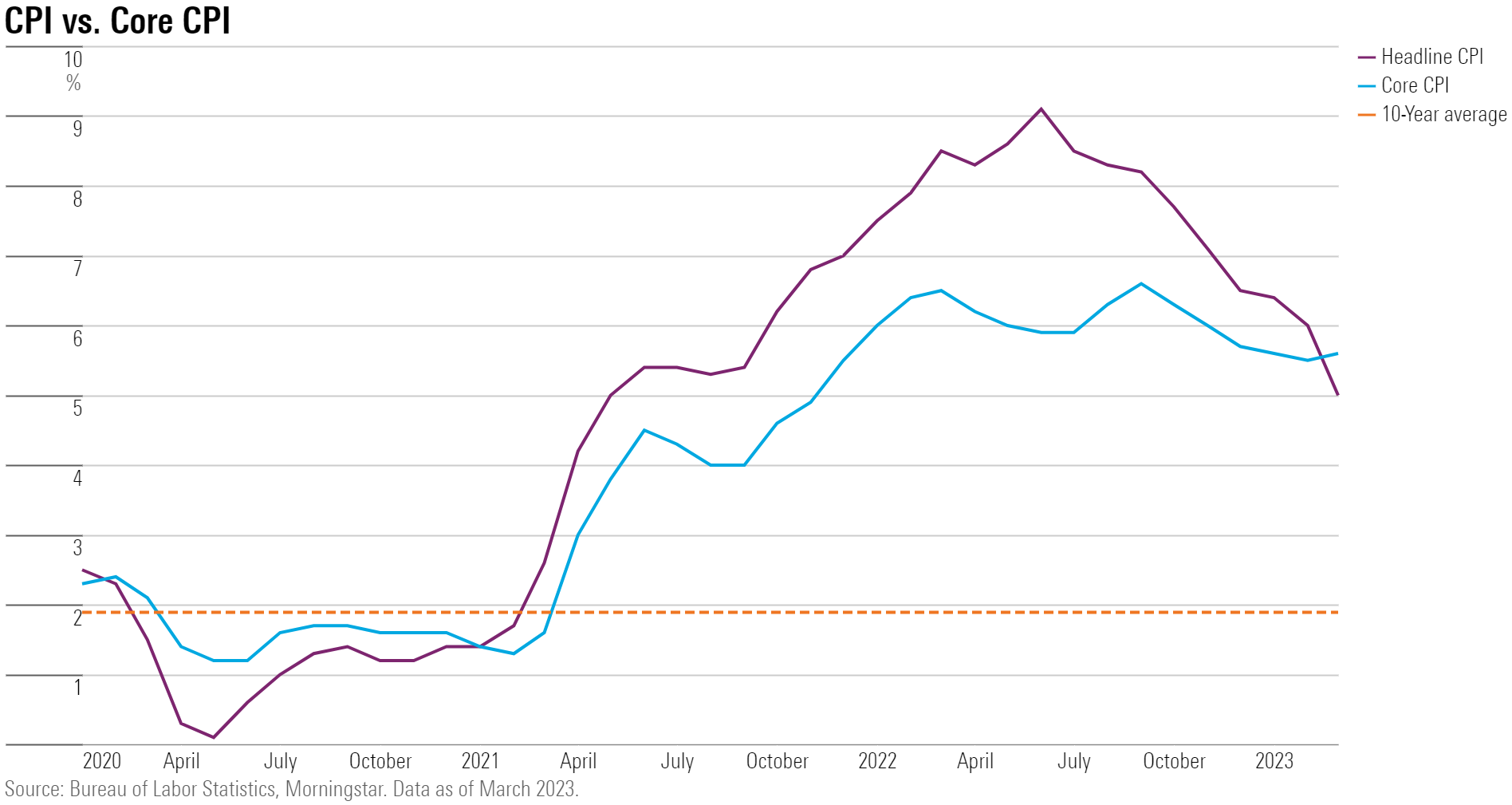

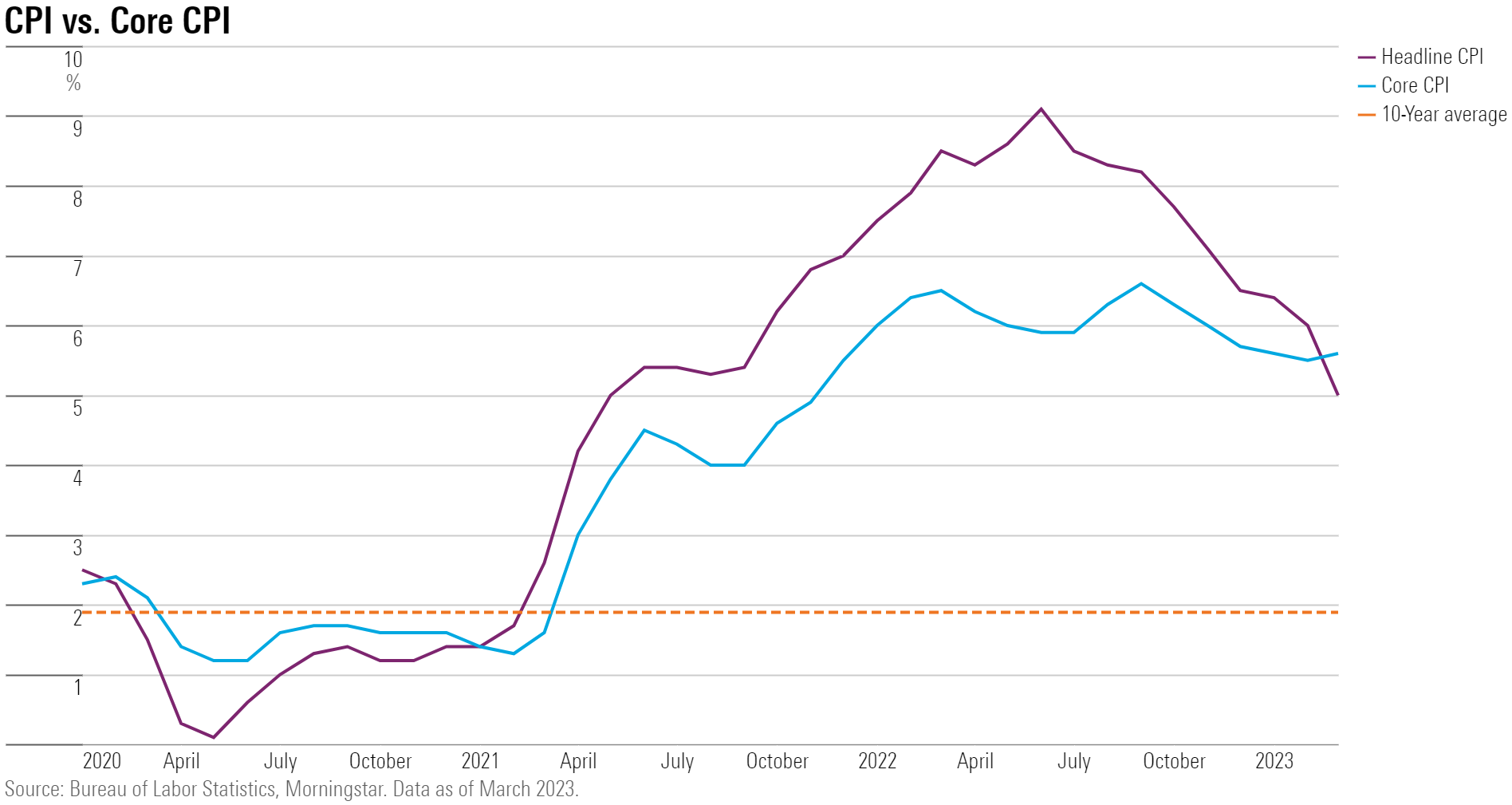

The US Consumer Price Index (CPI) report for March 2023 showed inflation chalking up its tamest increase in nearly two years, but upward pressure on prices continued at a pace that leaves the Federal Reserve on track to raise interest rates yet again next month.

Still, there was some good news to be had for consumer wallets. Much of the increase in inflation is now being driven by rents, which lag the rest of the economy and are widely expected to slow in coming months. Elsewhere, inflation pressures have stabilised, or even better, showing signs of deflation: declining prices. Energy prices, including the prices paid at the gas pump, also declined.

