:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

On this episode of The Long View, Martin Lau, managing partner of FSSA Investment Managers, talks China’s economy, markets, property sector, and more.

Here are a few excerpts from Lau’s conversation with Morningstar’s Christine Benz and Jeff Ptak.

Is China Misunderstood by Foreign Investors?

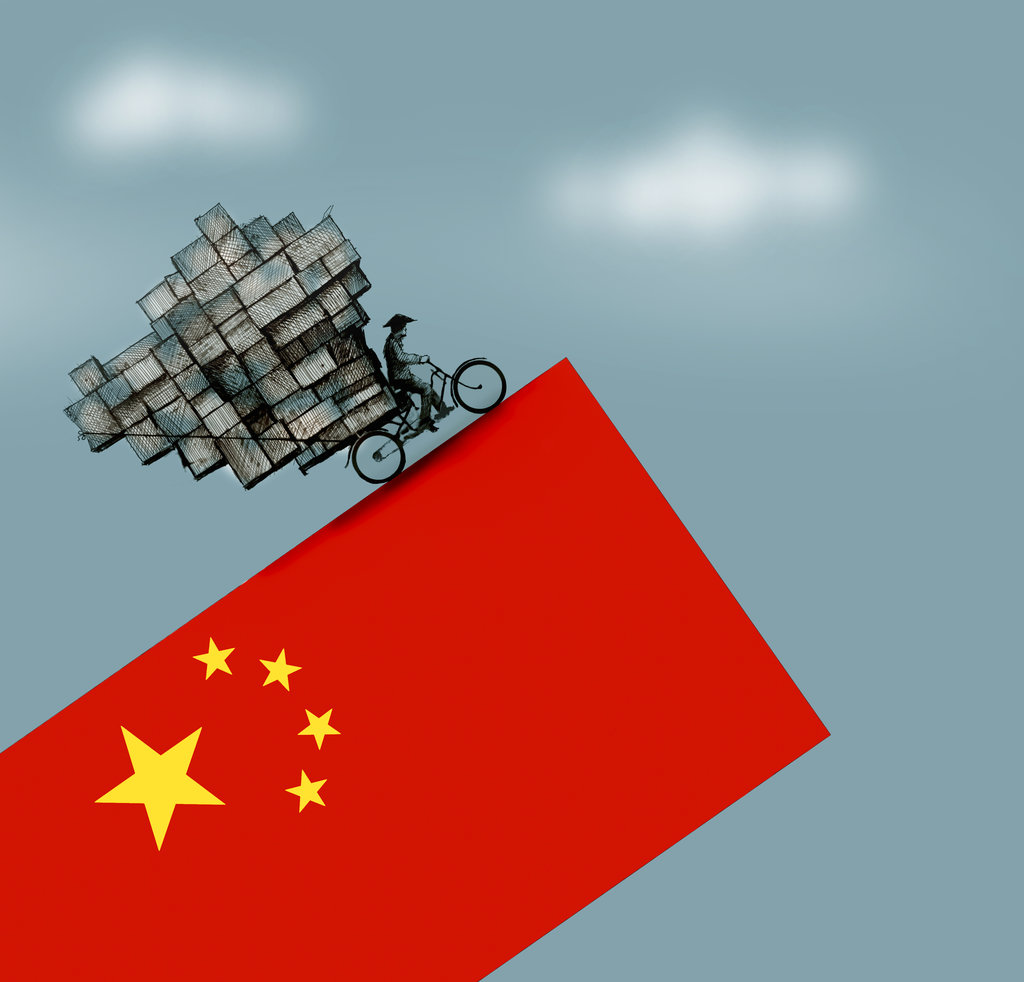

Christine Benz: When we spoke to you last time, you said, “China has never been as great as you think, and China is probably not as bad as you think also,” meaning that China is misunderstood at times by foreign investors, and yet their alarm can confer good future returns. How does that apply to the present situation?

Martin Lau: I’ve been looking at China for 30 years, and I think that pattern is still pretty much true. I think once every five years, there will be a reason why people are super bullish about China. And once every five years, there’s a reason why people are super bearish about China. And that has been the case for the last 10, 20 years at least. For now, I think we are more to the negative side. And the reason for that is property, economy, regulation, government, and many of the things that we discussed.

I’ve been following Goldman Sachs’ CIO survey. I participated in it because I wanted to get the results. About four or five years ago, there was this question about what’s your favorite market and what’s your favorite stock, and what’s your least favorite market and what’s your least favorite stock. Three, four years ago, China was the most favorite market. And then what’s your most favorite sector? China tech. And what’s your most favorite stock? Alibaba (BABA) and Meituan (03690), and all those. Last year, the favorite market—this is a survey in Asia—was actually Southeast Asia. And what’s your least favorite market? China. What’s your least favorite stock? China tech. I think that tells you the cyclicality of the sentiment. Has Tencent (00700) really changed that much since four or five years ago? I would argue that it hasn’t really changed. The management is the same, the business is the same, and earnings are higher. It’s mainly the sentiment that has changed.

