Kate Lin: Welcome to Morningstar. Diversification is said to be the only free lunch in investing. However, when faced with the decisions between active and passive products within a multi-asset portfolio, how should one choose? Does the decision differ based on the asset class and geography? Joining us as we explore the factors for allocation decisions is Samuel Lo, our senior manager research analyst.

Hi Sam. In your recent studies, you found that investors are better off investing in an active strategy for some, while passive strategies are better for others. This links to the efficient market theory, so tell us more about it.

Active Vs Passive

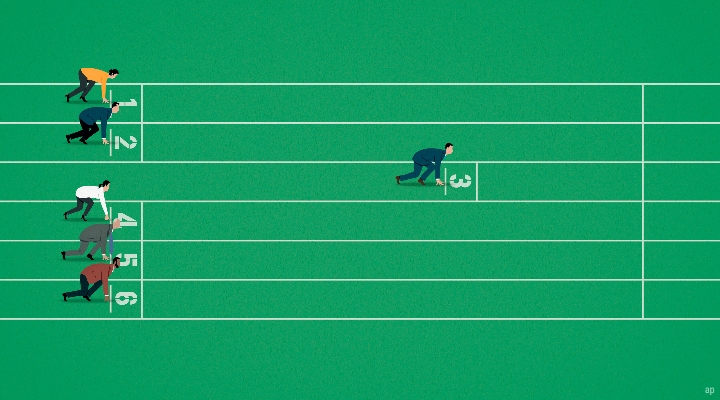

Samuel Lo: Sure, so active and passive funds are like two different tools with different pros and cons, and it is very important to know when it is more advantageous to use one over the other. As a recap, active funds are managed with the target of beating the markets, although they tend to be more expensive. On the other hand, passive funds only aim to track the performance of a specific market, but they typically cost a lot less. So when an investor constructs a diversified multi-asset portfolio, one of the first questions that he or she may have is whether to use active funds or passive funds. And the key message that I would like to send across is that these two types of investments are not mutually exclusive and investors can actually build better portfolios by combining them both and harnessing their respective strengths.

And therefore the more important question is actually when to use which. And the general principle is that asset classes are not born equal. In some asset classes, it is more difficult for active managers to generate alpha, and that means it is hard to outperform the market after adjusted for risks. And we say that these markets have low alpha potential. And these are typically markets that are very efficient and competitive and where information is readily available and news are quickly assimilated. In some other asset classes, it may be easier for active managers to beat the market, and we say that these markets have higher alpha potential. So generally speaking, now investors can be better served by using an active approach for asset classes with high alpha potential, while a low-cost passive approach may be more suitable for asset classes with low or even negative net alpha potential.

Which Strategy is Good for Asia ex-Japan Equities

Lin: Right. So we look at asset classes in detail. In what asset class is active better and what about passive?

Lo: Yeah, so let's begin our discussion on equities. So an example of a high alpha potential asset class is Asia ex-Japan equities. If you look within the region, China is very different from Korea, and India is very different from Taiwan. So the diverse character across Asia ex-Japan and the fast-evolving economic, regulatory, and geopolitical environment provides the opportunity for successful active managers to identify winning bets and also avoid the pitfalls. And besides, there's an abundance of high-quality active Asia ex-Japan funds available to local investors and at a reasonable cost. So of the 14 Asia ex-Japan equity funds that are sold to retail investors in Asia and rated by Morningstar analysts, 10 out of the 14 are expected to generate net alpha over the long run. So an active investment approach is more likely to be fruitful here.

In contrast, it may be more productive to use a passive approach for a low alpha potential asset class such as US equities. The United States is arguably the most efficient market globally. Its stock market is the most followed and traded stock market in the world, and it is very challenging to beat the market there.

So while some funds obviously can beat the market, it is quite hard to identify them, and it is even harder for investors in Asia considering the available offerings here and the fee levels. Only two out of 10 Morningstar analyst-rated US large-cap blend equity funds available here for Asian investors are expected to deliver alpha over the market cycle. So as a result, it is likely more productive for investors to obtain U.S. equities exposure via low-cost ETFs that are readily available.

More Nuances in Fixed Income Funds

Lin: Right. And what about fixed income? What are your findings?

Lo: Yes, for fixed income, it is typically harder for fixed income strategies to add as much value as equity ones. However, from an implementation perspective, it is quite common for investors to use actively managed funds to invest in fixed income. So one key reason for that is due to product availability. While investors can find some global bond ETFs in the U.S., it can be quite difficult, if not impossible, to find ETFs for other fixed income categories such as Asian bonds.

And besides, even if the investor decides to invest in U.S.-listed ETFs, in general, they will be subject to a 30% withholding tax on the ETF distributions, which hampers the intended cost benefits of a passive approach. Furthermore, there may also be structural challenges inherent for some other fixed income categories, such as higher bonds. These bonds are inherently less liquid and involve higher trading costs, which increases the difficulty of a passive indexing approach. For these reasons, it is actually quite common for investors to use active funds in the fixed income space.

Lin: Thank you so much for your insights, Sam. For Morningstar, I am Kate Lin.

.png)

.jpg)