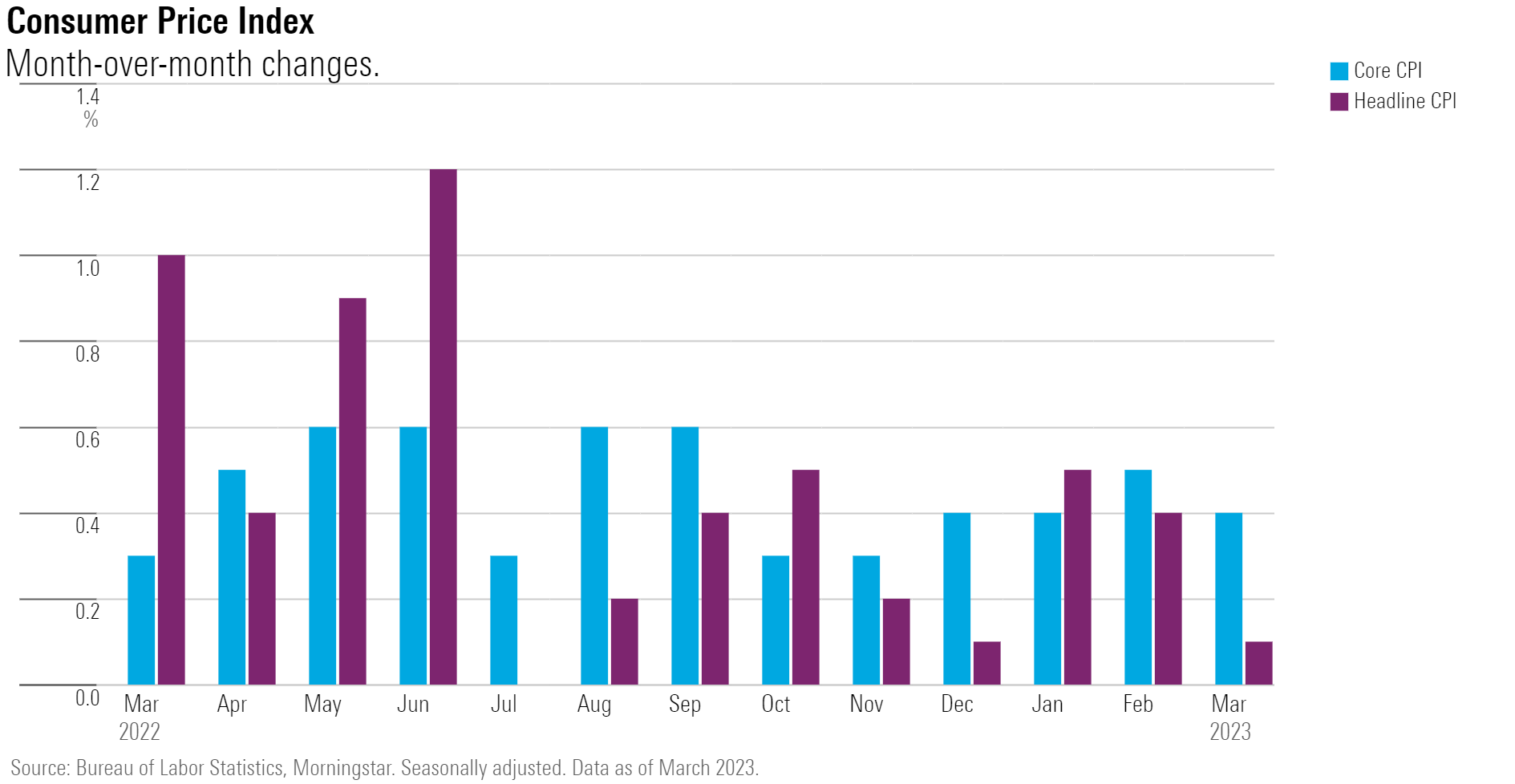

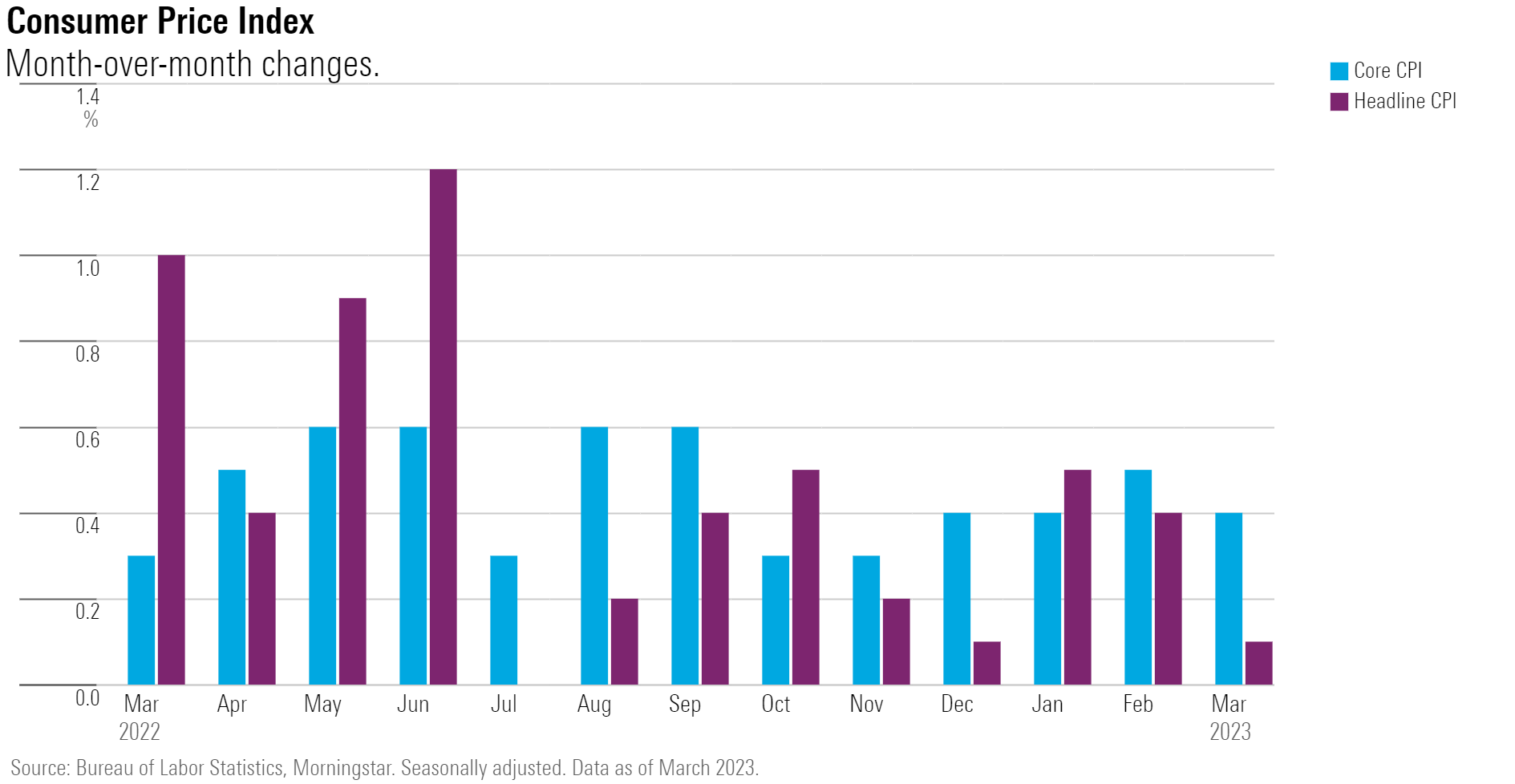

Overall, the US Bureau of Labor Statistics reported a rise of 0.1% in the CPI for March. Meanwhile, core CPI, which excludes the volatile food and energy components, rose 0.4%.

"Today’s inflation report shows core inflation holding steady, more or less," says Preston Caldwell, chief US economist at Morningstar.

However, "there’s still good reason to expect falling inflation on the horizon," Caldwell adds, "but for now, the Fed is likely to hike rates again in May."

March CPI Report Key Stats

• CPI rose 0.1% for the month versus 0.4% in February;

• Core CPI rose 0.4% after rising 0.5% in February;

• CPI, year over year, rose 5.0% after rising 6.0% in February;

• Core CPI, year over year, rose 5.6% after rising 5.5% in February.

