Robinhood intends to pursue international expansion, including into Europe and Asia.

Robinhood’s Controversies

In an SEC filing, Robinhood said it faces over 50 lawsuits following actions taken during the “meme stock” trading frenzy of early 2021. Facing a potential liquidity issue, Robinhood temporarily halted trading for stocks like GameStop and AMC Entertainment, preventing Robinhood users from buying additional shares. Robinhood’s co-founder and CEO Vladimir Tenev faced Congressional questioning shortly thereafter.

In March 2020, Robinhood’s trading platform crashed during a period of extreme market volatility, leaving users unable to make trades and without a customer service line to call. The outage was particularly painful given how fast the average Robinhood user trades; Robinhood users trade riskier securities and at a faster pace than those of any other retail brokerage.

In a settlement with the Financial Industry Regulatory Authority, Robinhood recently agreed to pay nearly $70 million in penalties and compensation to harmed customers following the 2020 outage and other alleged transgressions going back to 2016.

Finra’s claims against Robinhood include:

- Distributing false and misleading information to customers;

- Failure to exercise due diligence before approving options accounts;

- Failure to supervise technology critical to providing customers with core services; and

- Failure to create a reasonably designed business continuity plan to cover technology-related emergencies.

The Finra settlement wasn’t Robinhood’s first major fine. In findings published in December 2020, the SEC stated that Robinhood had previously failed to disclose its largest source of revenue--payment for order flows. The commission also found that Robinhood had sacrificed price improvements for its customers (a potential benefit of outsourcing customer orders to principal trading firms) in the name of higher revenue. The SEC fined Robinhood $65 million.

How Does Robinhood Make Money?

Here are Robinhood’s main sources of revenue:

Interest: Robinhood collects interest earned on users’ uninvested cash and lending securities.

Robinhood Gold: For $5 per month, users of this premium service can get margin investing and additional data and research.

Payment for order flows: Robinhood outsources its users' orders to principal trading firms to execute the trades. These trading firms then pay Robinhood in return for the opportunity.

Payment for order flows makes up most of the company’s revenue. In its SEC filing, Robinhood said four principal trading firms, or “market makers,” accounted for 59% of revenue in first-quarter 2021, with Citadel Securities alone making up 27%. Overall, revenue from market makers made up 81% of Robinhood’s total revenue for the period. Given Robinhood’s large proportion of payment for order flow revenue, any curtailing of payment for order flow by the SEC would be a significant risk to the company’s valuation.

Payments for order flows mean that Robinhood benefits from more trades. The platform itself seems to encourage high-frequency trading. Among the different securities that users can purchase, Robinhood benefits the most from options, which are generally riskier than traditional stocks.

Robinhood's Competition

Robinhood competes with a bevy of discount brokerage platforms offered by both public and private firms. Many of these companies also offer more-traditional brokerage options in addition to online platforms for do-it-yourself investors. Many also have an array of revenue streams from business segments that are separate from their retail brokerages altogether.

Charles Schwab, TD Ameritrade (acquired by Charles Schwab), E*Trade (acquired by Morgan Stanley MS), Fidelity Investments, and Interactive Brokers stand out as some of the most widely used discount brokerages in the US. Pressured by Robinhood’s growing popularity, these firms eliminated stock-trading fees for online trades in 2019.

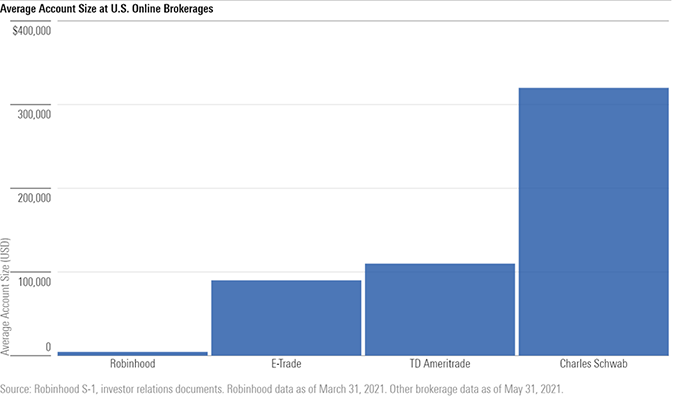

Though both Charles Schwab and TD Ameritrade took a hit when they slashed their commissions, Morningstar equity analyst Michael Wong views Charles Schwab-TD Ameritrade as a financial sector powerhouse. The combined firm has over $7 trillion of client assets. While Robinhood has managed to attract more users to its platform than Schwab, the average Robinhood account holds about $4,500, compared with roughly $320,000 at Charles Schwab and $110,000 at TD Ameritrade as of May.

In addition to its scale and cost efficiency, Wong sees an advantage in Schwab’s investment offerings: “We estimate that around 25% of client assets are in either a Charles Schwab proprietary or a controlled product, which allows the company to extract more profits on client assets than other brokerages where their clients use primarily third-party products.”

Opportunities for Future Growth

According to PitchBook, Robinhood is part of the “wealthtech” segment, which consists of companies that provide alternatives to traditional wealth-management services. PitchBook analyst Robert Le believes companies in this space have opportunities “to attract new assets from customers who expect digital, user-centric, and multichannel solutions to manage their assets.”

PitchBook analysts have identified three primary drivers of the wealthtech industry that stand to benefit Robinhood.

Demographic shift: The US is undergoing the largest intergenerational wealth transfer in history. As a younger generation takes over their inheritance, they will likely place more importance on investing rather than saving than their predecessors.

Preferences for passive investments: As more consumers turn to passively managed products, there is an opportunity for automated products and technology to replace traditional relationship-based services.

Large traditional market: Alternative wealth-management products represent a small share of global assets under management, leaving them plenty of room to grow in the space and disrupt traditional wealth-management providers.

Robinhood may prove that all publicity is good publicity--after all, there’s no denying that the discount brokerage has become a household name. Despite media backlash and regulatory scrutiny, Robinhood has continued to grow its user base at an impressive rate.

.png)