The bear market seems to be receding, with the stock market taking on another 2% gain this past week. But the jury is still out as to whether a new bull market is truly underway.

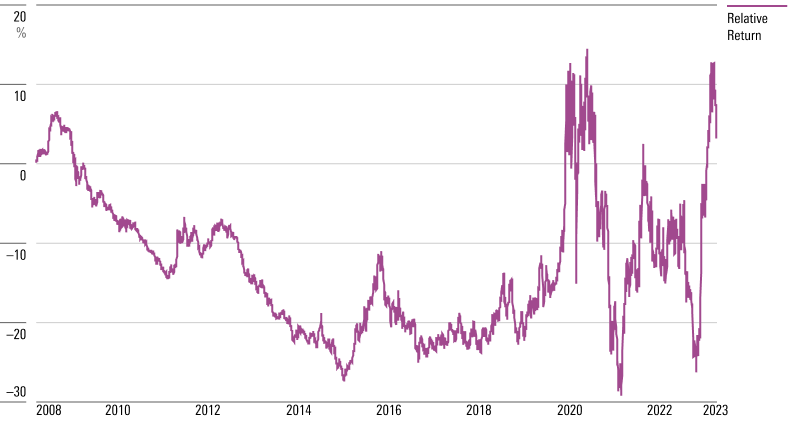

The issue isn’t the extent of the market’s bounce. The Morningstar US Market Index is up 25.1% from its bear market low; for many investors, the standard for a bull market is a 20% gain from a low. The issue is the market’s rally remains exceptionally narrow. It's also led by a relatively small number of stocks.

"History shows broad-based advances are more sustainable than narrow ones. By all accounts, this year has been a narrow advance," says Jurrien Timmer, director of global macro at Fidelity Investments.

One way to see just how limited the market’s gains have been is to shift the focus from traditional indices to equal-weighted ones. The Morningstar US Market Index tracks companies incorporated and/or primarily listed in the US market.

Like most other popular market indexes, its weightings are based on the market capitalisations of those companies. The largest US stocks make up the heaviest weightings in the index, while smaller companies have smaller positions.

The Morningstar US Target Market Exposure Equal Weighted Index is a collection of the 590 largest US stocks, all of whom are weighted equally. In 2023 through 11 July, the US Market Index gained 16.6% while the equal-weighted index rose just 10.6%. A great majority of the difference comes from the outsized concentrations of seven of the very largest stocks in the US Market Index.

"The equal-weighted indexes show a different picture than the standard market-cap weighted ones," Timmer says. "The equal-weighted index has been going sideways for a year, which is a long time."

There have been some signs this dynamic is changing in the last few weeks, Timmer notes.

"The latest month has pulled up the rest of the market a little bit, which is good news, but there’s still a very big dispersion," he says.