The March CPI increase of 0.1% came in lower than consensus estimates and marked an improvement from the 0.4% increase shown in the February CPI report. The lion’s share of the March CPI increase was driven by shelter costs, which more than offset an energy-price decline of 3.5% month over month. Food prices were unchanged in March overall, as restaurant prices rose 0.6%, but food at home prices fell 0.3%.

The 0.4% rise in core CPI was in line with economists' forecasts. Notable price increases came from shelter, motor vehicle insurance, airline fares, and new vehicles. Prices for used cars and trucks as well as medical care decreased over the month.

When it came to year-over-year inflation rates, the CPI’s 5.0% rise in March was just below economists’ forecasts, but the 5.6% rise in core CPI matched expectations.

Shelter Prices Will Likely Moderate

Shelter prices increased at 8.5% annualised based on a three-month moving average, ticking down compared with a month ago, according to Caldwell. At the same time, core prices increased at a 5.1% annualised growth rate, he says, with that rate holding steady compared with month-ago levels. Core inflation excluding shelter was 2.7%, up compared with a month ago but still in moderate territory, Caldwell says.

"The slight drop in shelter inflation is a harbinger for further decreases to come, in our view," Caldwell says.

"After two years of rapid growth, market rents have been about flat over the past six months. The shelter component of the inflation index responds to market rents with a lag. We expect weak housing demand along with the large backlog of supply to put sustained downward pressure on shelter inflation."

