2022 has gone from bad to worse for semiconductor stocks, and that's caused real problems for other markets.

Heading into October the stocks of semiconductor companies, whose chips go into everything from computers to cars, were already posting big losses for the year on growing fears of a recession. That came after a difficult two years when the pandemic, along with a fire at a major chip factory, debilitated output.

Then on 7 October, the US Department of Commerce announced strict restrictions on the sale of semiconductors and equipment to China. The restrictions could cost hundreds of millions to billions of dollars in revenue for several semiconductor firms that investors were already expecting to struggle in the next few years.

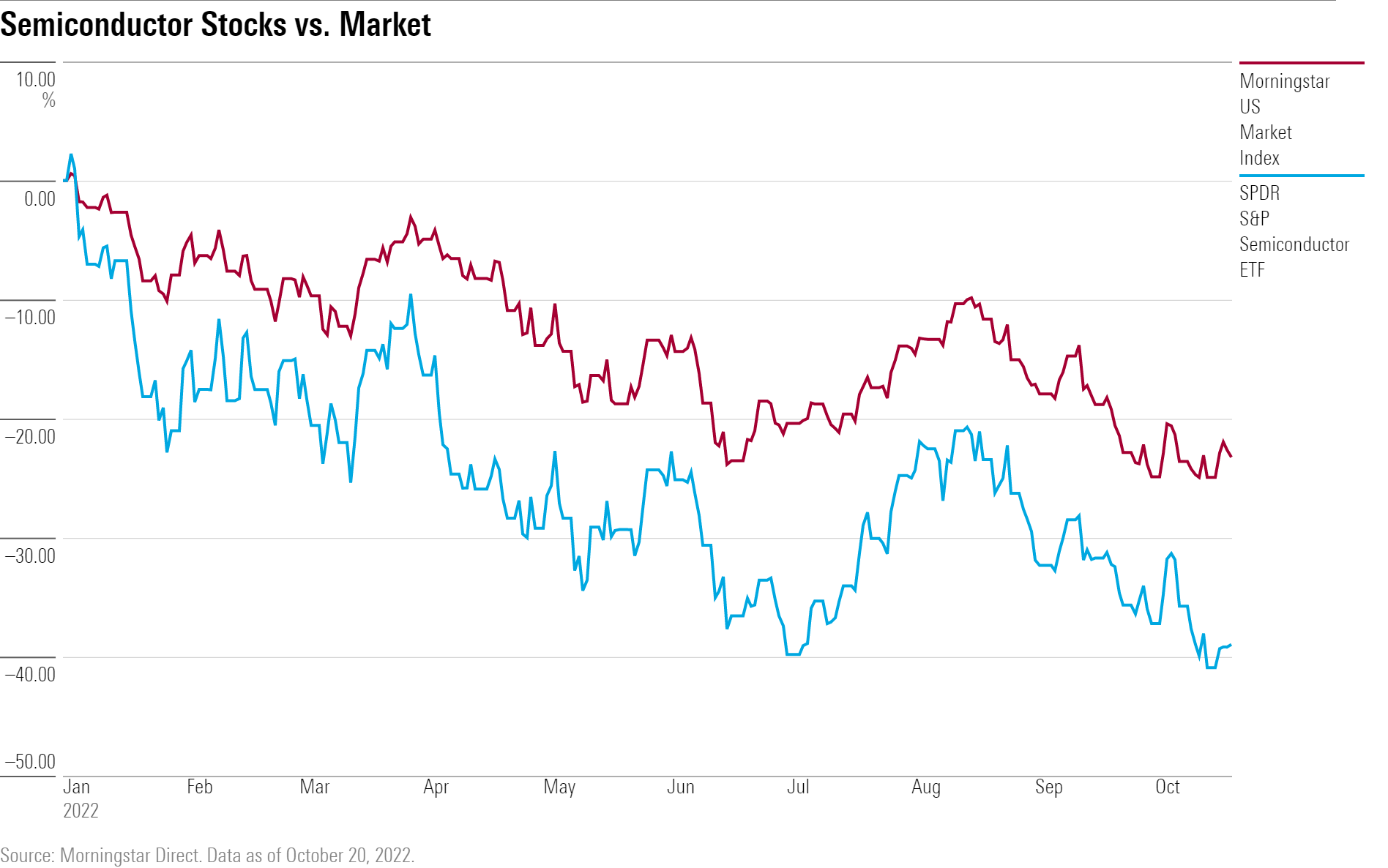

The damage to stocks in the sector has been significant. As of 20 October, the SPDR S&P Semiconductor ETF (XSD) is down 38.97% in 2022, having extended losses following news of the export restrictions.

