JD.com Stock at a Glance

Fair Value Estimate: US$ 88.00 eper ADS, HK$ 341 per share

Morningstar Rating: 5 stars

Morningstar Uncertainty Rating: High

Morningstar Economic Moat Rating: Wide

JD.com Earnings Update

JD.com beat Refinitiv consensus as of Aug. 16 and our estimate for revenue and non-GAAP net income in the second quarter. However, JD.com’s Nasdaq traded shares dropped 3% on the day of earnings. We think it is because of the quarter's zero year-on-year growth in operating profit for main segment JD Retail, a sharp decline from double-digit growth in every quarter previously since the second quarter of 2022. This underperforms Alibaba’s Taobao and Tmall Group’s 9% year-on-year growth in adjusted EBITA in the June quarter. JD Retail's operating margin before unallocated items for the quarter was 3.2%, lower than 3.4% for the second quarter of 2022, and weaker than our 3.4% expectation. We estimate JD Retail’s weak operating profit is due to higher marketing spending, which was up 17% year on year for the group in the quarter, and completely offset the benefit from faster growth in the higher-margin third-party business. As a comparison, Alibaba’s Taobao and Tmall Group adjusted EBITA margin also declined by 120 basis points to 42.9% in the quarter on a year-on-year basis due to a higher mix of lower-margin first-party business and investment back into the business.

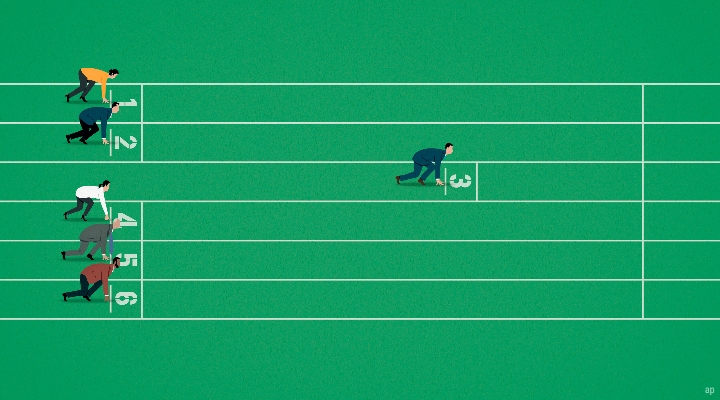

We maintain our full-year estimates despite stronger-than-expected second-quarter results, due to recent weak China macroeconomic data and lower conviction of large-scale China consumption stimulus. Our fair value estimates remain US$ 88 per ADS and HK$ 341 per share. The share price is still attractive for long-term investors and we think JD.com’s intangible asset of quality logistics remains. JD.com’s comments on third-party GMV growing faster is in line with our prediction. We continue to think the expansion of scale and cost advantage in the first-party business will slow but cost advantage still remains. We think there is near-term weakness and uncertainty amid the big overhaul at JD.com in 2022, and it's still our least preferred play in China traditional comprehensive e-commerce platform coverage.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EWMG3XJM2RA4ZLC5J5M6SSVVZA.jpg)

.png)