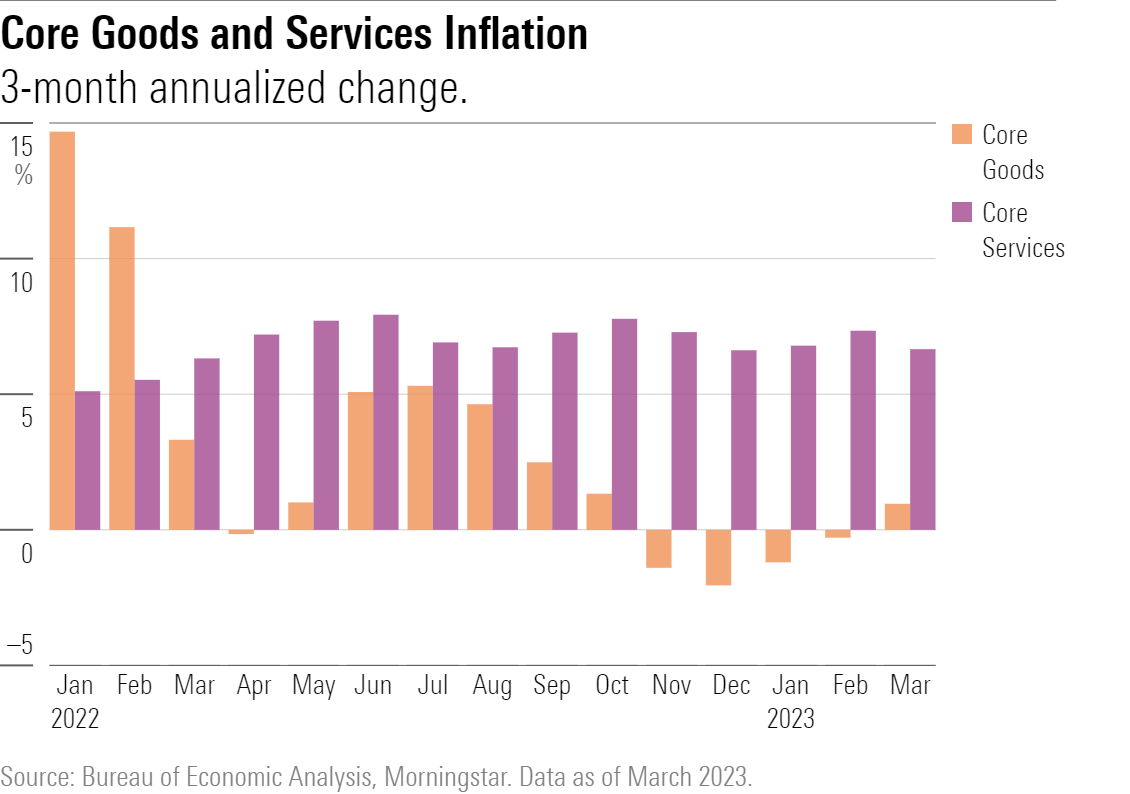

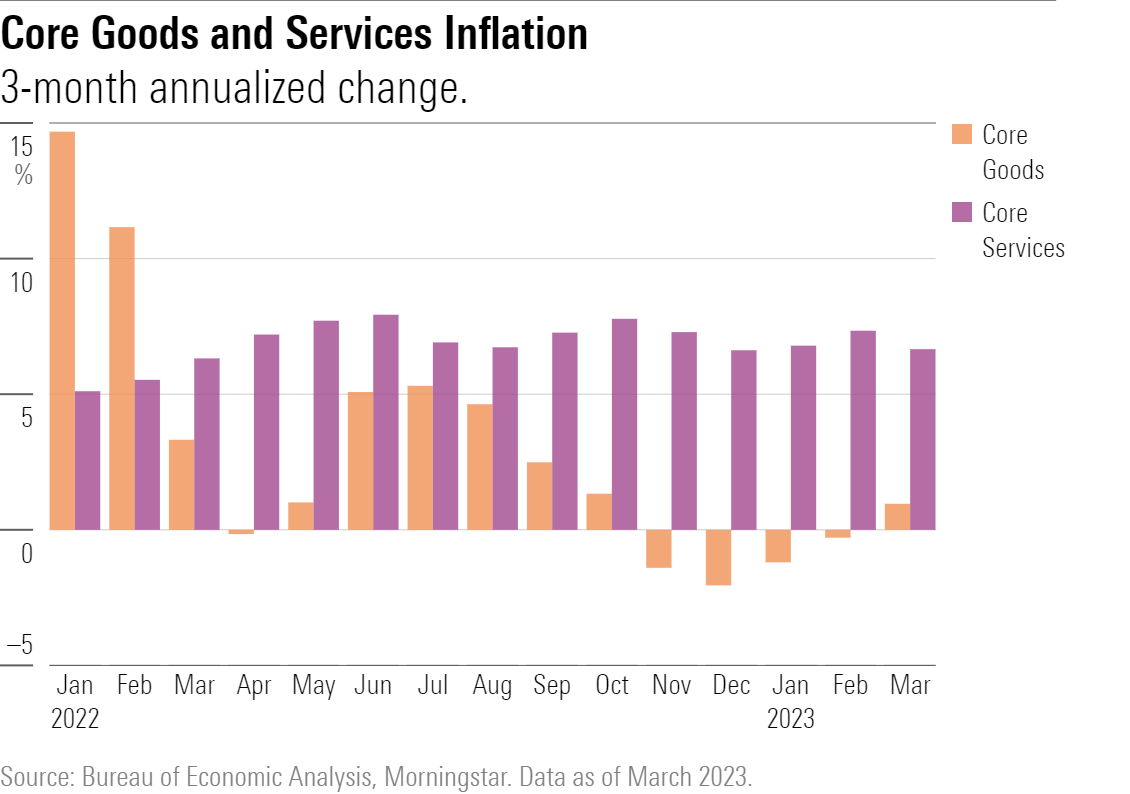

Elevated Core Goods Prices Persist, for Now

The uptick in core inflation excluding shelter was driven by core goods prices.

"Some of this will likely persist for another couple of months, with leading-edge data indicating a rebound in used-car prices," Caldwell says.

"On the other hand, we expect easing supply chain pressures to lead to a sustained period of deflation in core goods prices over the next couple of years."

New vehicle prices (in contrast to used vehicles) haven’t fallen from their peak levels yet, Caldwell says, but that will likely change this year, according to automakers’ guidance.

In terms of core services prices, Caldwell says, "there are a lot of moving parts: transportation prices are up, but some other components are down.” In addition, he says that wage growth – a key driver for core services inflation outside of housing – appears to be moderating.

"Outside of the core index, we did see a meaningful drop in food inflation in March,” Caldwell says. "We’ll have to wait for additional months of data to see if this develops into a trend. But a drop in food inflation makes sense given the recent fall in transportation costs and other supply chain components, and it would accord with our forecasts."

In March, energy prices fell 3.5% over the month for their steepest decline since August 2022. Within the energy component of the March CPI, gasoline prices fell 4.6%, and utilities prices fell 7.1%.

In terms of core goods and services, transportation services prices rose 1.4% over the month after rising 1.1% in February. Growth for apparel prices slowed, rising 0.3% for the month after rising 0.8% in February.