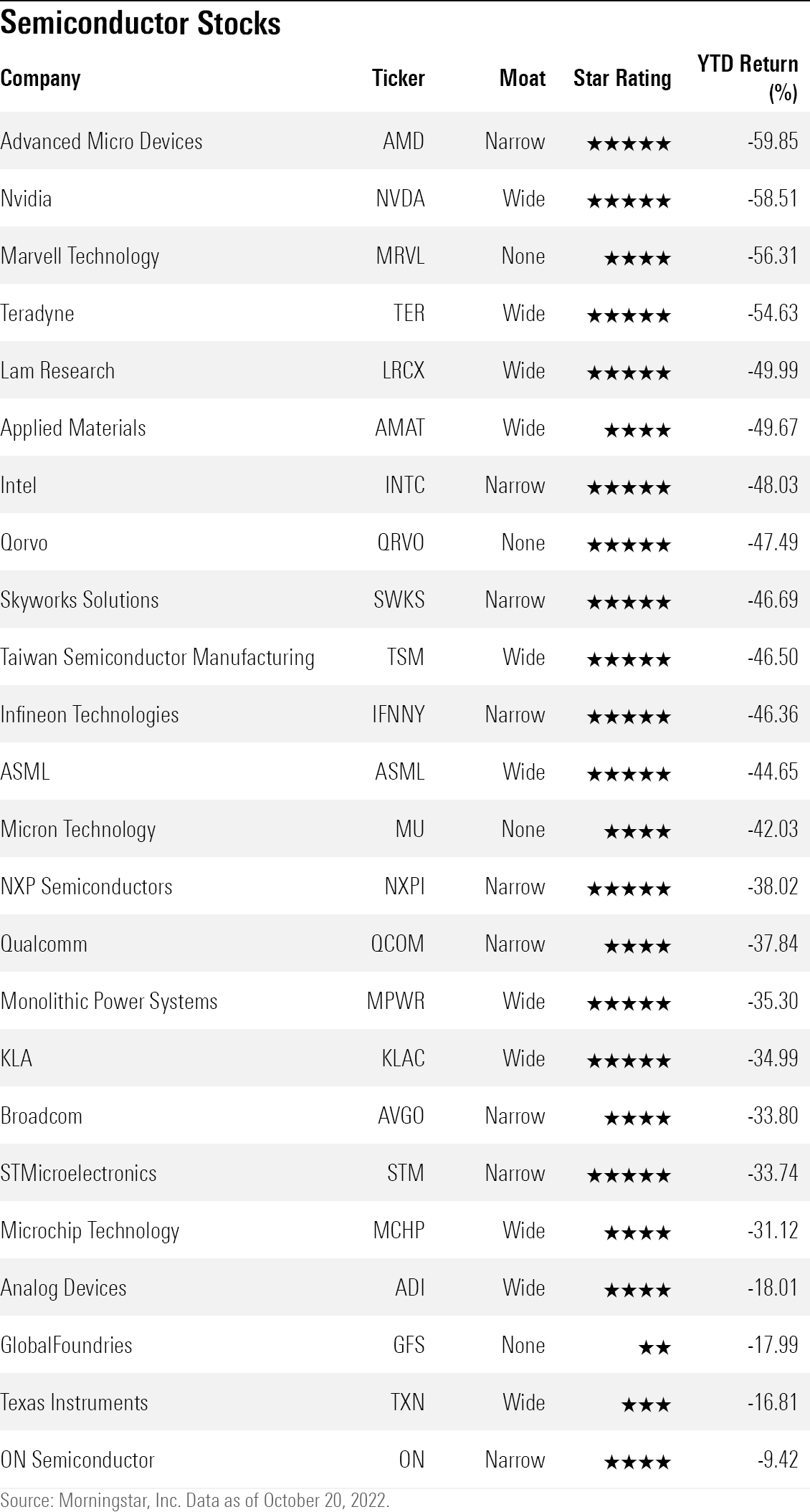

Market leader Nvidia (NVDA) fell 7.13% since the restrictions were announced, and is down 58.51% for the year. The restrictions could impact as much as $400 million in potential revenue from China in the company’s third quarter, says Morningstar technology sector strategist Abhinav Davuluri. More details may be disclosedwhen the company reports earnings on 16 November. We wrote about Nvidia last month for our tech week.

Advanced Micro Devices (AMD) was hit even harder, falling 14.86% since 7 October. The firm also released preliminary results for its third quarter with revenue of $5.6 billion, below the original guidance of $6.7 billion. The company cited weakness in PC sales as one of the primary reasons for the lower revenue. Full results will be released on 1 November. Advanced Micro Devices is down 59.85% for the year.

Firms that produce the technology used to manufacture semiconductors have also been hurt, including Lam Research (LRCX) and Applied Materials (AMAT), which are both down more than 10% since the export restrictions were announced, and almost 50% for the year.

Both companies recently disclosed details about potential losses due to the China restrictions. Applied Materials now expects revenue to decrease by about $400 million during its fiscal-fourth quarter, and those results are due 17 November.

When Lam Research released their fiscal-first quarter results on 19 October, the company lowered its 2023 forecast for total spending on equipment used for wafer fabrication, a process to develop semiconductors, in part due to the restrictions. "Specifically, the negative revenue impact from the restrictions is expected to be in the range of $2 billion to $2.5 billion," Davuluri says.