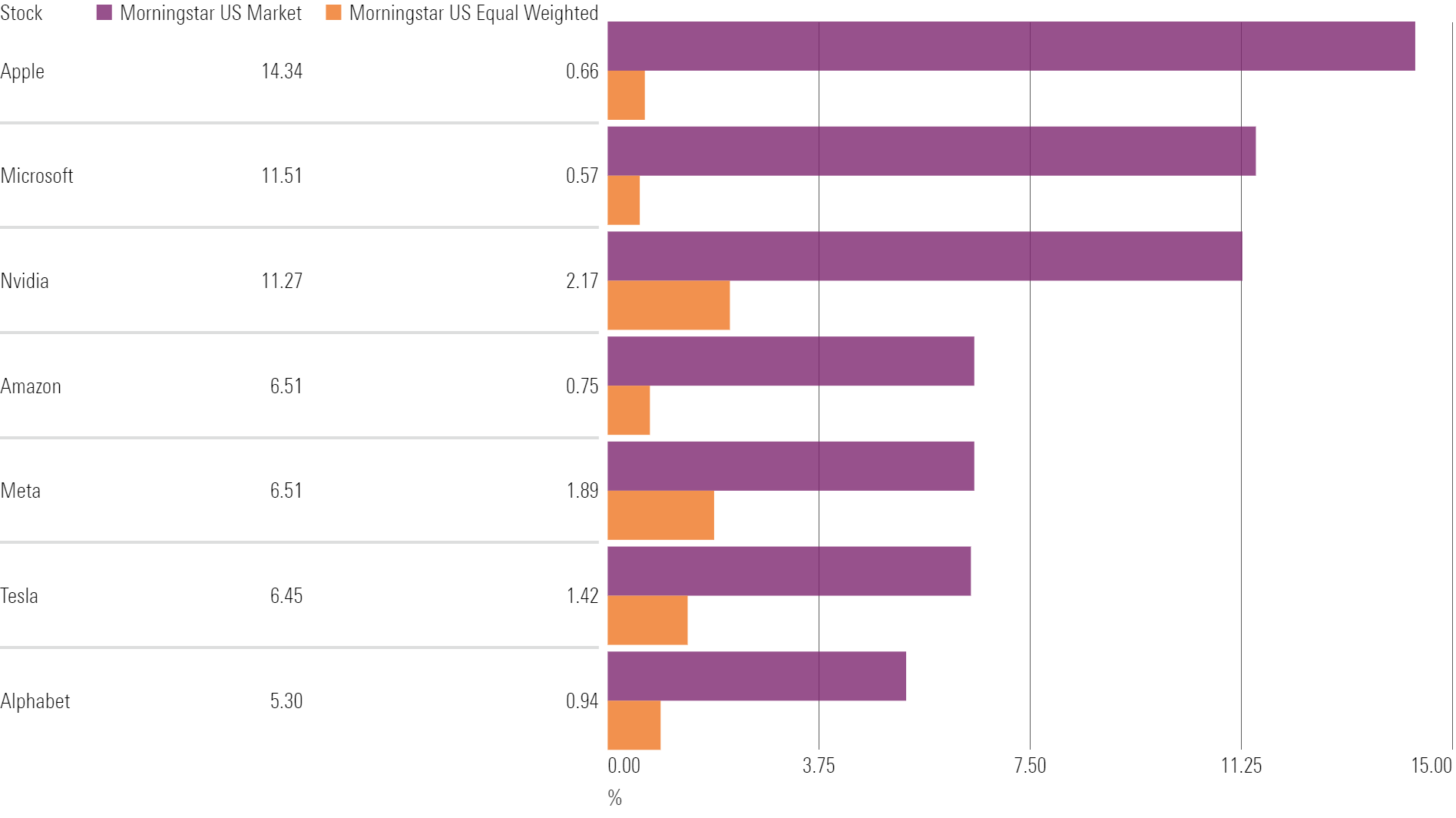

Concentrations Make a Big Impact

Through the first half of 2023, nearly all the returns in the Morningstar US Market Index have come from the very largest stocks, including Apple [AAPL], Microsoft [MSFT], and Nvidia [NVDA].

Apple – the largest technology company in the world by revenue and the largest stock in the United States by market cap – returned 45% through July 11.

In the market index, Apple alone contributed 2.3 percentage points, or 14.3%, of the index’s total return of 16.6% for the period. In the equal-weighted index, though, the company only contributed 0.07 percentage points (less than 1%) of the index’s total return of 10.3%.

The contributions of the other leading stocks were almost entirely wiped away from the equal-weighted index as well. Microsoft (with a market cap of $2.6 trillion [£1.5 trillion] and a contribution of 11.5% of the market-cap weighted index return), Amazon.com [AMZN] (with a market cap of $1.4 trillion and a contribution of 6.5%), and Google parent company Alphabet [GOOGL] (with a market cap of $1.6 trillion and a contribution of 5.3%) each contributed less than 1% of the equal-weighted index’s total return.

Only Nvidia, which rose 190.2% through July 11, managed to contribute more than 2.0% (0.23 percentage points) to the equal-weighted index’s total return for the period. Meta Platforms [META] contributed 1.9% (0.2 percentage points) to the equal-weighted index, while Tesla [TSLA] contributed 1.4% (0.1 percentage points).

When Will the Concentration Broaden?

So when will the market's concentration broaden?

"My sense is that, if earnings end up coming down more than the consensus expects, then these stocks will probably keep outperforming because they are considered a safe place to hide," Timmer says.

On the other hand, "if and when the Fed starts to signal that it is done raising interest rates, the market could really have some legs, and leadership could evolve to a much broader market than we’ve seen".

If the current leadership of the few largest companies continues, "that’s a negative because it shows that investors don’t trust the rest of the market," Timmer explains. "If the current leadership ends, I think that would be a good sign that we are in a new market."