Prices for used cars and trucks continued to fall, down 0.9% for the month.

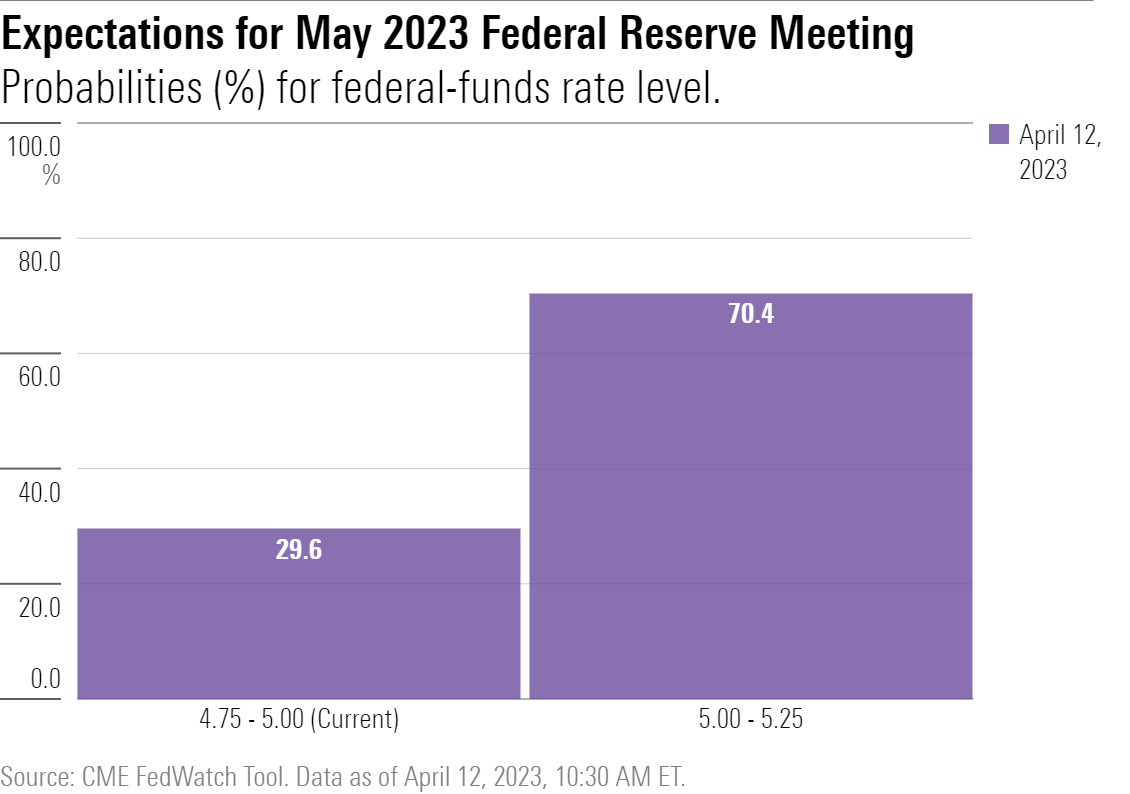

Rate Hike Expectations Strengthen

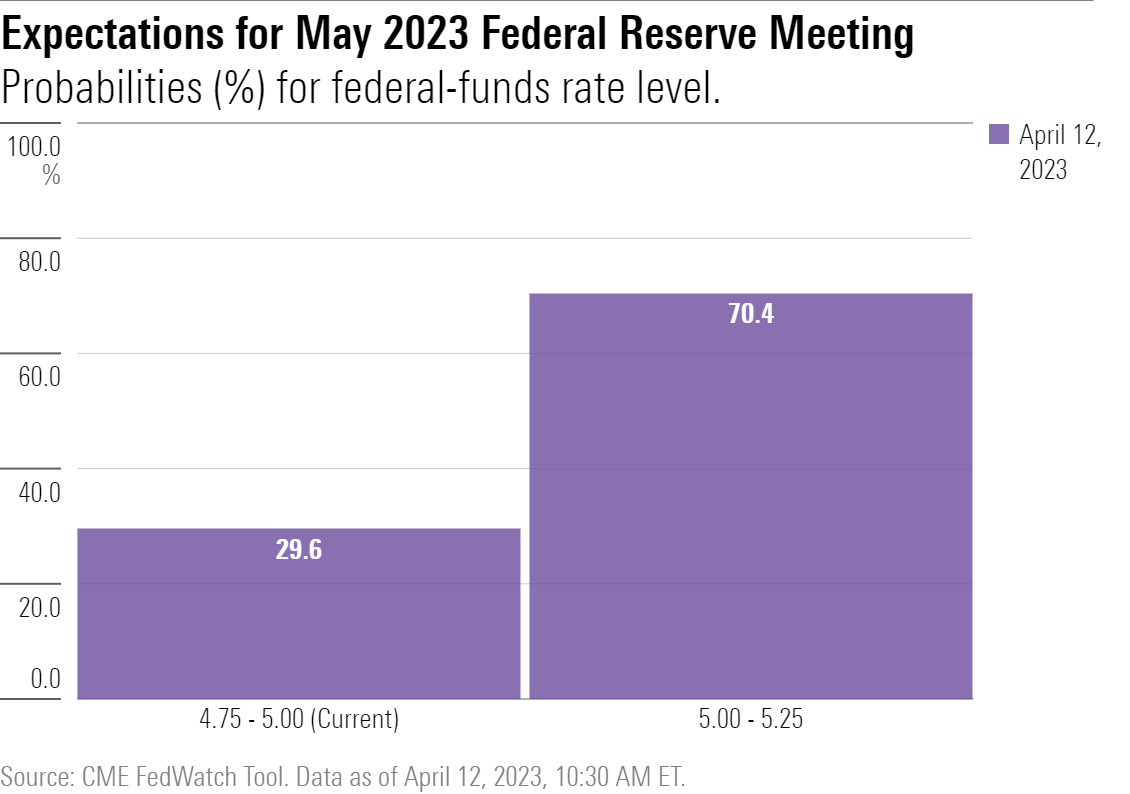

The vast majority of market participants now expect the federal funds effective rate target to rise 0.25% to a range of 5.00% to 5.25% at the Fed meeting on 3 May, according to the CME FedWatch Tool. Remaining participants expect the Fed to keep the rate unchanged at its current target rate of 4.75% to 5.00%.

A week ago, prices suggested a roughly equal split in the futures market: half expected the Fed to hold rates unchanged at its May meeting, and half expected the target rate to rise by a quarter point. With the release of the March CPI report, 70.4% of futures market participants foresee the Fed raising its target rate by a quarter point.

Caldwell’s expectations for interest-rate hikes fall in line with market expectations: "after today’s report, we continue to think the Fed’s May meeting will result in another 0.25-point hike in the federal-funds rate," he says.

Though inflation readings are an important part of the picture, much of the interest-rate debate now centers around financial stability concerns, Caldwell notes.

"The dominant view at the Fed appears to be that it can prop up the banking system with liquidity injections, leaving it free to raise the federal-funds rate as needed to fight inflation."