Taiwan Semiconductor Manufacturing (TSM) — the world’s largest semiconductor foundr y— fell 14.49% following the restrictions. Even though only 10.4% of their revenue comes from China, investors sold the stock based on concerns about how fewer sales to the country by Taiwan Semiconductor’s clients may hurt the manufacturer’s order volumes.

Morningstar equity analyst Phelix Lee cut revenue growth expectations for Taiwan Semiconductor’s high-processing chip segment by 50% for 2023, and by 25% in 2024. TSM shares are down 46.50% for the year.

The punishing losses for semiconductor stocks has taken a big toll on the technology sector this year, and has also been a measurable drag on the broader market. Semiconductor stocks make up 23.30% of the Morningstar US Technology Index, with most of that represented by the index’s weight in Nvidia and Intel (INTC). As of 20 October, the industry contributed 10.89 percentage points to the sector’s 33.27% decline this year.

The Morningstar US Market Index has a 5.31% weighting in semiconductor stocks, yet the group contributed 2.66 percentage points to the 23.24% year-to-date decline in the index.

US Restrictions May Hurt Revenue

While a recession would slow demand for semiconductors, it’s the US action against China that is now the focus of investors.

The restrictions have two key elements, Morningstar’s Davuluri says.

The first are limits around which chips can be sold. "There’s a threshold for performance," says Davuluri, where the sale of powerful chips to China, namely those used in data centers and artificial intelligence, would be restricted. "The second part is on the equipment side, which is to prevent China from making their own replacements or substitutes for the chips that are banned."