He continues: "my sense is that if earnings end up coming down more than the consensus expects, then these stocks will probably keep outperforming because they are considered a safe place to hide."

Events This Week

Tuesday, July 18

Corporate Earnings: Bank of America [BAC], Morgan Stanley [MS], BNY Mellon [BK], and PNC Financial Services Group [PNC]

Wednesday, July 19

Economic Releases: June New Residential Construction report (FactSet consensus: +1.5 million to 1.6 million as of July 14, 2023)

Corporate Earnings: M&T Bank [MTB], Goldman Sachs Group [GS], US Bancorp [USB], International Business Machines [IBM], Tesla [TSLA], Zions Bancorporation [ZION], and Netflix [NFLX]

Thursday, July 20

Economic Releases: July Federal Reserve of Philadelphia Index (FactSet consensus: -10 to -13.7 as of 14 July 2023)

Corporate Earnings: Taiwan Semiconductor Manufacturing [TSM], Discover Financial Services [DFS], Truist Financial [TFC], American Airlines Group [AAL], Johnson & Johnson [JNJ], Blackstone [BX], Fifth Third Bancorp [FITB], KeyCorp [KEY], United Airlines Holdings [UAL], Capital One Financial [COF], and Kinder Morgan [KMI].

Friday, July 21

Corporate Earnings: Comerica [CMA], American Express [AXP], Huntington Bancshares [HBAN], and Regions Financial [RF].

For the Trading Week Ending 14 July

• The Morningstar US Market Index rose 2.02%;

• All 11 stock sectors were up for the week, with consumer cyclical and communication services as the top performers. Consumer cyclical stocks gained 2.9%, while communication services rose 2.6%;

• Yields on 10-year US Treasuries decreased to 3.82% from 4.05%;

• West Texas Intermediate crude prices rose 2.11% to $75.42 per barrel;

• Of the 848 US-listed companies covered by Morningstar, 720, or 85%, were up, and 128, or 15%, were down.