Caldwell says he’ll be closely watching the upcoming data on retail sales and other components of economic activity. "A sharp drop could signal that the Fed is at risk of overtightening."

Further out, the majority of market participants now see the Fed pausing its rate hikes in June and either holding steady or beginning to lower rates thereafter. Caldwell’s forecasts match this view.

U.S. Fed Raises Rates, but Uncertainty Reigns Amid Banking Crisis

U.S. Fed Raises Rates, but Uncertainty Reigns Amid Banking Crisis

Why Investors Should Care About the Banking Scare

Why Investors Should Care About the Banking Scare

U.S. Stocks Hit Record Highs

U.S. Stocks Hit Record Highs

What Caused 2023's 'Everything' Rally?

What Caused 2023's 'Everything' Rally?

Upcoming changes to our membership offerings, tools, and features

Upcoming changes to our membership offerings, tools, and features

Highlights from the 2025 Morningstar Fund Awards (Singapore)

Highlights from the 2025 Morningstar Fund Awards (Singapore)

.png) 2025 Morningstar Fund Award Winners

2025 Morningstar Fund Award Winners

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

Asian High-Yield Bonds Rebound Strongly in 2024, but Caution Prevails for 2025

6 Undervalued US Stocks That Just Raised Dividends

6 Undervalued US Stocks That Just Raised Dividends