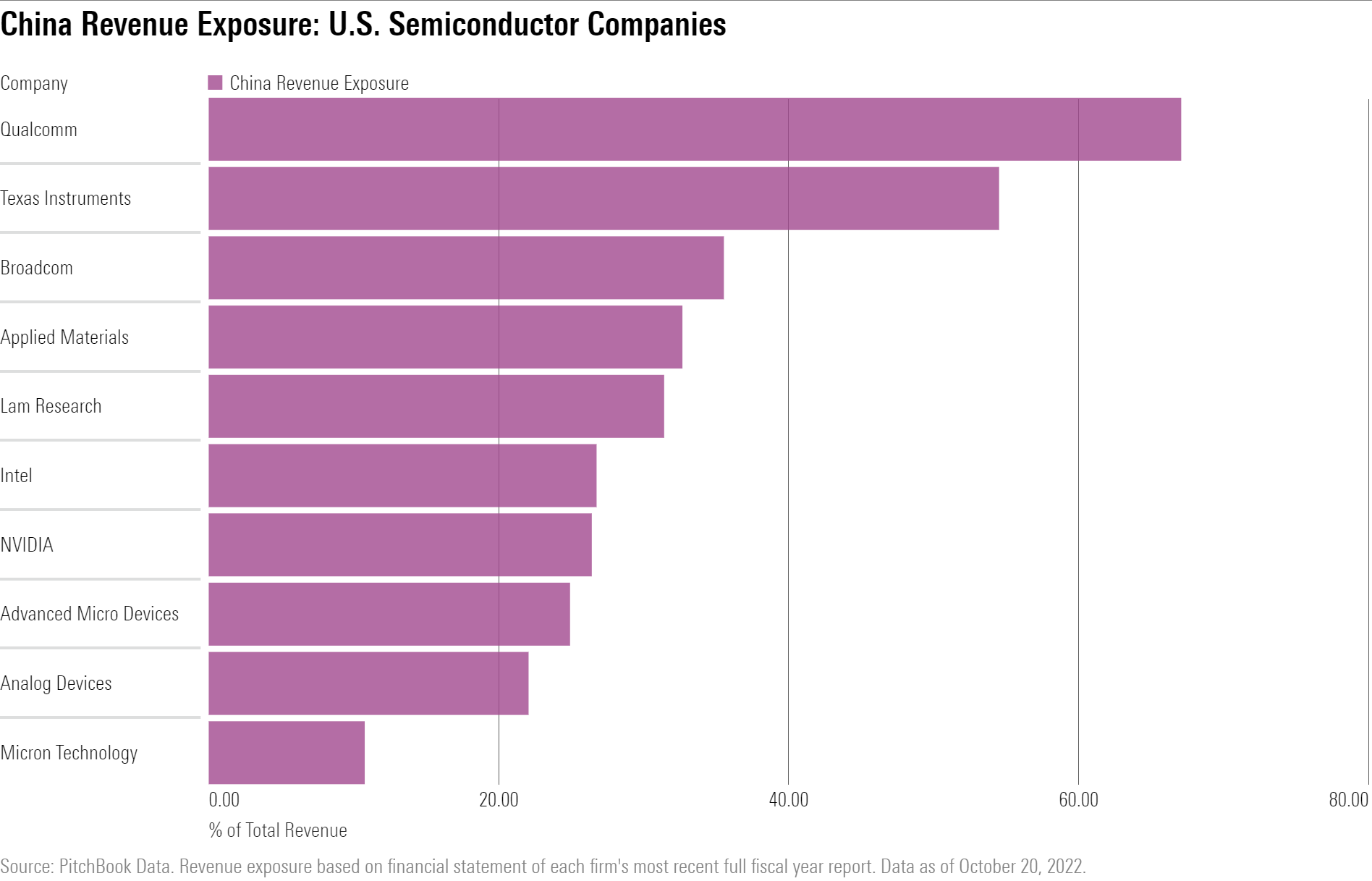

The problem for these firms is that the types of chips that are banned are among the most lucrative they produce. Furthermore, China tends to make up a significant portion of the revenue earned by semiconductor companies. Among the US-based semiconductor firms covered by Morningstar, their average revenue exposure to China was 31% in 2021, according to PitchBook Data.