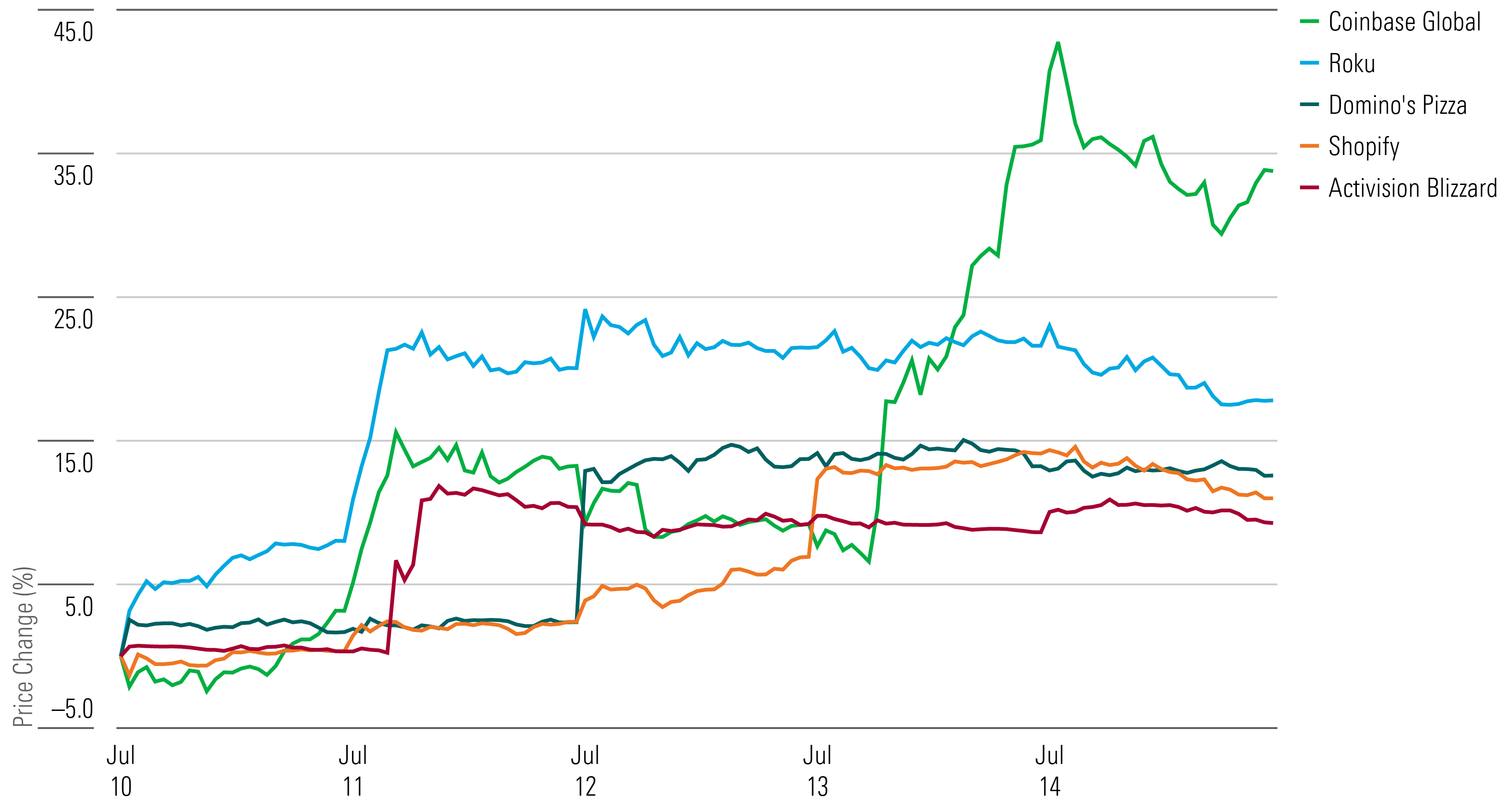

What Stocks Are Up?

Coinbase Global [COIN] stock soared in reaction to the results of the Securities and Exchange Commission’s case against fellow cryptocurrency exchange Ripple.

The regulatory agency alleged Ripple made unregistered sales of securities of its own token to institutional buyers and public exchanges. A judge sided with the exchange, saying Ripple’s private sales were securities contracts while its public transactions were not.

Morningstar equity analyst Michael Miller explains the trial was "a much-watched case in cryptocurrency as the question of whether cryptocurrencies are securities has important ramifications for the industry as a whole," given the SEC’s June suit against Coinbase.

He says "this is ultimately an incrementally positive outcome for Coinbase, with its stock trading nearly three times more than at the start of the year after the results were released."

Shares for Roku [ROKU] and Shopify [SHOP] jumped after the media equipment manufacturer and e-commerce company announced a new partnership.

When watching an ad for a business powered by Shopify on their Roku television, viewers can directly purchase featured products using their remote. Roku says that, in addition to gaining point-of-sale access to viewers and growing its customer base, Shopify will have access to the company’s personal data and gain insights on purchasing trends.

Similarly, a new delivery partnership with Uber Technologies [UBER] sent Domino’s Pizza [DPZ] stock up. Previously committed to using its own delivery system over third-party sales platforms, the restaurant chain will allow customers worldwide to order through the Uber Eats and Postmates apps, with delivery still handled by Domino’s.

The deal shows that "the value of incremental delivery orders and access to aggregator-loyal clientele may outweigh the risk of cannibalisation," according to Morningstar equity analyst Sean Dunlop. He also highlights third-party platforms’ presence in the quick-service restaurant space as a mainstay, accounting for 18% of sales in 2022, according to Euromonitor.

Activision Blizzard [ATVI] stock increased after a federal court judge ruled to allow the video game holding company to advance its merger with Microsoft. After suing to block the deal in December 2022, the Federal Trade Commission requested a preliminary injunction in June to prevent the transaction from closing on its July 18 deadline. The court said the agency’s claim that the merger would reduce competition could not be proven, adding that Microsoft’s commitments to offer Activision’s games to other consoles and cloud providers would increase competition.

What Stocks Are Down?