Can this go on further? We basically have no idea. But then the basic principle and the lesson learned for us for many years is to try to shy away from macro as much as possible because China is a little bit of a black box because of information and many reasons. The more you get closer to the macro numbers, the more you will get confused, and maybe you will probably become positive and negative at the wrong time. We want to focus on the earnings and management, and that’s what we do.

The other thing—and I think you can actually debate on this one, and you might quote this actually next time I’m invited for this podcast again. I do have a strong feeling—there are two feelings. One is that the best time to buy into a stock market or market is when the economy is bad. So, the best time to buy the United States was when the U.S. economy was on its knees. And the same with the United Kingdom. By the way, people think Japan is now great, but Japan’s economy has been very bad. So, that’s the first point. The second point: I’m increasingly of the view that a poor economy is not necessarily bad for a company. It, of course, depends on what business you are in. But when the economy is sluggish or weak, it makes the management think of changes. It forces you to think differently, to differentiate from your competitors and think about return a bit more, and so on.

So, I think the fact that China is not doing as well could be a blessing in disguise. And I’m going to tell you one final example before the next question. If you think about, let’s say, property. Right now, if you look at Chinese developers, let’s say 40% of the developers have already defaulted on their bond, so it’s really bad. But if you believe in capital return, capital cycle, and so on, if you are a property company in China, if you manage to survive this downturn, imagine the lack of capacity or lack of competition in three to four years’ time. I think that could be a blessing in disguise. So, usually, a tough economy would take out capacity from different industries. And, again, I do think the best time to buy a market is when the economy is tough.

Chinese Banks Look Safe From Recent Property Sector Problems

Jeff Ptak: I think you’ve stated previously you don’t expect recent problems in the Chinese property sector to spill over into Chinese banks in the same way the real estate sector caused a contagion during the global financial crisis. Why is that?

Lau: I think there are a few differences between China and the U.S. And these differences could be good and could be bad. I’m going to talk about the good things, and I’m going to talk about the bad things. In China, the government has a strong control over many things, or most things. They’ve introduced so many measures on property that the property market started to turn down. And of course, recently, they’ve been trying to reverse some of the policies. In China, all the banks are owned by the government. Foreign banks or foreign capital is a tiny percentage of the Chinese economy. So, if the bank continued to lend, let’s say to Evergrande, it would not have the issues. I think there’s a certain degree of control that you can have on the economies. That’s why we say the contagion is unlikely to do the same.

If you look at the U.S. and the more developed world, the reason why there could be a banking crisis is when there’s a problem and the bank pulled the plug on, let’s say, WorldCom. And whether WorldCom is seriously a problem or not, it would go bust. And the same with Silicon Valley Bank. By the time people lose confidence in that bank, mathematically speaking, it would have issues. Whereas in China, all the banks are basically owned by the government. This is the reason why we don’t think you have get-out-of-control contagion to every bank and things like that. The negative part of this—and you mentioned the lower return from China over the last, say, 10, 15 years—is the lack of market mechanism. So, imagine if you are a zombie company. Many newspapers have written about the zombie companies and the ghost towns in China in the past. Basically, the bank may not pull the plug as they should, and therefore from a supply perspective, a lot of the excess or useless capacities would not be taken out from the system immediately and therefore result in lower returns for investors. This is a bit similar to Japan. And you might argue China may ultimately become more like Japan. Japan has kind of dragged on and on, but Japan is not very dependent on foreign debt. So, it would just stay like this for a bit longer.

Is Some of the Tumult in the Chinese Property Sector by Design?

Benz: You also wrote that you think some of the tumult in the Chinese property sector is by design, reflecting the government’s desire to create defaults and in the process, combat moral hazard. But with the Chinese government controlling the banks that have made these bad loans, is it realistic to think that this will lead to more disciplined lending and borrowing?

Lau: Yes, that’s an interesting question. If you look at human history, whether it’s China or the U.S., there are moral hazards for companies, and people take risk and take risk at the wrong time. So, I’m sure the Chinese government tried to avoid moral hazard by not bailing out Evergrande, but you’re almost guaranteed there will be another company doing some stupid things maybe 10 years down the road, because I think it’s human nature to be greedy or maybe take excessive risks at the wrong time.

I think—and this is one of the reasons why the market has disappointed and why this market sentiment has been more negative recently—there was an expectation that the Chinese government may bail out either the economy or certain developers in China, because if you want a better economy, you really don’t want developers to default. I cannot think about a situation whereby a U.S. developer defaults and then the economy would be booming. This simply doesn’t happen. So, the fact that the government has not introduced a more aggressive policy response and the fact that Chinese government has allowed, the recent one being Country Garden, to default—the market is concerned when that happens that means the economy is not going to be very strong and therefore there’s a good reason why you’re concerned.

If you look at the background of all these property companies in China, the reason why they are having problems now is that they are taking huge, huge risks by leveraging, and we never invested in any of these developers. But if you look at five years ago, if you look at the balance sheet, you think they are really, really brave. And this goes back to the first-generation entrepreneurs. If you look at the histories of these property entrepreneurs, they started off being farmers and they took a lot of risk and became super rich. So, I think that in a way it’s good, but it is bad for the economy.

.png)