Not all companies will be hurt by the new restrictions to the same degree.

Although Qualcomm (QCOM) has revenue exposure of 67% to China, the company produces chips used in smartphones, which is below the performance threshold included in the restrictions on sales to China.

Davuluri notes, however, that Qualcomm isn’t completely immune to the restrictions. "Chinese smartphone OEMs [original equipment manufacturers] may try to limit their use of Qualcomm chips and use of non-US alternatives in the future, such as Taiwan-based MediaTek (MDTKF)."

For companies like Nvidia and AMD, both of which have about a 26% revenue exposure to China, the impact will be more profound. The ban would apply to the graphics processing units (GPUs) used in data centers, which tend to be more lucrative.

Not all revenue from China would be erased for Nvidia and AMD. The sale of consumer GPUs and central processing units (CPU) products would likely remain.

"I don’t think AMD or Nvidia would be stopped from selling chips for consoles or PCs," Davuluri says. The risk for that market will be that China could strive for semiconductor independence, and a China-based player could appear to take a bite out of the remaining demand that AMD and Nvidia could legally service. However, there’s a "high barrier to entry" to the GPU market, and that risk could take years to manifest, says Davuluri.

The revenue impact for data center semiconductor business segments is also a bit more nuanced. Davuluri notes that there could still be room to sell to China. "Nvidia has talked about being able to sell some chips, such as older generation ones, that aren’t above the [performance] threshold," he says. While revenue loss from China would be slightly cushioned in that event, it would only be temporary.

"Ultimately, as performance continues to improve and expand, they’ll need the latest and greatest at some point. That’ll force them to try to develop their own homegrown solutions," Davuluri says.

The Near-Term Outlook is Dim

While the US Department of Commerce’s restrictions have been primarily responsible for depressing investor sentiment around semiconductor stocks in the last two weeks, it only compounded concerns about the industry that have existed for the past few months.

Fears of a global recession and weaker consumer spending habits have led to companies reducing expenditures for innovative semiconductor products across various markets.

High demand for personal computers during the pandemic in 2020 and 2021 led to manufacturers placing a large number of orders at foundries to produce more chips. However, that demand fell in 2022.

"A lot of people that would have upgraded, have already upgraded whether from a consumer or enterprise standpoint, so that [demand] was due for a considerable slowdown," says Davuluri. However, given that the orders chipmakers placed couldn’t be canceled, the PC market now finds itself oversaturated with semiconductors.

But it’s more than just falling PC demand that is depressing the semiconductor market. While 2020 and 2021 were robust years for semiconductor firms due to PC demand, a large amount of growth in the industry in the last decade was actually driven by smartphones.

"Smartphones are actually the biggest market for chips today, and that’s been seeing a lot of weakness," says Davuluri.

As shown with the recent iPhone 14, smartphone manufacturers have been focused on improving their models incrementally this year, compared to the more advanced updates that occurred in 2020 and 2021. That led to weaker demand for innovative semiconductor solutions for smartphones. Concerns about falling consumer spending in the event of a potential recession would put a limit on growth in the smartphone semiconductor market.

Semiconductor demand for enterprise and data center solutions have held up a little better compared to more consumer-oriented markets like PCs and smartphones, according to Davuluri. But he expects to see that slow down as well in 2023. "That is a function of softer and more conservative spending in a potential recessionary environment," he says.

Davuluri sees the semiconductor industry broadly performing weakly in 2023, with certain markets remaining difficult due to supply shortages, such as semiconductors for industrial and car usage. However, the uncertainty is in how long that weakness would last.

While the near-term outlook for semiconductors is relatively uncertain, Davuluri sees the semiconductor market growing to about $1 trillion in total sales toward the end of the decade, from about $620 billion this year.

"That growth expectation is still intact, but that doesn’t mean we won’t have cycles and downturns, and that’s what 2023 is shaping up to be."

Morningstar Newsletters

Stay up to date with our daily and weekly newsletter content

.png)