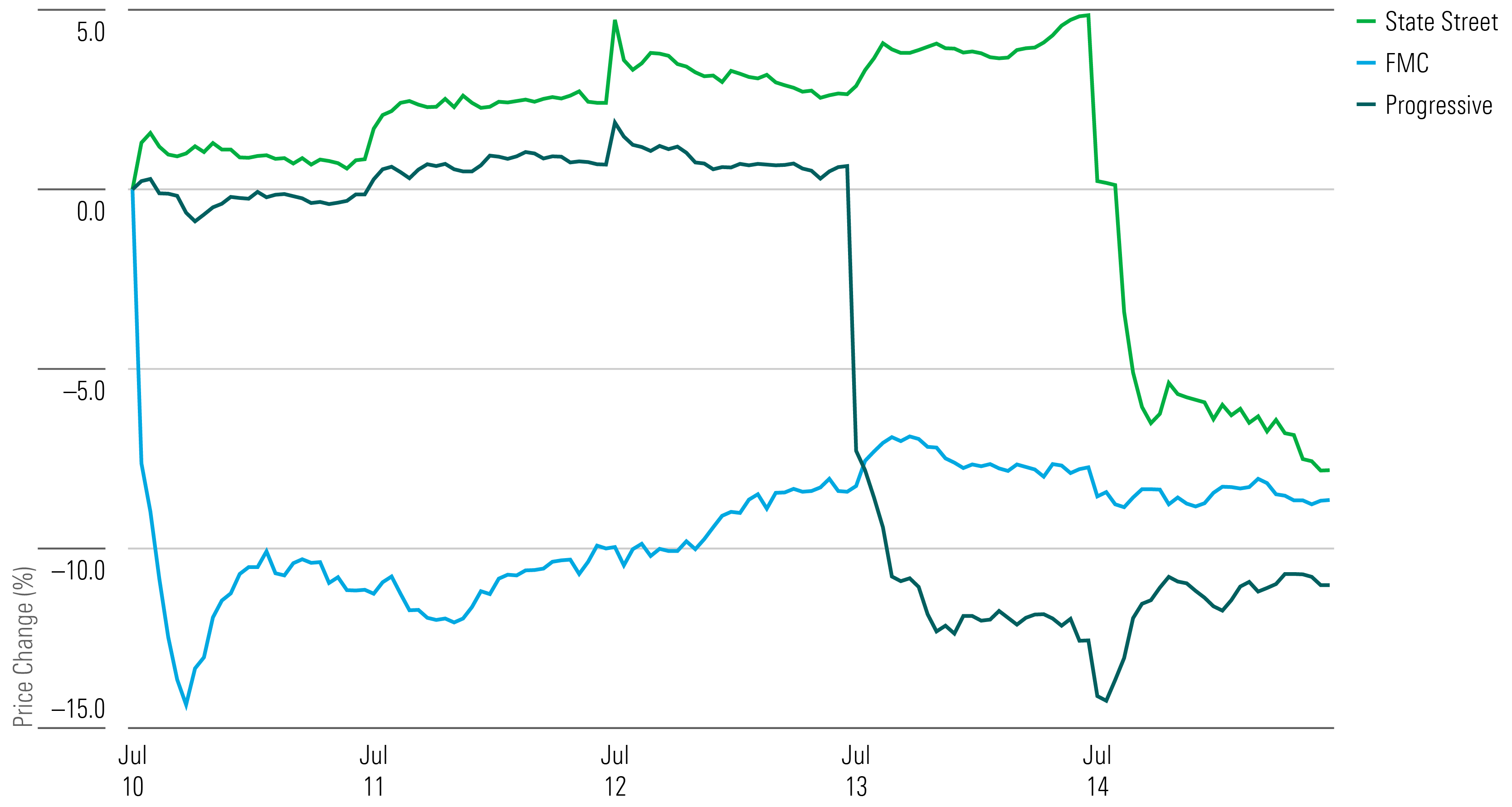

Progressive [PGR] stock fell after its second-quarter results showed a decline in its profitability. The insurance provider posted earnings per share of $0.57, lower than consensus estimates of $0.85 per share. The company posted strong growth at the expense of its underwriting profitability, which Morningstar senior equity analyst Brett Horn says is below its historical norms.

FMC [FMC] stock dropped after the chemical manufacturing company reduced its revenue and adjusted guidance for the year. The move resulted from lower volumes, partially offset by lower unit production costs, says Morningstar strategist Seth Goldstein. “While the lower volumes will affect profits in the near term, we see little impact on FMC’s long-term outlook,” Goldstein says, adding that he views the selloff as an opportunity for long-term investors.

Shares for State Street [STT] dropped after the financial services company posted its second-quarter results. The company generated $3.1 billion in revenue and had earnings per share of $2.17, both of which are below FactSet estimates. With the firm reporting a decline in interest income and deposits, Morningstar equity analyst Rajiv Bhatia says that “these trends show no signs of slowing down.”

.png)